Europe’s Power Crisis Moves North as Water Shortage Persists

(Bloomberg) -- As the frontier of Europe’s energy crisis moves north, the Nordic region faces a worsening power crisis as dwindling water reservoirs hamper the generation of hydroelectric power.

Nordic power prices were five times higher in September than a year ago. That’s hitting everyone from power-hungry factories and miners, to students struggling with their bills. Inflation is rocketing.

Europe’s northern corner can’t hide from the global shortage of natural gas and coal, with falling water reserves curbing the region’s most important source of electricity. Sweden is relying on a 52-year-old plant that burns oil to keep the lights on and a local utility is trying to convince industrial users to save energy as cold weather draws closer.

“The combination of low Nordic hydro reservoirs and low European gas storage levels is creating a perfect storm, with high coal and carbon prices on top of that,” said Mats Persson, head of trading at Fortum Oyj. “With new power cables to Germany and the U.K., the big price variations we have seen in Europe are entering the Nordic system.”

Norwegian hydro levels are at their lowest in more than a decade for this time of the year. While some rain arrived in the past few days, the situation in southwest Norway has been so bad that grid operator Statnett SF issued a warning to traders on Monday, saying the power balance stands at two on a scale where five means rationing. That part of the country has the largest reservoir capacity and links to Germany and Denmark, as well as a new cable to Britain.

The filling level was 52.3% for week of Sept. 20 in the area, the lowest since 2006 for that week. That’s sparking concern just weeks before the critical turning point when reservoirs start to decline later in the fall.

“Normally the reservoirs fill up at this time of year, but in both August and September we have had heat records and very little rainfall,” said Anders Gaudestad, executive vice president of power management at Agder Energi.

Data on the availability of water is as significant to the power market as the aggregate number for European gas storage levels, which traders watch like hawks these days. European gas surged to a record 100 euros ($116) per megawatt-hour on Friday, and traded at about 95 euros on Monday morning.

There isn’t enough water to export to both the continent and the U.K., said Sigbjorn Seland, chief analyst at industry consultant StormGeo Nena AS. Britain and Ireland are arguably the hardest hit by the global gas shortage and are starved of power.

“The idea of us being a green battery for Europe kind of falls flat on its face this winter,” said Andre Gustavsson, an analyst at Swedish utility Skelleftea Kraft AB, whose worst-case scenario is that surging prices will hit economic growth as companies start to curb output.

Swedish utility Oresundskraft AB plans to ask some industrial customers to be flexible in their consumption. That could help ease a strained power balance in the south, where Uniper SE’s oil-fired power plant ran at full throttle regularly in September.

Read More: What’s Behind Europe’s Skyrocketing Power Prices: QuickTake

Volatile prices are here to stay as nuclear, coal and gas plants are decommissioned, said Mats Gustavsson, vice president for energy at Swedish miner Boliden AB. The company just signed a new long-term power contract for a smelter in Norway.

“What’s dangerous is that the lowest price is increasing all the time,” he said. “So if you want to hedge yourself you will pay a much higher price.”

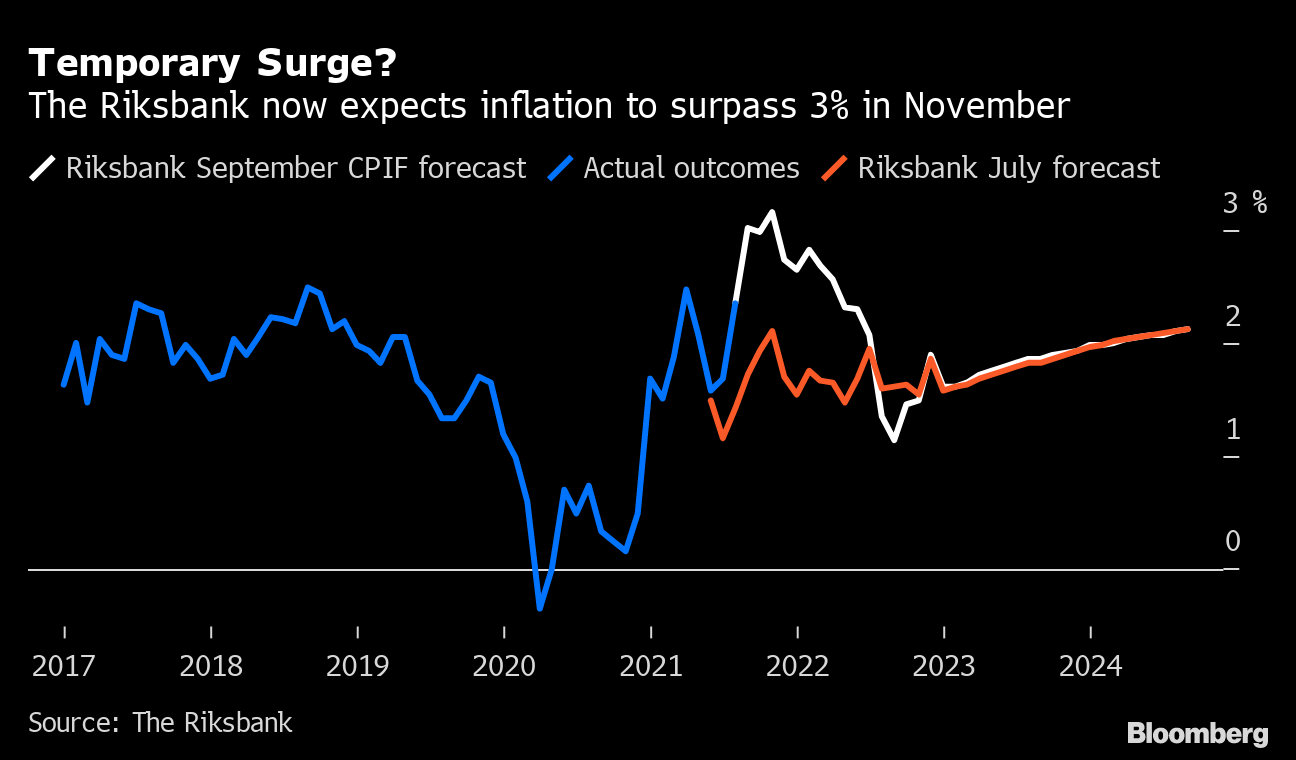

Soaring prices may push inflation in Sweden above 3% in coming months, a level last seen in 2008.

For the millions of homes and businesses that rely on electricity for most of their heating needs, the crisis is immediate. The hardest hit students have even been forced to borrow to pay their soaring bills, according to student leader Gesine Fischer.

Vegard Vardla, a 23-year-old student in Lillehammer outside Oslo, expects his monthly bill to double to about 1,400 Norwegian kroner ($160) when a fixed rate for him and his roommate runs out in a few weeks.

“I might have to sacrifice some of my savings to pay electricity bills,” Vardla said.

(Adds record gas price in eighth paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances