China’s Energy Crisis Highlights Weaknesses in Xi’s Power Plans

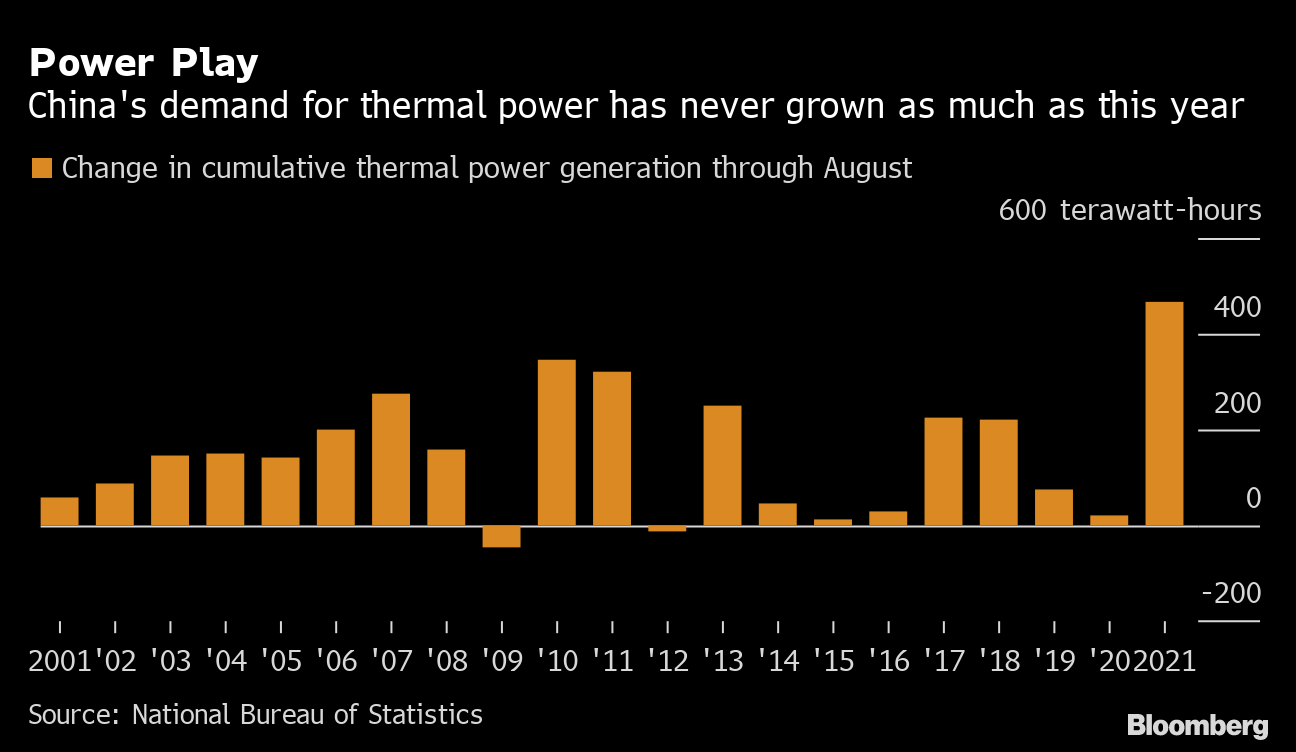

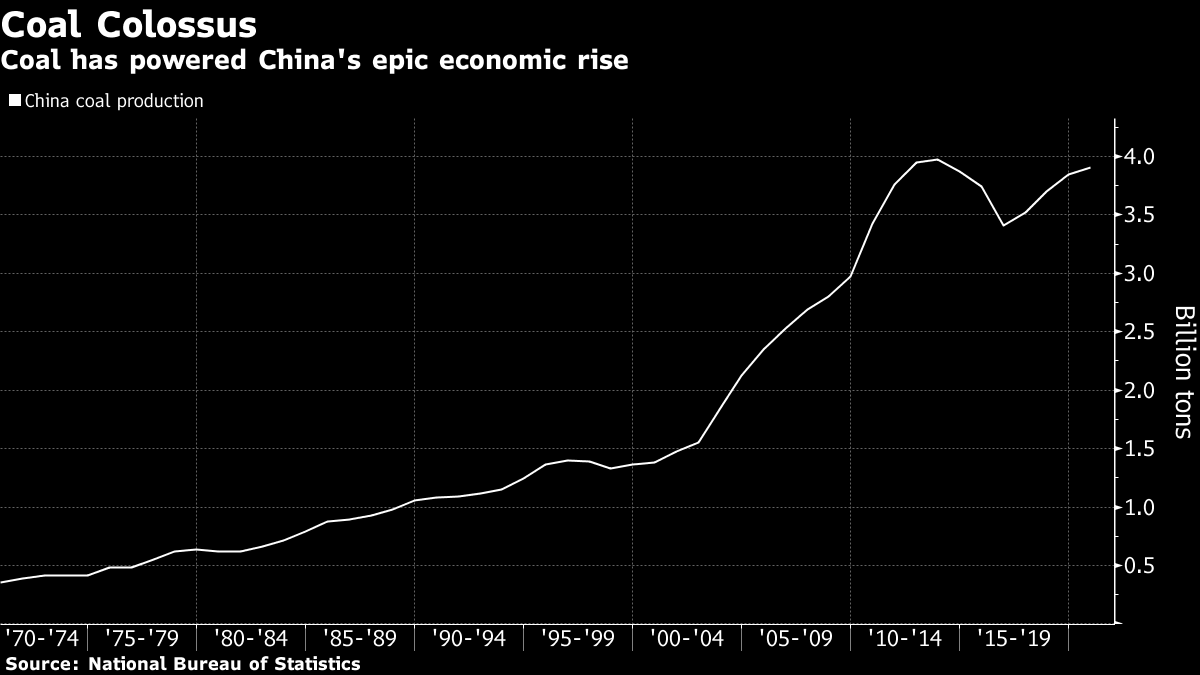

(Bloomberg) -- China’s energy crisis has highlighted weaknesses in one of President Xi Jinping’s top priorities -- energy security -- that could have ramifications for the power system for years to come.

To avoid repeats of the chaos ravaging the world’s second biggest economy, the country will probably have to take major steps toward reshaping its grid and power market, building fuel reserves, and adding more renewable and flexible energy sources.

“These are all on the cards and there will be great impetus once the dust has settled on this episode,” said Michal Meidan, director of the China Energy Research Programme at the Oxford Institute for Energy Studies.

Here are some policy options that Beijing is likely to explore.

Set Them Free

A trigger for the current crisis was power plants shutting down because of heavy losses on buying expensive coal and selling into a highly regulated electricity market. Today’s pricing regime dates only to 2019, when fixed electricity benchmarks were replaced with a hybrid model offering some flexibility, but far short of the free-floating rates seen in parts of Europe and the U.S.

Hunan province is planning to trial a pricing system linked to coal costs from October. Guangdong has raised tariffs to incentivize more supply. And the country is considering raising rates on industrial users. But a major obstacle to more liberalization is the potential hit to downstream users including manufacturers.

“If China liberalizes the power market, then it may provide enough power supply, but rising power costs could also make a dent on the local economy,” said BloombergNEF’s head of China research Kou Nannan.

Get Connected

More connectivity between power grids in different regions could ease localized shortages. China’s two main grid operators -- State Grid Corp. of China oversees more than 80% of the country, while China Southern Grid Corp. handles five southern provinces -- have rapidly built out long-distance power lines across the country, but there’s still more work to do.

At present, there are significant disconnects -- both physically and in terms of coordination -- between different parts of the country, or even in some cases within the same provinces, said David Fishman, a manager at Lantau Group, an energy consultancy. And there’s very little inter-provincial power trading.

“That’s why you can have issues where one part of the country has lots of power and another place doesn’t have any,” Fishman said. “The more connectivity you have, the more you can efficiently allocate supply. So there is a case for more investment in ultra-high voltage lines and more local lines.”

Go Green

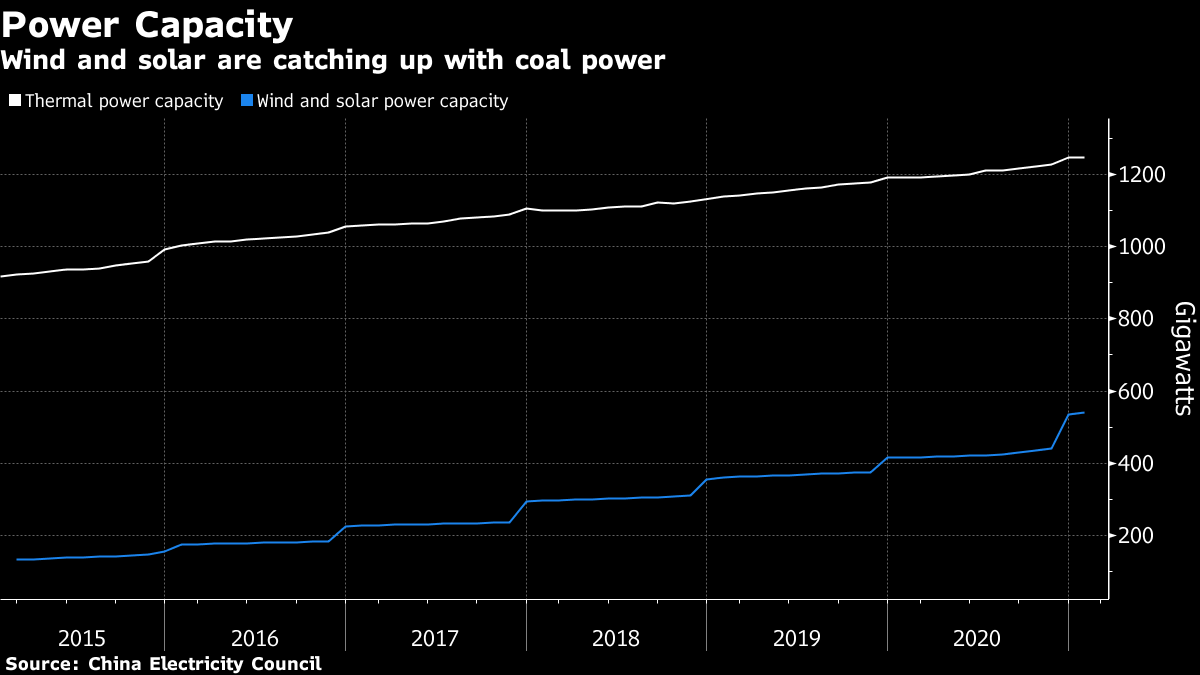

The global energy crunch has, for some, exposed the pitfalls of moving away from fossil fuels before renewable energy is mature. In China, the government “will probably be a bit more cautious about retiring the coal fleet,” said BloombergNEF’s Kou.

But the current situation -- where China’s being forced to hunt for gas and coal in a global bidding war -- highlights the security benefits of domestic wind, solar and hydropower. What’s needed in addition to the country’s plans to add massive amounts of clean energy are investments in flexible storage such as pumped hydro or large-scale batteries to manage the ups and downs of renewable flows.

“Recent months have exposed the vulnerability of China and many other economies to fossil fuel prices and strengthened the case for moving to zero-carbon energy sources,” said Lauri Myllyvirta, lead analyst at the Centre for Research on Clean Energy and Air.

Stocking Up

Even with China’s renewables binge, coal isn’t going away any time soon, and September’s debacle has exposed serious problems in the management of the fuel’s supply and reserves, Lantau’s Fishman said. Inventories at power plants are running critically low with prices soaring even before winter arrives.

One way to cushion such shortages would be to copy the success of its strategic oil reserves by building and filling state-owned coal storage facilities throughout the country. Not only would that provide a backstop in future times of need, but buying to fill up inventories during periods of fallow demand could help miners as well.

Plans for such a program are already underway. After power shortages last winter, the country’s five-year plan through 2025 included a vow to strengthen coal reserve capacity. And in June, the government said it aimed to raise those stockpiles to 600 million tons, or about 15% of annual consumption.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods