Record Offshore Wind Auction Boosts UK’s Hopes for 2030 Goal

(Bloomberg) -- Britain stepped up support for offshore wind in the latest subsidy auction, showing the government is still determined to meet its ambitious 2030 clean-power goal even as costs rise.

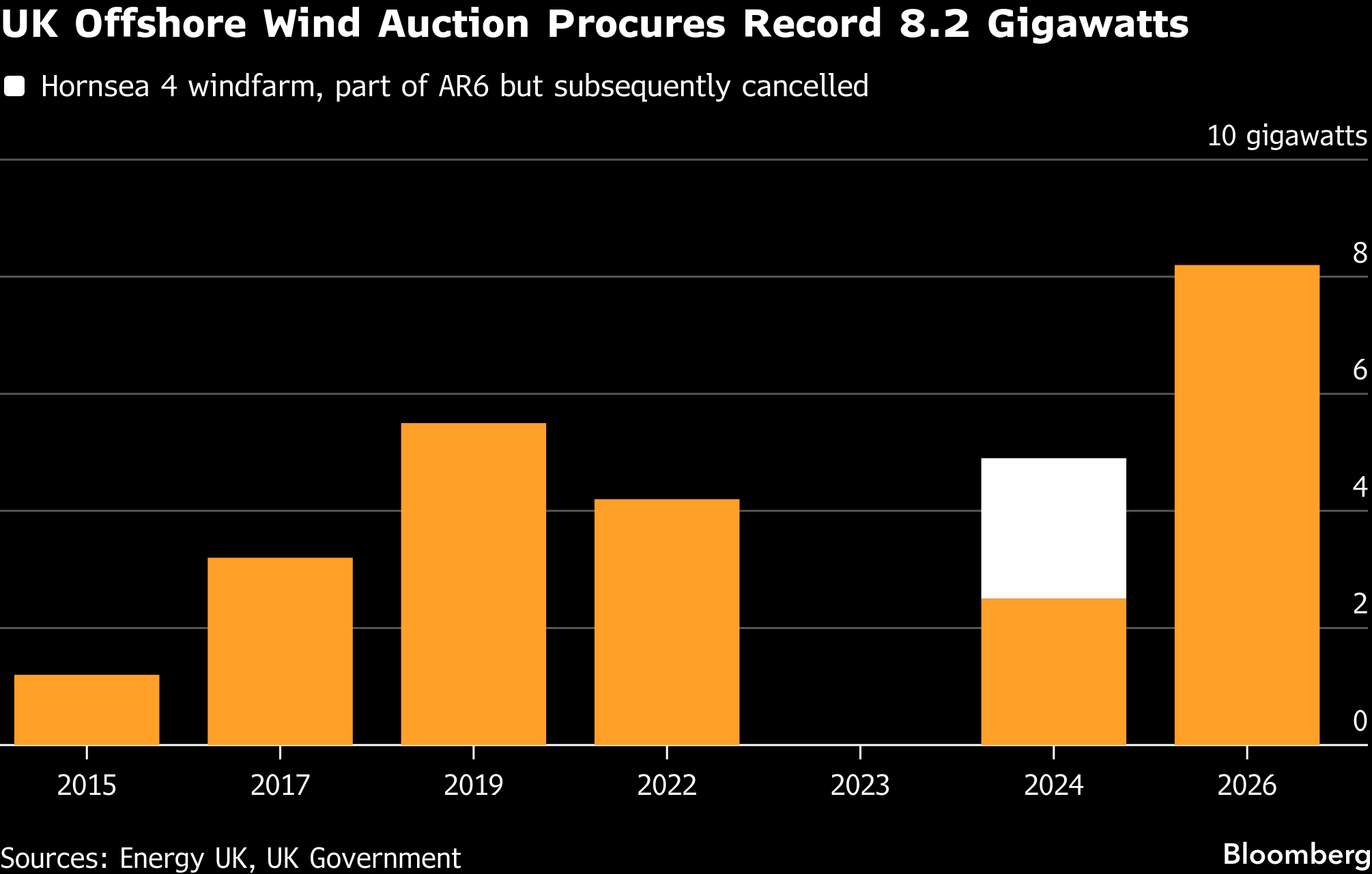

The 8.2 gigawatts of offshore wind beat analysts’ expectations and will boost the likelihood of the government delivering on its promise to almost totally exit fossil fuels in power generation. The UK now needs around 7 gigawatts of new capacity in the next auction, which is the last realistic chance to get projects built in time.

The government will pay developers more for projects won in this auction compared with last year, a cost that’s ultimately paid for by consumers. It creates a difficult balancing act for Prime Minister Keir Starmer, who has pledged to cut household bills during the current parliament.

“With these results, Britain is taking back control of our energy sovereignty,” said Energy Secretary Ed Miliband in a statement. The results deliver the biggest single procurement of offshore wind energy in British and European history, according to the statement.

The auction secured capacity at a price of £65.45 ($88) per megawatt-hour. This price, higher than in last year’s auction, still represents a “net benefit to bills over the next decade,” according to analysis from Aurora Energy Research.

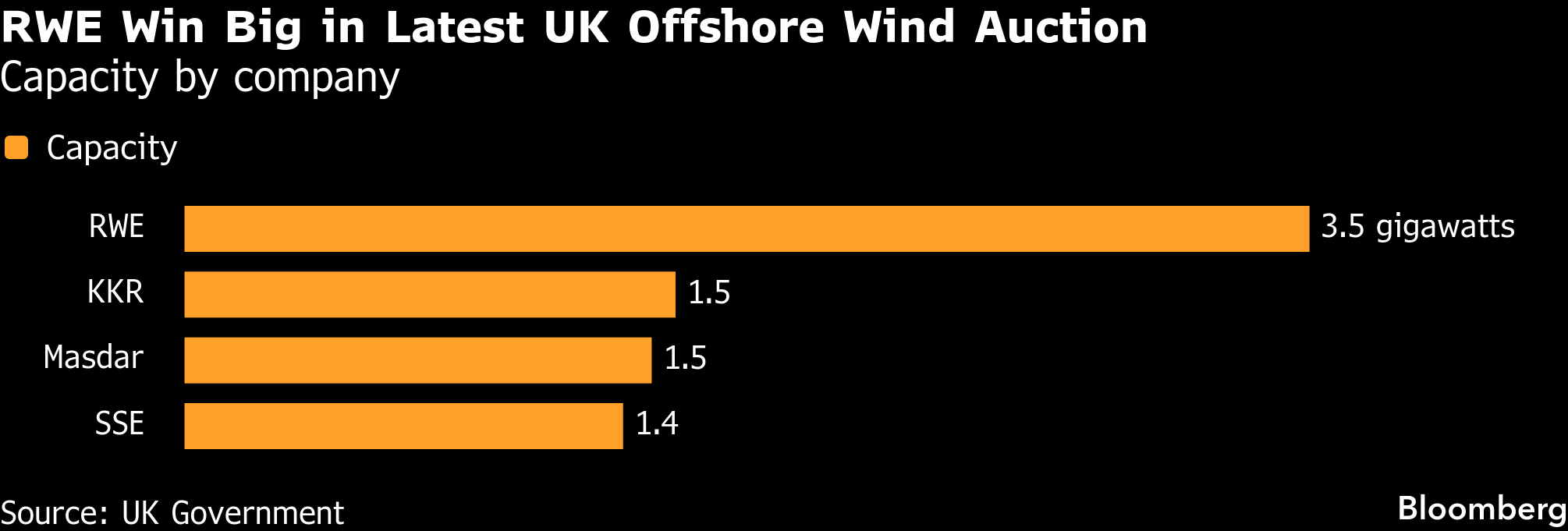

RWE AG was the major winner, involved in all but one of the projects that won. Separately, RWE said it has agreed a deal with KKR & Co to develop, construct and operate the Norfolk Vanguard East and Norfolk Vanguard West projects, which were awarded contracts in the auction.

Another winner, RWE’s Dogger Bank South, doesn’t yet have planning permission, which means it may not be built in time to meet the 2030 goal. RWE’s shares rose as much as 3.5%, to the highest level in almost 15 years.

The government says investing in renewables and moving away from a gas-based power system will ultimately lower electricity costs, but it does mean that the high upfront expense of building wind farms is passed on to consumers in the short term.

Costs are likely to be higher than expected because the government overspent on its original £900m budget for fixed-bottom offshore wind. The program was increased to almost £1.8 billion under new rules that allow the government to choose extra projects if they are deemed good value for consumers.

Since the early 2000s, the cost of building offshore wind has fallen as the technology matured and turbines became more powerful. In recent years, however, supply-chain disruptions, rising raw-material costs and higher financing expenses have pushed prices up for some projects. As a result, governments around Europe have struggled to attract bids for offshore wind developments over the past year, with higher costs making developers more cautious.

High Prices

Britain continues to have some of the highest electricity prices in Europe, putting pressure on households, slowing the uptake of technologies such as electric vehicles and heat pumps, and threatening the country’s competitiveness in attracting emerging sectors like data centers.

Power demand is set to rise and governments are preparing their energy systems for this increase by rapidly scaling up wind and solar generation capacity. Alongside building out renewable energy capacity, grids must also be upgraded to bring the power from where it is generated to where it is needed.

While the UK has long been a leader in offshore wind and climate policies, both have become increasingly politicized, particularly after US President Donald Trump rolled back support for renewable projects in the US, a shift that has weighed on the operations of several European developers there.

During a visit to Scotland last year, Trump reiterated his opposition to wind farms, especially projects proposed off the coast near his golf courses. While Scotland is seeking to pivot from its oil-dependent past to become a global leader in wind energy, Trump instead described Aberdeen as the “oil capital of Europe” and urged further expansion of the sector.

Including more nascent floating offshore wind capacity, the total procured capacity at the recent auction was 8.4 gigawatts.

“The results of the government’s offshore and floating offshore wind auction represent a significant step forward in delivering the UK’s evolution to clean energy,” said James Alexander, chief executive officer of the UK Sustainable Investment and Finance Association.

(Updates with bill impact and share prices)

©2026 Bloomberg L.P.