European Natural Gas Prices Drop to Near 3-Week Low on Rising Supply

(Bloomberg) -- European gas prices slumped for a sixth day, the longest losing streak in more than a year, as cargoes of the liquefied fuel head to the continent just as industrial shutdowns and warm weather curb demand.

Futures fell as much as 9.7% on Wednesday as a flotilla of U.S. LNG cargoes is headed to the region, while several vessels that were sailing to Asia have now diverted to Europe. More supplies come after record prices earlier this month forced factories to halt or slow output, curbing demand just as the continent faces unseasonably warm temperatures.

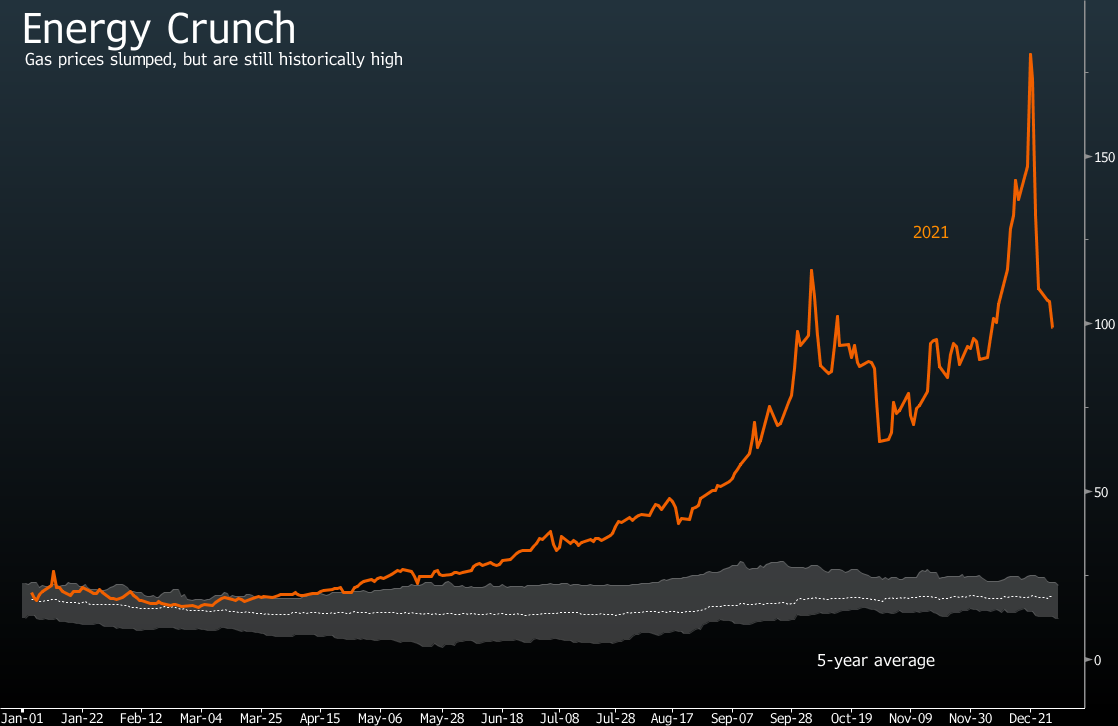

European gas prices surged more than 400% this year, with Russia curbing flows at a time demand was rebounding. While prices have slumped over the past week, they are still more than five times higher than the average of the past five years. The LNG relief may also be short-sighted, with geopolitical tensions and Russian pressure to get its controversial Nord stream 2 pipeline to Germany approved keeping traders on edge.

“Europe’s gas problem may not go away next year,” said Andrew Hill, head of European gas analysis at BloombergNEF, in a report on Wednesday. “Geopolitical issues and acrimony with Russia, particularly around the Nord Stream 2 pipeline, will increase the scope for Russia to limit flows to Europe in the first half of the year, and potentially much longer.”

Benchmark European gas prices fell to 96.22 euros a megawatt-hour, before trading at 97.50 euros by 9:51 a.m. in Amsterdam. In the U.K., prices slumped as much as 12% to 235 pence a therm, the lowest since Dec. 7.

LNG supplies are already entering European grids. Flows from the Isle of Grain and Milford Haven Terminals in the U.K. have surged more than 20% since Dec. 24, according to data from the National Grid. Flows at other ports in Europe are also set to increase, with the number of U.S. cargoes heading for the continent’s ports jumping by one-third over the weekend.

The region is also attracting more supplies as Asia’s biggest buyers opt to use their inventories this winter instead of procuring more cargoes.

EARLIER: Another Winter LNG Cargo Appears to Divert to Europe From China

Gas has whipsawed in recent weeks, soaring to record levels above 180 euros a megawatt-hour last week, following a sharp drop in shipments from Russia. Power markets have followed a similar trend, with traders bracing for tight supplies in early January, when about 30% of France’s nuclear fleet will be offline.

German power for next year fell as much as 2.1% to 221 euros a megawatt-hour.

High energy prices have already forced Aluminium Dunkerque Industries France, Europe’s top smelter of the metal, to curb output. Trafigura’s Nyrstar said it will pause zinc production in France in early January and Romanian fertilizer maker Azomures temporarily halted activity.

Higher wind power production and milder weather have also helped to reduce demand for the fuel to generate electricity and heating.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally