European Gas Extends Gains as Giant Field in Norway Cuts Output

(Bloomberg) -- European natural gas prices extended gains as one of the region’s biggest fields curbed output because of a fault.

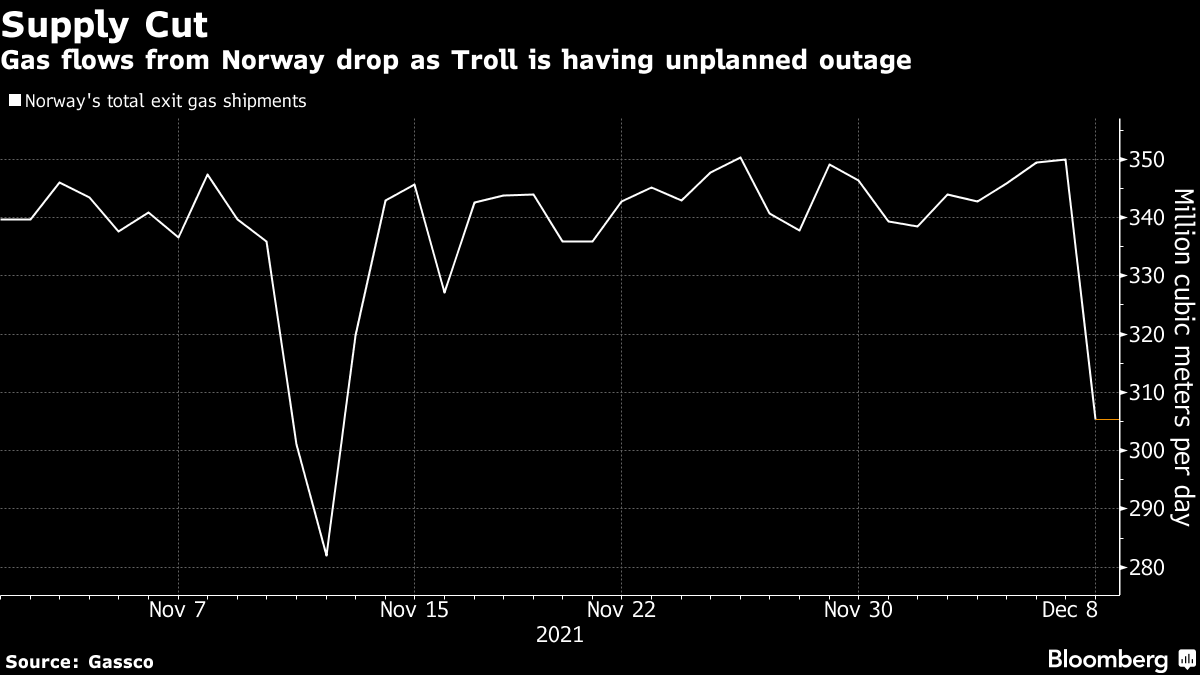

Shipments from Norway are expected to slump by nearly 13% on Wednesday after the Troll field suffered an unplanned outage, according to network operator Gassco AS. Dutch front-month gas, the European benchmark, rose as much as 9.6%, topping 105 euros a megawatt-hour.

“Given the outage length is uncertain, this has added yet more risk to the benchmark price,” said Tom Marzec-Manser, an analyst for European gas and LNG at ICIS. Equinor ASA, Troll’s operator, didn’t elaborate on the field’s issues, saying that while it was having “some operational problems that lead to reduced production” the company delivers on its “obligations.”

The reduction in gas flows from Norway is another bullish factor for traders already worried about winter supplies from top provider Russia as tensions surge with the U.S. over Moscow’s positioning of troops at the Ukrainian border.

For now, the U.S. scuttled efforts to add new sanctions to Russia’s new Nord Stream 2 gas pipeline to Germany, but the project is one of the potential targets if Russia invades Ukraine, according to people familiar with the plans.

U.S. Wants Nord Stream 2 Halted If Putin Invaded Ukraine

The benchmark Dutch gas contract rose 7.4% to 103 euros a megawatt-hour by 11:18 a.m. Amsterdam, while the U.K. month-ahead gas added 8.9% to 265.80 pence a therm.

Summer gas contracts are also seeing strong gains, as Europe’s unusually low reserves are quickly depleting, without much extra fuel set to arrive imminently. Russia, from whom many had expected additional flows during this heating season, is keeping its volumes steady, and at levels below this time last year.

Low stockpiles in Europe would mean elevated demand to replenish them when the summer season comes, which may push prices even higher given uncertainty over supplies.

“The storage situation is critical,” Cristian Signoretto, director for global gas and LNG portfolio at Eni SpA, said in an interview this week. “The outlook for gas markets in Europe for this winter and the whole 2022 is still on the tight side.”

While much depends on the weather, a decrease in Europe’s domestic production and intense competition for liquefied natural gas cargoes with other regions are exacerbating supply tightness, Signoretto said. Meanwhile, the halt of a major pipeline delivering Algerian gas to Spain and a reduction of spot flows from Russia aren’t helping either.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances