Next Brexit Test Is A Carbon Market With High Volatility Risk

(Bloomberg) --

The U.K. is set to start its own carbon market with the aim of putting a price on polluting that it hopes will help achieve the country’s ambitious climate goals.

The first auction of emission permits on May 19 is the latest test of how the country copes with the separation from the European Union, its largest trading partner.

Until January, Britain was part of the EU’s emissions trading system, the world’s largest cap-and-trade program and the centerpiece of the bloc’s efforts to limit climate change. By going it alone, the U.K. is forgoing a 16-year-old market that helped cut EU emissions by almost a quarter in the past two decades.

The U.K. auction will be keenly watched to see how close prices will be to those in Europe, where emission costs have doubled in the past six months to a record. Too high a price could tilt the economic playing field against U.K. companies by overburdening them with permit costs, while one too low diminishes the incentive to invest in low-carbon technology.

While the U.K. market was designed to be almost exactly like the EU system, there are a few key differences.

The main one is that it’s much smaller. That means there are far fewer industrial and power-sector emissions that need permits. The U.K. is set to auction about 83 million permits this year, compared to more than 700 million for the EU.

It’s an issue market participants are concerned about. Earlier this year representatives from industry groups in the U.K. and Europe wrote to Prime Minister Boris Johnson to urge him to link the carbon trading system with the larger EU system. That would mean permits from both the U.K. and EU could be used to account for emissions in either.

The smaller market size also raises the risk of bigger price swings. An emissions trading system is meant to give businesses an indication of when is a good time to invest in lower-carbon alternatives. A high degree of volatility could hurt confidence that the emissions price is a reliable figure.

“It’s an emissions trading system for a very small market, which makes no sense,” said Jan Ahrens, head of research at SparkChange, a platform to facilitate investments in carbon markets. “That has the risk of having high price volatility.”

Volatility and a surging price could also be affected by how much financial players buy into the market. Demand from investment funds helped drive the gains in the EU carbon price this year. Ahrens said the investors he works with are eager to buy British carbon.

So how much will emissions cost in the U.K.? The main indicator is the EU carbon price, which has gained more than 70% this year to a peak of 56.90 euros per metric ton, or 49.01 pounds, on Friday.

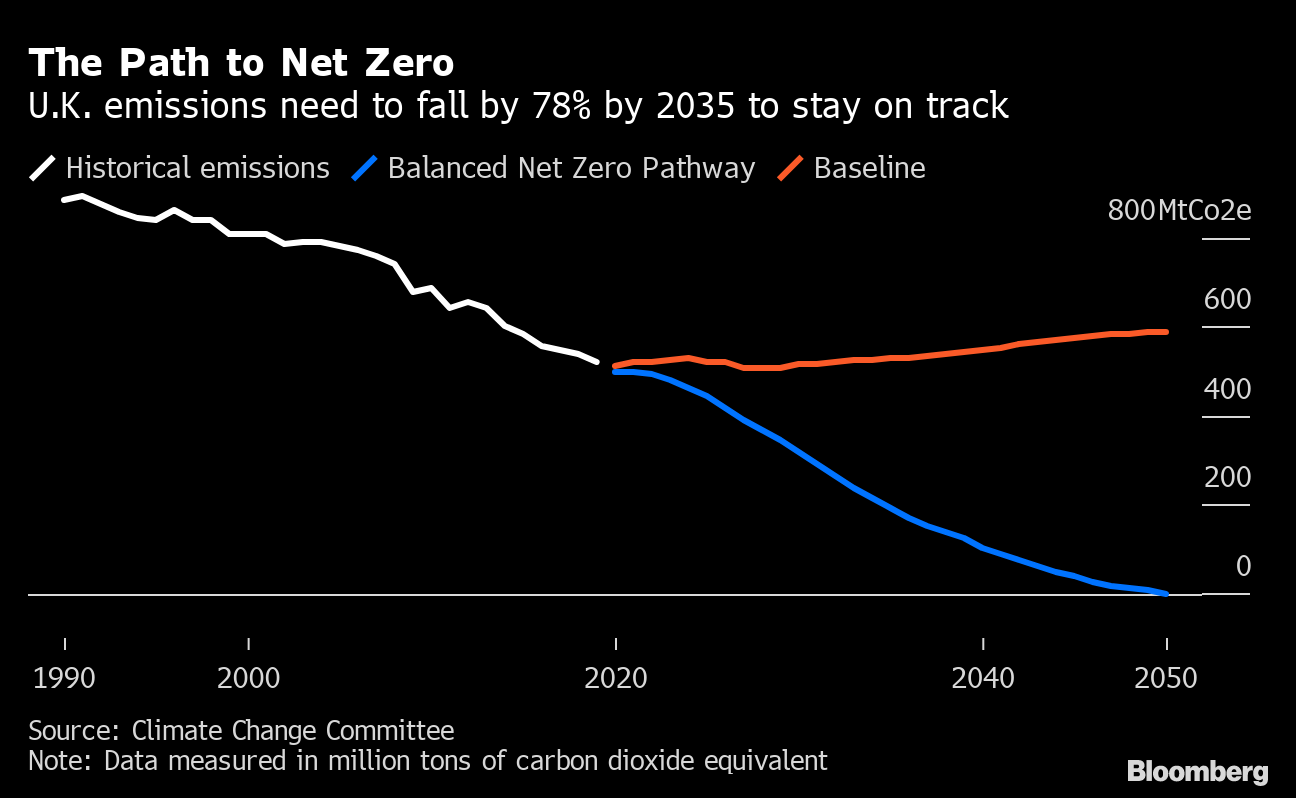

The U.K. market is set to be oversupplied from the outset, a bearish indicator for prices. The cap for total emissions is about 156 million tons, compared with about 97 million tons of actual emissions estimated by BloombergNEF. That surplus is intentional, allowing market participants to accumulate permits to hedge for future years. The cap will likely be revised in the coming years to shrink with the U.K.’s plans to rapidly cut emissions this decade.

There is also a safety net built into the British system. Unlike the EU, the U.K. has a price floor so that permits can’t be auctioned below 22 pounds. But similar to the EU, there’s a mechanism for the government to add permits to the market if prices rise too far, too fast.

U.K. Plans Deeper Carbon Cuts to Spur Climate Change Fight

It’s a part of the U.K.’s effort to ensure that the system works as planned, that companies that need permits can get them and that prices don’t bounce around too much after the market’s launch.

“This is the first year, so they want to make sure the market is effective,” said Bo Qin, analyst at BloombergNEF. “Not too high, not too low,”

For more articles like this, please visit us at bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis