Texas Plans to Become the Bitcoin Capital, Vulnerable Power Grid and All

(Bloomberg) -- Texas, already home to the most vulnerable power grid in the U.S., is about to be hit by a surge in demand for electricity that’s twice the size of Austin’s.

An army of cryptocurrency miners heading to the state for its cheap power and laissez-faire regulation is forecast to send demand soaring by as much as 5,000 megawatts over the next two years. The crypto migration to Texas has been building for months, but the sheer volume of power those miners will need — two times more than the capital city of almost 1 million people consumed in all of 2020 — is only now becoming clear.

The boom comes as the electrical system is already under strain from an expanding population and robust economy. Even before the new demand comes online, the state’s grid has proven to be lethally unreliable. Catastrophic blackouts in February plunged millions into darkness for days, and, ultimately, led to at least 210 deaths.

Proponents like Senator Ted Cruz and Governor Greg Abbott, both Republicans, say crypto miners are ultimately good for the grid, since they say the miners can soak up excess clean power and, when needed, can voluntarily throttle back in seconds to help avert blackouts. But it raises the question of what these miners will do when the state’s electricity demand inevitably outstrips supply: Will they adhere to an honor system of curtailing their power use, especially when the Bitcoin price is itself so high, or will it mean even more pressure on an overwhelmed grid?

“There’s nobody looking at the scale of potential investment in crypto and its energy demand over the next couple of years and trying to account for that in some sort of strategic plan,” said Adrian Shelley, director of the Texas office of the consumer advocacy and lobbying group Public Citizen, which has sharply criticized the vulnerabilities of the state’s unregulated power market.

Here’s what you need to know about Texas, cryptocurrency and the power grid.

Why Texas?

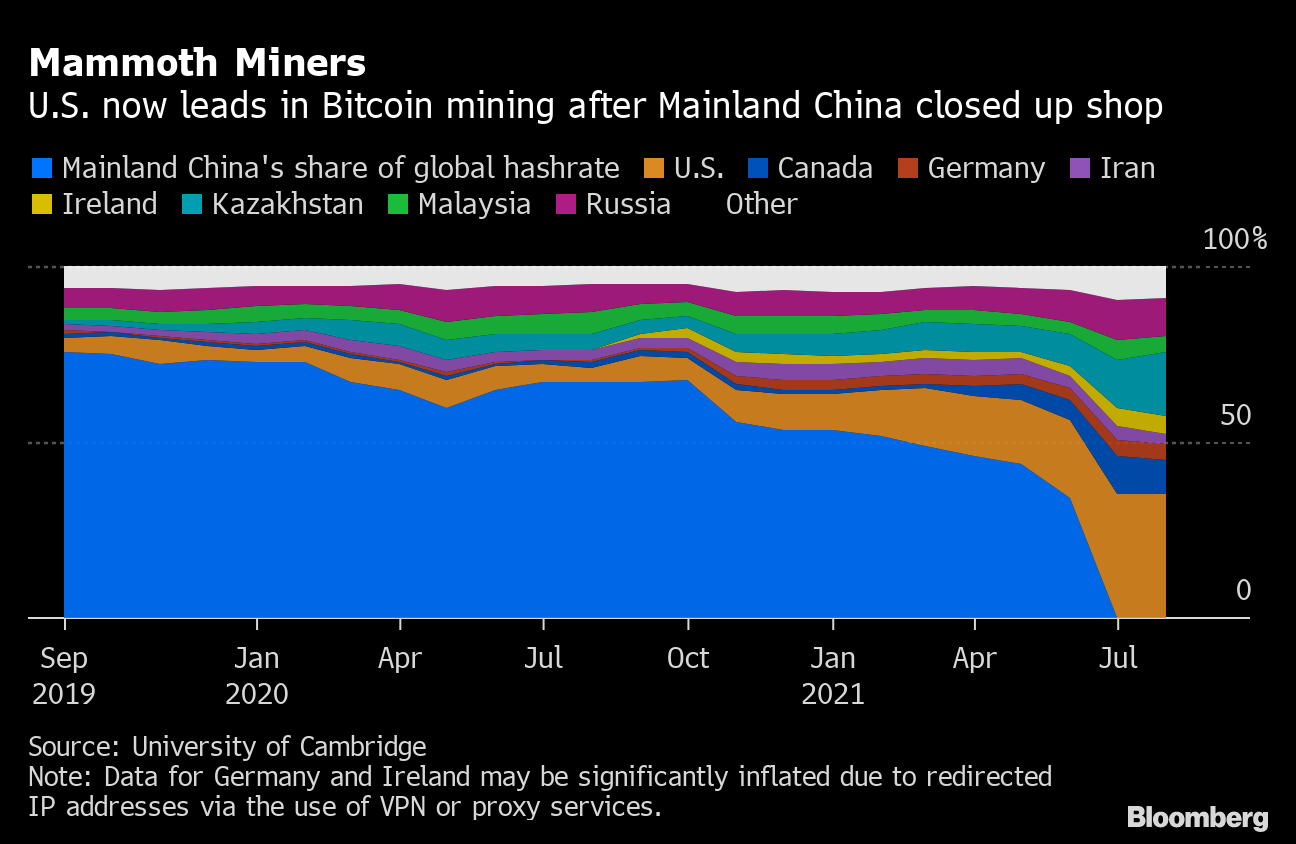

Texas is rolling out the red carpet for crypto miners as onetime leader China has banned the industry. Mining for crypto requires massive amounts of power, complicating Beijing’s efforts to curb greenhouse-gas emissions and shore up energy supplies ahead of the winter.

Miners setting up shop in the Lone Star State can often count on a 10-year tax abatement, sales tax credits and workforce training from the state, depending on where they are located and how many jobs they add. Even without formal incentives, the cheap power prices and the state’s hands-off policy toward business is often enough of a lure.

The pitch is working: The grid operator Electric Reliability Council of Texas, or Ercot, will account for about 20% of the Bitcoin network globally by the end of 2022, up from 8% to 10% today, according to Lee Bratcher, president of the Texas Blockchain council. Right now, Ercot has somewhere between 500 and 1,000 megawatts of mining capacity, out of about 2,000 nationwide. The state grid will add another 3,000 to 5,000 megawatts of mining demand by the end of 2023, he said.

While it's likely the grid will have enough total capacity to meet the surge in demand, the even bigger question at play is reliability and whether there will be enough power when demand is at peaks and supply is vulnerable, according to Moody’s analyst Toby Shea.

“Texas has been very business friendly and Ercot is one of the largest deregulated energy grids in the world,” said Dave Perrill, chief executive officer of mining-infrastructure company Compute North. His company had been planning to build more mining capacity across the U.S. in 2023, but it bumped that up to 2022 because there’s so much demand.

All nine U.S. and Canadian power grids have miners on them, but Texas now has the most, said Gregg Dixon, CEO of Voltus Inc., which helps large consumers procure power and provides demand-response services to U.S. crypto miners. Chinese nationals are behind a lot of that boom, he said.

“They come in and write $100 million checks on the spot,” he said.

Meanwhile, the Texas grid has come under strain as the population expanded by more than 4 million over the past decade to almost 30 million, part of a boom that created one of the fastest growing economies in the U.S. Austin is the state’s fourth-largest city, home to a little more than 3% of Texas residents.

Why It Could Be Bad for the Grid

While Ercot forecasts several thousand megawatts of mining demand will be added to the grid, the grid operator said it didn’t have any estimates for how much demand is currently coming from miners. It doesn’t know how much will be tacked onto its peak demand forecast, either, or how many companies will opt to curtail voluntarily in a disaster. Ercot is supposed to keep extra supplies handy—at least 13.75% more than that forecasted peak—to help avert blackouts in a cold snap or heat wave.

Forecasting supply and demand was already getting more difficult across U.S. grids. Extreme storms driven by climate change have disrupted supplies, and more electricity now comes from intermittent wind and solar. The rise of electric vehicles also makes it harder to predict where and when they will plug in. Adding to that, mining “is an enormous variable load,” said Tom Deitrich, CEO of Itron Inc., which provides utilities with demand-response capabilities.

Taken together, that means the grid could have the wrong amount of power right when the state needs it the most. Mismatched priorities in the Texas energy sector and a massive miss in power demand forecasts in February ended in catastrophe: millions of people in the dark, more than $20 billion in damages and calls to overhaul the state’s energy sector.

“The impact of Bitcoin mining is only going to increase peak demand, so it increases stress on the grid,” said Ben Hertz-Shargel, global head of Grid Edge, a division of energy consultant Wood Mackenzie. “In times of scarcity, like in February of this year, Bitcoin mining could have an unhelpful contribution to net load.”

Why Texas Broke: The Crisis That Sank the State Has No Easy Fix

Critics also say the sheer amount of new mining demand could raise power costs for average consumers, though no one has been able to quantify how much prices could rise. When Plattsburgh in upstate New York attracted crypto miners, it found they initially used up all the spare cheap hydro power, resulting in higher costs across the city; it ultimately had to put in place tariffs for miners to keep everyone else’s costs down.

“They turned the switch on and all of the sudden, we realize—Holy smokes!—where did this electricity usage come from?” said Mayor Christopher Rosenquest.

Another overlooked part of mining: Its energy intensity will continue to rise because the system is designed to make it harder to mine each incremental coin. Miners are evolving from small “mom and pops” adding connections to their basements to massive servers racked in large air-conditioned warehouses, using increasingly more power.

Ed Hirs, an energy fellow at the University of Houston, warns that Texas and crypto aren’t a good match.

“Who is the beneficiary of Bitcoin mining? It doesn’t provide employment, doesn’t pay taxes,” he said. “There are some social welfare issues here that I think a lot of people will tend to ignore until there is a crisis.”

Why It Could Be Good for the Grid

The crypto industry’s pitch for why it makes sense in Texas is simple: It’s good for the energy transition and the environment. Miners say they will drive a surge of new wind and solar development by signing long-term contracts, accelerating the state’s transition away from coal. And mining operations can act as a balancing force by soaking up excess clean power that would otherwise be wasted. Elon Musk has said Tesla Inc. would allow transactions in Bitcoin again once the mining is done with more clean energy.

Unlike a factory or oil refinery, crypto miners can cut their electricity usage within seconds to ease tight grid conditions. The mining industry likes to draw parallels to battery storage technology that can kick in when needed.

Crypto mining is “a very special kind of demand; it can curtail very quickly,” said Carrie Bivens, a former operations manager for the state grid who now serves as the independent market monitor with Potomac Economics. “By the same token, if that load never existed at all, there wouldn't be a need to curtail.”

Bitcoin Miner Is Scoring 700% Profits Selling Energy to Grid

Some miners are voluntarily opting into programs where they get paid to sell power back to the grid during high-demand periods—both a benefit for the greater good and their own cashflows. For instance, if a miner had contracted power for $50 a megawatt-hour, it could have sold that power back back to the grid for $9,000 during the February crisis and pocketed the difference.

A 300-megawatt mining site in Rockdale, in central Texas, that Riot Blockchain Inc. bought earlier this year, called Whinstone, is one of two facilities so far that have signed up for Ercot’s “controllable load resource” program that pays a premium to industrial users that will allow the grid operator to automatically reduce or increase their power usage when needed. The other in the program is Compute North’s 50-megawatt facility in Big Spring, in western Texas.

On a recent weekend, Ercot ordered the Whinstone site to decrease usage on back-to-back days after two plants went offline. “Our machines’ power danced, ramped up and down based on what Ercot told our software to do, and what it did is it helped stabilize the grid while other generation came on,” said Chad Everett Harris, CEO of the facility. Harris said it voluntarily shut down on Feb. 11 as temperatures plunged across Texas, three days before Ercot started cutting of power to save the grid.

In fact, miners realize most of their appeal right now is their ability to do good—curtail output to help the grid even at the risk of their own profits—otherwise they lose the argument that they’re aiding energy transition, Dixon of Voltus said. That’s why he thinks companies will do the right thing, unregulated or not.

“It is the elephant in the room,” he said. “And if they violate it, they destroy themselves.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost