Adani Share Tumult Deepens With Some Diving by Daily Limit

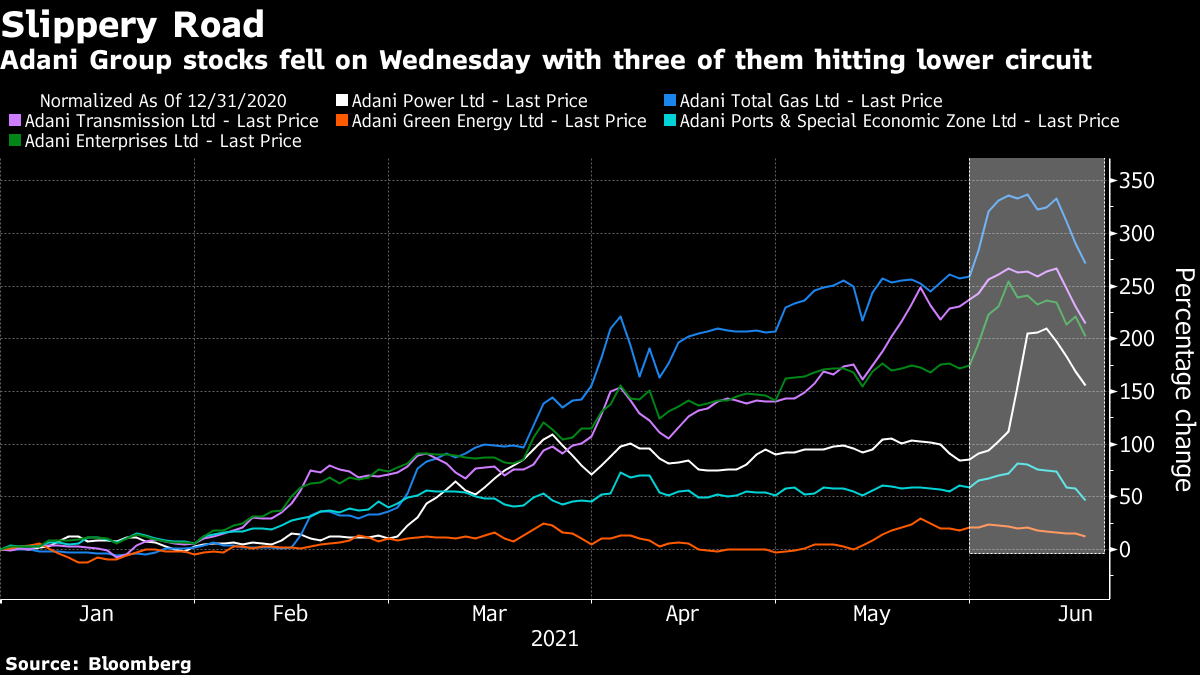

(Bloomberg) -- The slump in shares of companies controlled by Indian billionaire Gautam Adani deepened on Wednesday with three of them tumbling by the daily limit for the third straight day.

Adani Total Gas Ltd., Adani Power Ltd. and Adani Transmission Ltd. hit the lower circuit after dropping 5% each even as the group denied a local report Monday that said accounts of three Mauritius-based funds that own the group’s stocks were frozen.

The dramatic rout marks a halt to the dizzying rally in shares of some of the Adani Group of companies that had added almost $40 billion to the billionaire’s wealth this year through Friday that made him the second-richest person in Asia. His net worth, based on Tuesday’s closing share prices, is $71.5 billion.

Read: Barred or Not? Adani Investors Fret Over Three Mauritius Funds

The conglomerate refuted The Economic Times report on Monday, which said National Securities Depository Ltd. froze the accounts of Albula Investment Fund, Cresta Fund and APMS Investment Fund. It called the report “blatantly erroneous” and followed up with another statement Tuesday citing communication from India’s national depository that the three funds’ demat accounts are “suspended for debit.”

The funds, registered at the same address in Port Louis, own more than 435 billion rupees ($6 billion) in four Adani group firms, the report had said.

In other firms, Adani Enterprises Ltd. fell 5.9% to a two-week low while Adani Ports and Special Economic Zone Ltd. dropped to its lowest level since end-March, slipping 7.2%. Adani Green Energy Ltd. declined 2.4% to a one-month low.

Dollar bonds issued by Adani group firms have pared some of the losses from earlier this week. Adani Ports & Special Economic Zone’s dollar bond due 2031 fell by a record 3.3 cents on the dollar on Monday to 94.1 cents and is now trading at 95.6 cents.

(Updates with closing share prices.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says