Kwarteng Vows to Help Ease Energy Price Impact on U.K. Industry

(Bloomberg) -- U.K. Business Secretary Kwasi Kwarteng said he’ll work to ease the growing pressure on industry from surging gas prices, following a meeting with representatives of energy-intensive companies.

Kwarteng said he is “determined to secure a competitive future for our energy intensive industries, and promised to continue to work closely with companies over the coming days to further understand and help mitigate the impacts of any cost increases faced by businesses,” his department said late Friday.

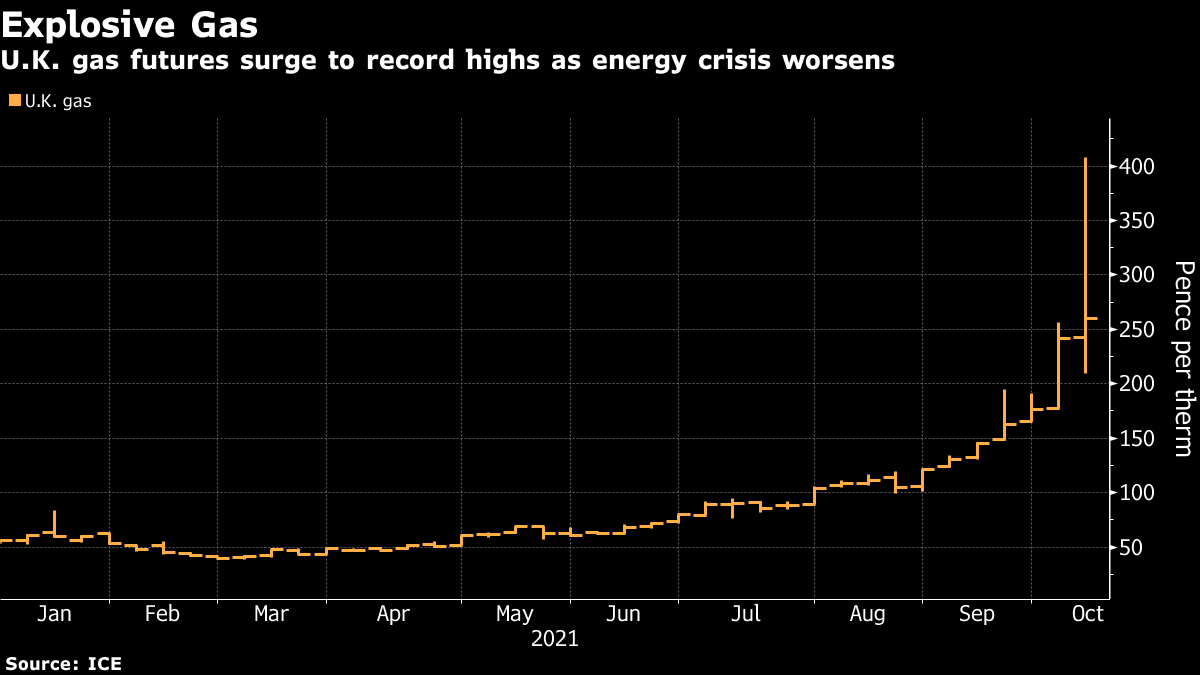

Wholesale gas prices have increased almost six-fold over the past year, putting an increasing strain on both domestic consumers and industrial users. While households are protected to some extent from market ructions by a price cap that’s adjusted twice a year, large factories are more exposed, prompting fears some will have to stop operations this winter.

The Energy Intensive Users’ Group, whose members include the steel, chemical, cement, paper, ceramics and glass industries, earlier said Kwarteng had pledged to find “practical solutions” to help soften the impact of surging energy costs. It said in a statement that it welcomed Kwarteng’s “first steps” to “develop practical solutions and work with Treasury colleagues.”

Friday’s meeting came after the EIUG called on ministers to take emergency steps rapidly to alleviate the strain on big industrial energy consumers, or face shutdowns. Specifically, it wants action to contain gas, power and carbon prices to allow the most exposed companies to keep producing essential goods.

‘Uncompetitive Costs’

The EIUG committed to work with the government and the energy regulator “to overcome the immediate challenges posed by the unprecedented increases in energy prices this winter,” the group said. “Beyond the immediacy of this winter, the government must tackle the underlying issues that lead to uncompetitive energy costs.”

Kwarteng told the group he “remained confident in the security of gas supply this winter” and pointed to 2 billion pounds ($2.7 billion) worth of support to energy intensive users since 2013, according to the government statement.

The implications of higher gas prices were laid bare last month when two fertilizer plants closed, leading to a shortage of the carbon dioxide byproduct widely used in the food industry. A lack of CO2 would rapidly impact everyday products because it’s used to stun pigs and chickens for slaughter, in packaging to extend shelf life and to keep items frozen for delivery.

The government ultimately agreed to provide “limited” financial aid -- potentially running into the tens of millions of pounds -- to allow production to restart and ease the CO2 shortage. That three-week support package is due to run until next week, with the expectation that the food industry would negotiate higher prices for the CO2, as well as seek other sources for it.

Rising Bills

It’s not only companies feeling the pinch. Kwarteng also faces demands to reduce pressure on households after the energy regulator, Ofgem, raised the price cap on average bills by 12% on Oct. 1.

Though the cap won’t be changed again until April, the “unprecedented” rise in wholesale gas prices means a considerable rise is likely then, Ofgem Chief Executive Officer Jonathan Brearley said on Friday.

“We can’t predict what it’s going to be and our data collection goes right up until February,” he told BBC radio. “But you can see from all the turbulence, not just in Britain but across the world, regulators are managing this situation and we do expect significant rises in prices.”

Ten energy suppliers have already failed, in part because the cap prevented them from passing higher wholesale prices onto consumers. Both Brearley and Kwarteng told an energy conference on Thursday they expect more to follow.

“We need to sit down with the industry, look forward and make sure we make a more resilient market that can manage shocks like this in the future,” Brearley told the BBC.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis