Natural Gas Surges as U.S. Forecasts Stoke Winter Supply Jitters

(Bloomberg) -- Natural gas futures soared as forecasts for chilly November weather in the U.S. East heightened concern that supplies will struggle to meet demand this winter.

Henry Hub gas for November delivery gained as much as 10.7%, the biggest gain in almost three weeks, to $5.844 per million British thermal units. Prices are bouncing back from recent declines, though they’re still shy of the seven-year high reached earlier this month.

While mild October weather allowed producers to inject more gas into storage than usual, forecasts for a cooler early November in the Midwest and East are a reminder that supplies of the heating and power-generation fuel are still below normal. Meanwhile, the U.S. is expected to export every molecule it can to help ease shortages of gas in Europe and Asia.

“There is terrific concern about sufficiency of supply”, said John Kilduff, founding partner at Again Capital, adding that the market remains sensitive to any cold forecasts.

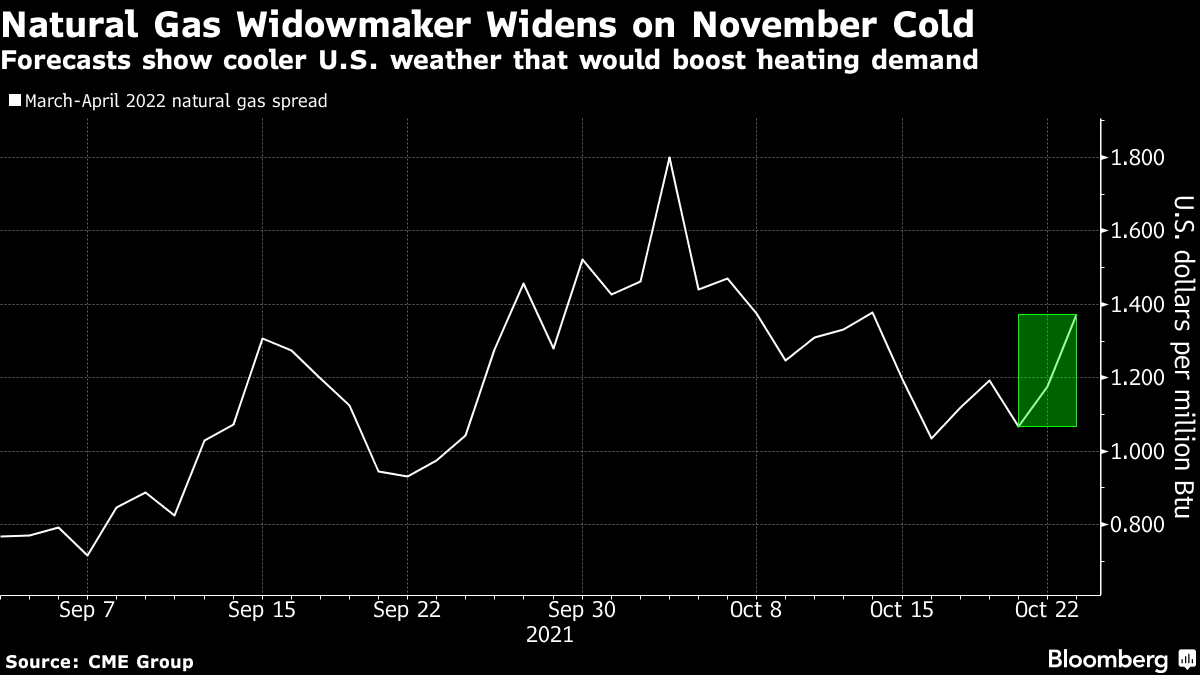

One sign of growing supply fears: The so-called widowmaker spread between March and April futures, essentially a bet on how tight inventories will be at the end of winter, widened to $1.481, the highest since Oct. 14.

Flows to liquefied natural gas terminals are seen at 11.3 billion cubic feet on Monday, up by more than 10% since Friday and the highest since May, according to BloombergNEF. Estimated volumes at Freeport LNG in Texas have rebounded after the terminal, one of the U.S.’s largest, faced issues with a wax buildup in its pipelines last week.

Traders positioning for the expiration of November options contracts could amplify volatility in gas prices in the next few days, EBW AnalyticsGroup said in a note to clients. November options expire on Tuesday.

Shares of U.S. gas producers also jumped. EQT Corp. gained 5.2% as of 11:51 a.m., with Antero Resources Corp. up 5.6%.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods