India’s Coal-Dominated Power Market Is Tilting Toward Solar

(Bloomberg) --

India’s largest power generator, NTPC Ltd., has long been a major player in coal-fired electricity. It’s right there in the name: Until 2005, it was known by its longform moniker, National Thermal Power Company.

But it has lately stepped into the renewables business, as have many other major power and industrial players in India, with a commitment last year to build 32 gigawatts of renewable energy by 2032. This week, it doubled up that commitment, raising its target to 60 gigawatts.

NTPC hasn’t said what its future renewable asset mix will be, but most of India’s renewables expansion will come from solar. Were it to be entirely solar, 60 gigawatts of total capacity by 2032 would be approximately a fifth of India’s expected solar installations to that date. That’s not far off NTPC’s current power market share of 17%, more than 90% of which is fossil fuel-fired.

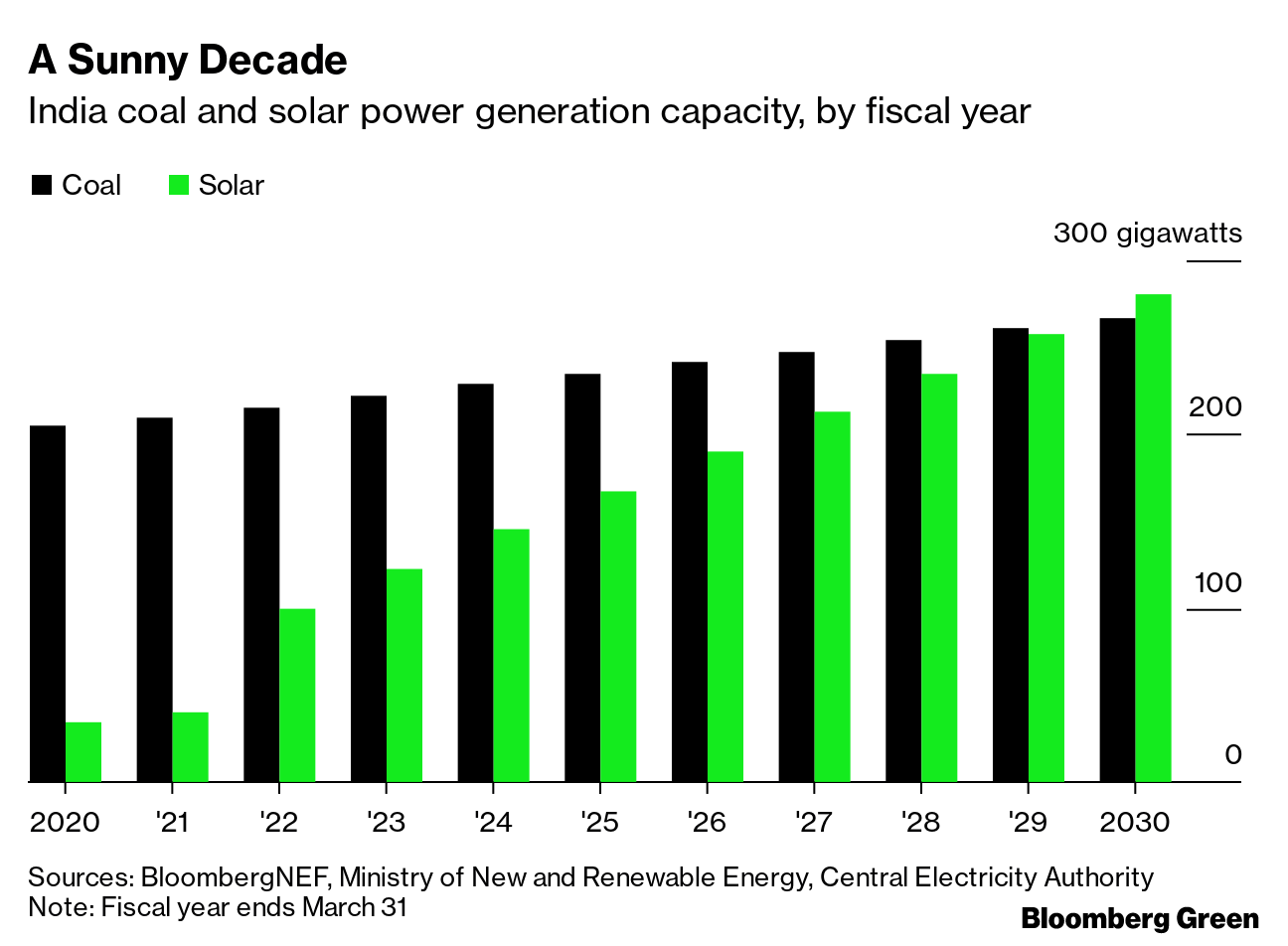

Any additional renewable power is good for India’s carbon intensity, but NTPC’s move also raises questions about the future of the nation’s coal fleet, which just might peak in the next decade. At the moment, solar is a pale shadow to India’s King Coal, which has about six times the installed capacity. However government projections and BloombergNEF analysis suggest that solar will overtake coal by the end of 2030. Solar capacity will expand 700% in the next 10 years; coal will expand, too, but only by 30%.

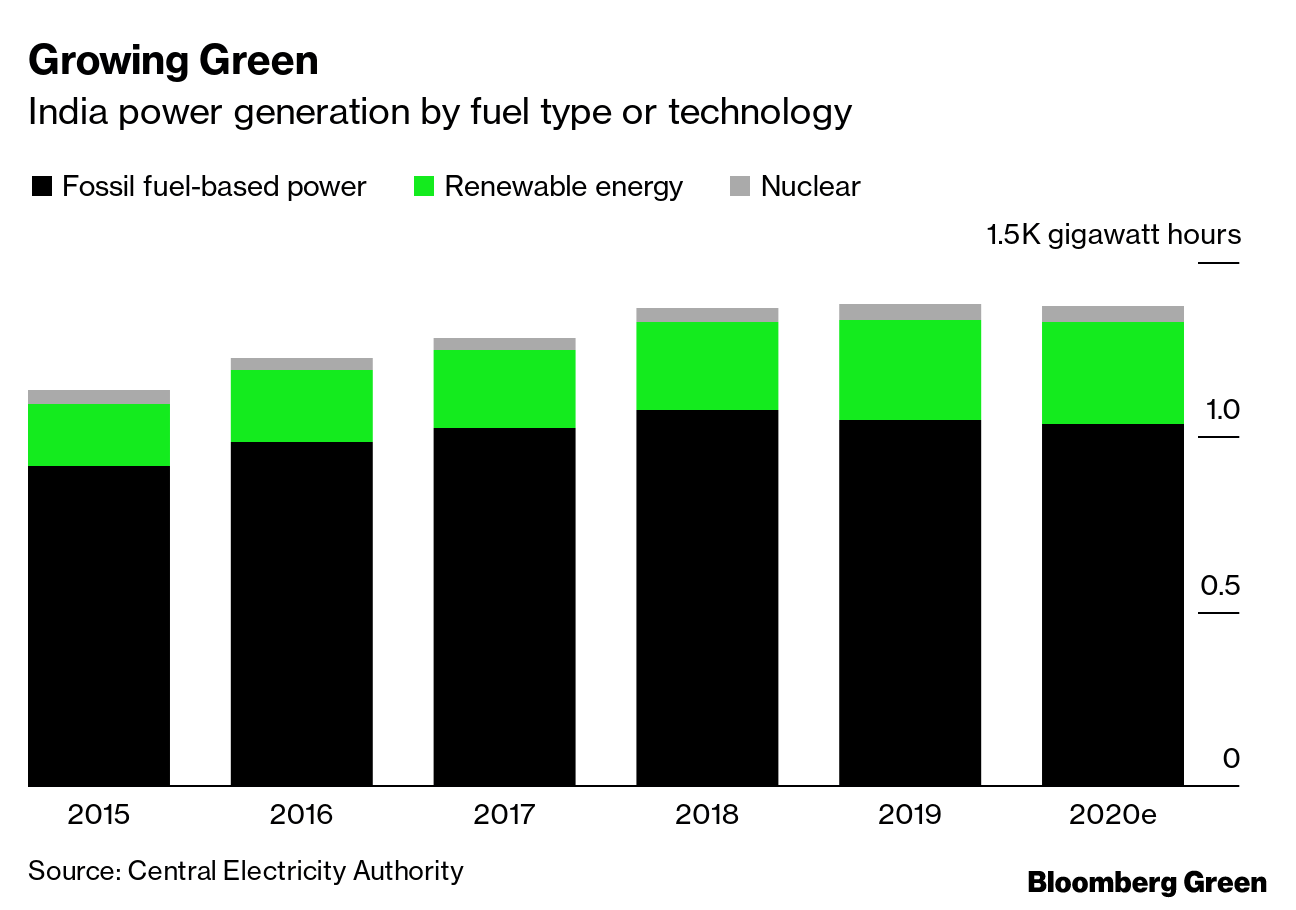

But this capacity figure doesn’t tell the real story of India’s coal fleet right now. It may be big, but its performance is uneven, and its utilization rate is falling. India’s fossil fuel-based power generation (which is almost entirely coal) declined in 2019, and again in 2020.

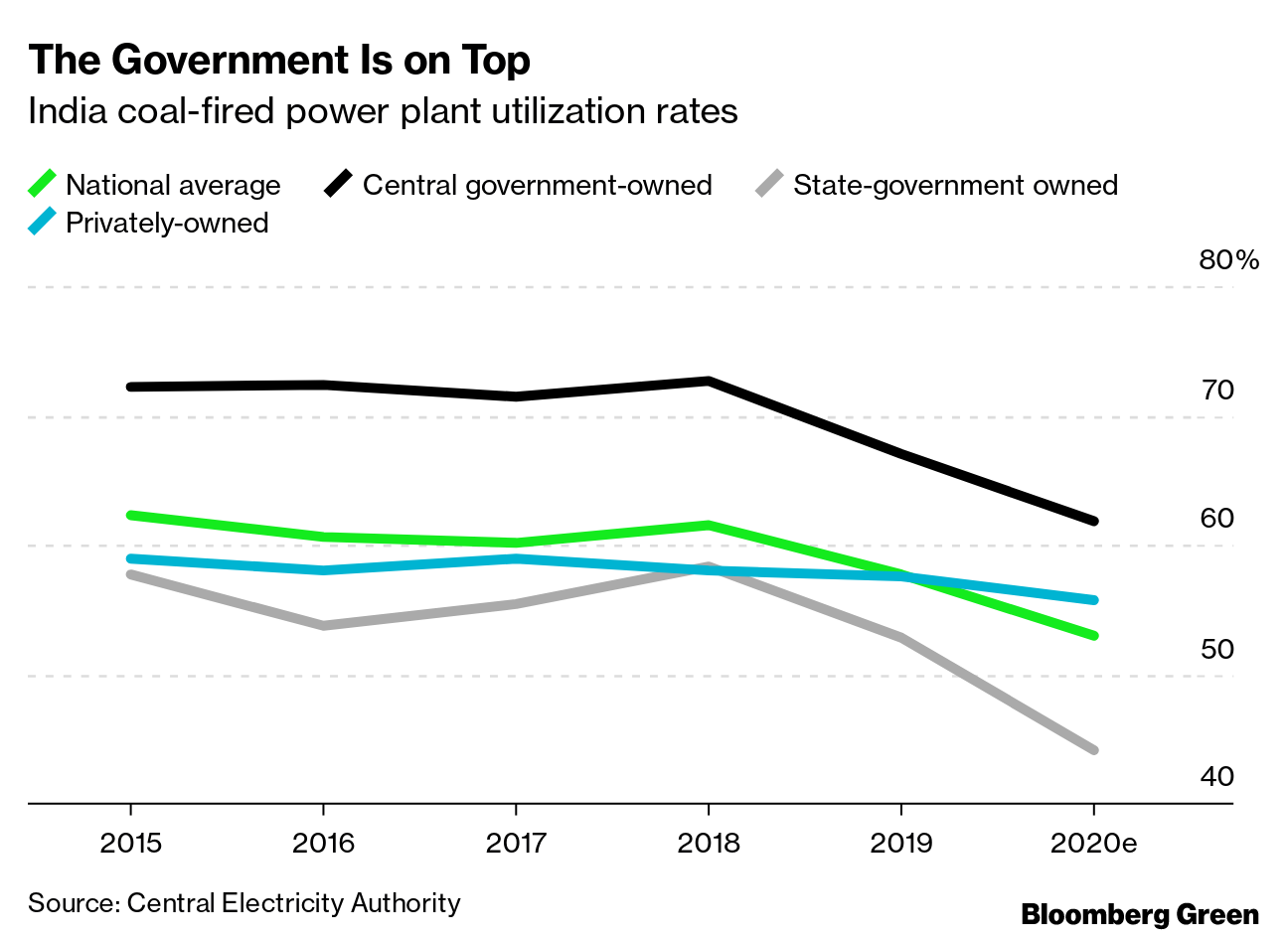

At the same time, the fleet of coal-fired plants kept growing. Spread a declining total amount of power generation over an expanding fleet and the math is simple: operating hours, or plant utilization, fell. NTPC and the other state-owned power generators have the highest utilization rates, which were still north of 60% last year. Privately owned plants were barely above 50%; state government-owned plants were well below 50%.

The higher the utilization rate, the easier it is to pay off a plant’s substantial capital costs and return money to shareholders. Below 50% utilization, plants are in a bad way, with essentially half the cash flow of a fully operating plant but the same fixed costs. Meanwhile, according to analysis by BNEF, the power from newly-built solar capacity in India is now cheaper than the power from existing Indian gas and coal plants.

This is why NTPC’s decision to double its renewable energy commitment is worth watching. On the company’s earnings call, Finance Director A.K. Gautam said that NTPC’s additional renewable energy commitments will not result in a change of its thermal fleet expansion plans — at least not yet. He stated that the company is waiting for a new committee under the country’s Central Electricity Authority to produce supply and demand projections. “Once that comes in maybe a year or so, we’ll look into our number and accordingly restructure it,” he said.

Even a slight restructuring, in Gautam’s words, could change the coal profile I described at the top of this essay. A handful of cancellations or a slight withdrawal of expansion plants and India’s still-growing coal fleet will peak, then fall. India’s once-National Thermal Power Company was for years the backbone of the country’s coal-fired power fleet growth. Its own renewables commitment might just be the thing to tilt that fleet into decline.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says