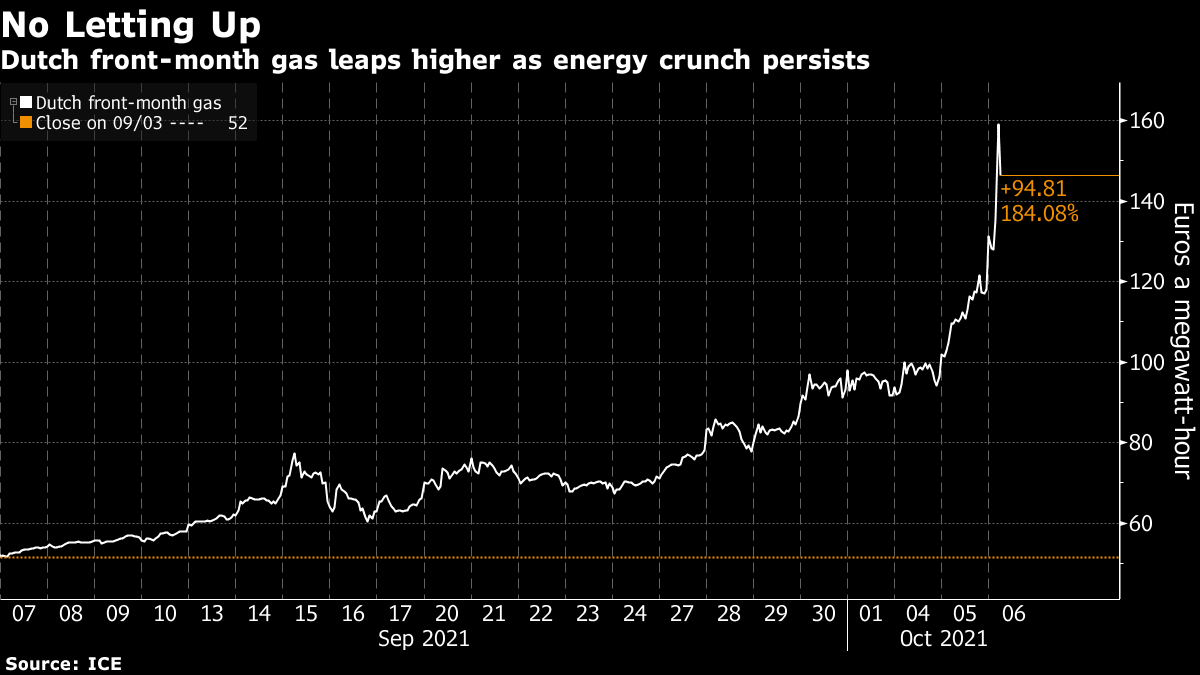

European Gas Surges 60% in Two Days as EU Sounds Alarm

(Bloomberg) -- European gas prices surged again, bringing their gains over just two days to 60%, as the impact of soaring energy costs rippled through equity and bond markets and the European Union sounded the alarm.

Dutch and U.K. gas futures continue to hit fresh records along with rising power prices. Rocketing energy costs are stoking inflationary pressures and fueling concern that economic growth will slow, prompting a slump in European stocks.

“It looks like a classic short squeeze to me,” said Ronald Smith, a senior analyst at BCS Global Markets, who expects the latest spike to be short-lived. “I expect we’re going to see some traders going bankrupt and liquidating their positions.”

Global gas and coal markets have tightened just as the heating season starts in the northern hemisphere, with limited supply failing to catch up with recovering demand. Colder weather is forecast for Europe next week, with temperatures across the mainland set to drop below normal levels.

Several European countries including France and Spain have called on the EU to take urgent action to cushion the blow of sky-high gas prices. The bloc’s energy chief, Kadri Simson, has pledged a revision to market rules by the end of the year to prevent surging costs from stifling the economic recovery.

“This price shock cannot be underestimated,” Simson told members of the European Parliament during a debate on the crisis. “It is hurting our citizens and in particular the most vulnerable households, weakening competitiveness and adding to inflationary pressure.”

With the gas crisis worsening by the day, some energy-intensive companies have shuttered operations because they’re becoming too expensive to run. With Europe’s stockpiles at their lowest seasonal level in more than a decade, deliveries from Russia limited and global competition for liquefied natural gas intense, the squeeze will only worsen as winter approaches.

Front-month Dutch gas jumped as much as 40% to a record 162.125 euros a megawatt-hour after closing up 20% the day before. It traded at 131.10 euros as of 1:01 p.m. in Amsterdam. The U.K. equivalent rose as much as 39%, hitting an unprecedented 407.82 pence a therm, before easing back to 335.81 pence.

“This is just ridiculous,” said Tom Marzec-Manser, an analyst at ICIS. “Almost impossible to even justify or qualify how and why it’s moving so fast and so high.”

Bloomberg Economics expects inflation in the euro area to average almost 4% in the fourth quarter, significantly more than forecast by the European Central Bank at the start of the year.

Read more: European Industry Buckles Under a Worsening Energy Squeeze

Europe continues to vie with Asia for deliveries of LNG. Despite the eye-watering rally in European gas prices, Asian LNG importers remain willing to pay a premium to the Dutch benchmark to attract supply for the winter, according to traders in Singapore. That means Europe will still struggle to lure extra LNG shipments to provide relief for the region.

“We are currently living exceptional circumstances,” analysts at consultant Engie EnergyScan said in a note. “The world gas market has never been in a situation where Asia and Europe were obliged to compete fiercely for the marginal LNG cargo available -- as the latter was supposed to benefit from comfortable pipeline supply.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says