Fund Managers Cash Out $350 Million of Bets on U.K. Deal Targets

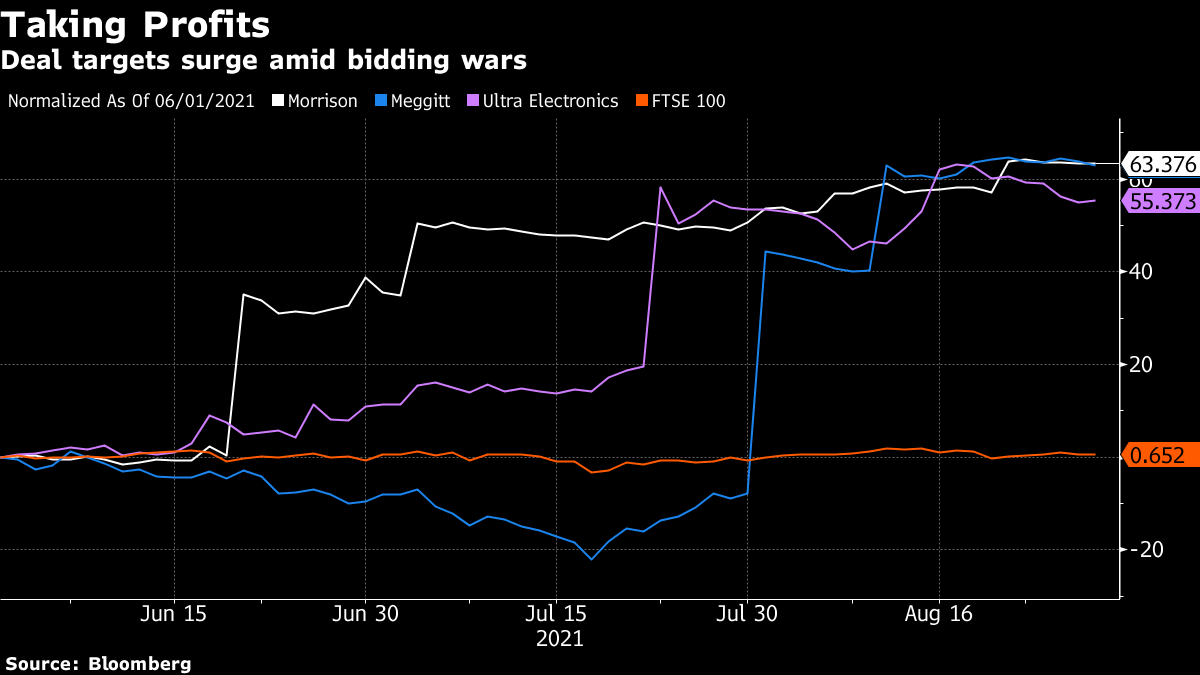

(Bloomberg) -- Key investors have been cashing out some of their bets on U.K. acquisition targets, raising around $350 million in recent weeks as bidding wars heat up for some of Britain’s most well-known companies.

Pendal Group Ltd., which owns British fund house J O Hambro Capital Management Ltd., has slashed its interest in grocery chain Wm Morrison Supermarkets Plc through dozens of transactions in the past couple months. This week, it’s already disclosed 11 trades to cut its stake.

The latest selldown announced Friday brings its ownership to 1.28%, less than half of what it had in late June, according to regulatory filings. J O Hambro was one of the first to speak out when Morrison got takeover approaches, saying it should hold out for more and engage only if it’s offered 270 pence per share.

It may now be feeling satisfied: Fortress Investment Group increased its bid beyond that level earlier this month, only to be topped two weeks later by an offer of 285 pence per share from Clayton Dubilier & Rice. Fortress is now considering whether to bump yet again, and Morrison shares are trading at 290.50 pence.

Morrison’s biggest shareholder is also taking some money off the table. Silchester International Investors LLP trimmed its stake several times this week and now owns 14.27%, down from 15.2% in June.

Other investors are taking profit elsewhere. U.S. asset manager Franklin Resources Inc. revealed Thursday it had cut its holding in defense supplier Meggitt Plc to 1.33%. That’s the fourth reduction it’s announced this week, and Franklin has now sold more than half its stock since early August. While it’s not possible to see exactly what the firms paid for their holdings, rising share prices mean they’ve almost certainly made gains.

Alpine Associates Management Inc., the merger arbitrage specialist led by Robert Zoellner Jr., disclosed this week its interest in Meggitt had fallen to 1.18%, from 1.28%. The moves come as American suitor Parker-Hannifin Corp. considers whether it wants to increase its offer for Meggitt to trump TransDigm Group Inc.’s rival proposal.

Takeovers of British companies have risen more than 400% this year to $200.4 billion, the busiest for the same period since 2007, as foreign acquirers and private equity firms hunt for bargains. In many cases, mid-cap companies unloved by stock market investors have become the subject of fierce bidding wars as suitors raise their offers multiple times.

Amidst all this selling, one investor known for wagering on deals is doubling down. TIG Advisors boosted its interest over the past few days in Meggitt, Morrison and Avast Plc, the antivirus software maker being bought by NortonLifeLock Inc. It’s also increased its exposure to John Laing Group Plc and Ultra Electronics Holdings Plc, both targets of private equity bids, by loading up on more derivatives tied to those stocks.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis