Activist Elliott Renews Push to Split Off SSE’s Renewables

(Bloomberg) --

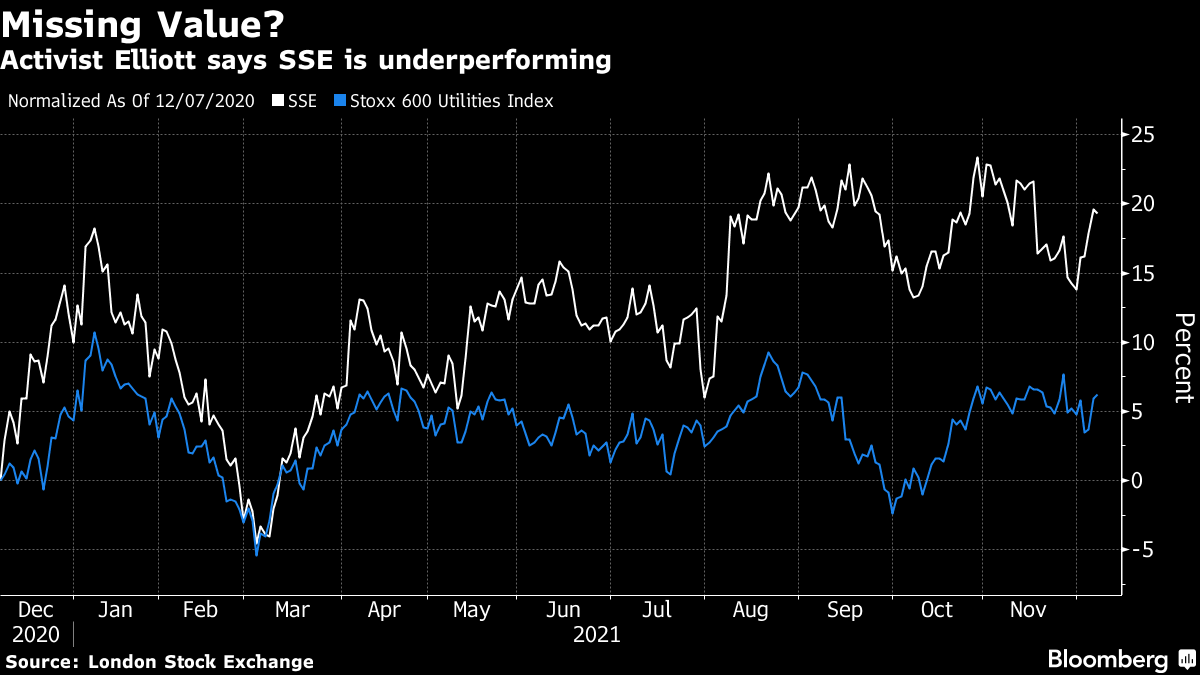

Elliott Investment Management renewed its push to get SSE Plc to split off its renewables business into a separate unit, a move the activist investor says would create 5 billion pounds ($6.6 billion) of value.

In a letter to SSE Chairman John Manzoni, Elliott said the company had failed to provide a convincing explanation for why it’s not pursuing a listing for its renewables division, according to a statement. Elliott, a top five investor in the firm, urged it to submit a “detailed and credible plan” to address its concerns.

SSE frustrated Elliott last month when it decided not to split up the company, arguing in a strategy update that such a move would lead to 95 million pounds a year of lost value. The utility also announced a 30% dividend cut from 2024 to fund a multibillion-pound increase in spending on net-zero infrastructure, a decision that disappointed investors, according to Elliott.

“Your announcement lacked ambition,” Jeff Rosenbaum and Nabeel Bhanji, portfolio managers at Elliott, said in the letter. “We demonstrated to you that a separation would resolve the long-term funding challenges that have hindered SSE’s growth historically, reversing years of share-price underperformance and allowing SSE to accelerate the green-energy investments.”

In response, the Perth, Scotland-based utility said it had been holding “constructive and supportive” discussions with investors since its strategy announcement.

“Separation risks valuable growth options across the clean-energy value chain,” the company said in a statement on Tuesday. “It is not the right outcome to maximize value for shareholders.”

SSE shares were little changed at 10:12 a.m. in London. They have risen almost 3% since the company’s strategy update on Nov. 17, taking their gain this year to 8.7%, compared with a 2.4% increase for the Stoxx 600 utilities index.

Wind Giant

How best to capitalize on the shift to net zero is a key question for utilities. SSE is the U.K.’s biggest developer of offshore wind and will benefit from Britain’s 40-gigawatt target for the technology by 2030.

“SSE’s regulated assets have significant growth potential; the renewables pipeline is amongst one of the highest in proportion to current company value,” analysts at Barclays Plc said. “If Elliott are to continue to push for a company split, it will either need to bring management onside -- difficult in our view -- or be done without management blessing.”

Elliott pointed to competitors Acciona SA, Eni SpA and Iberdrola SA, which have already split off renewables units or are thinking about doing so. It said SSE’s businesses are worth 21 pounds per share, 29% more than the current stock price, or a total of 5 billion pounds more than its market capitalization.

(Updates with SSE response starting in fifth paragraph, analyst comment in ninth.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost