Solar Power Eclipses Fintech as Africa’s New Investment Magnet

(Bloomberg) -- Solar and renewables are vying with fintech and payments as the top draws for African venture capital, with investors viewing energy projects as the most attractive on the continent’s startup scene, a study found.

Renewables and clean technology that reduces adverse environmental impacts — together with electric-mobility assets such as motorcycles and delivery vehicles — attracted the highest funding growth in 2025, raising $700 million, Briter said in its annual Africa Investment Report. That’s more than three times more than in the prior year.

Fintech and digital remained the most-funded sector by volume and deal count, the London-based research company said in the sixth edition of its study.

Overall, funding for African firms climbed by a quarter to more than $3.6 billion last year, with more than 635 disclosed deals announced, 43% more than the prior period, it said. There were a further 365 known transactions where the capital amount wasn’t made public.

South Africa raised the most funding, with 32% of the total, followed by Kenya at 29%, Egypt at 15% and Nigeria at 8%. Excluding $100 million mega-deals, the average transaction size reached its highest level since 2019.

Artificial intelligence has also emerged as one of the most closely watched areas of new investment in Africa, with 15% of deal activity coming from AI-enabled companies, the report said. However, deep research and development is limited, with most solutions being applications in established verticals, Briter said.

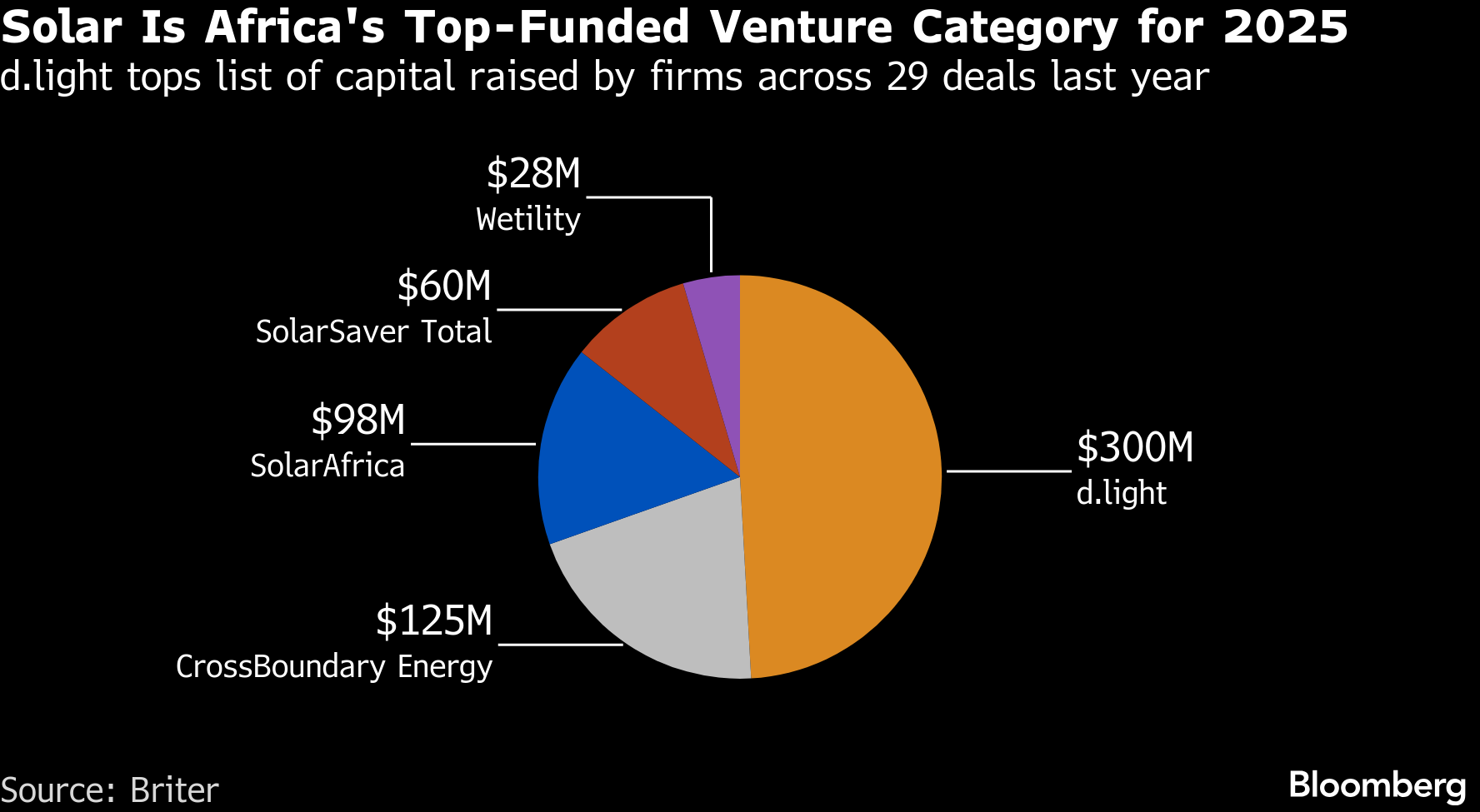

Solar energy was the top-funded category across 29 deals, driven by a surge in demand for off-grid power solutions as companies see opportunities to reach the almost 600 million people in Africa without electricity. The sector grew 26% from the previous year, with companies such as d.light, Sun King, CrossBoundary Energy, and SolarAfrica reaching deals.

Climate ventures have attracted more than $3 billion in sub-Saharan Africa over the last decade, with roughly 70% of that capital absorbed by just 20 companies, and mostly in Kenya. Francophone West Africa — particularly Senegal, Ivory Coast, and Burkina Faso — is emerging as an increasingly active hub of climate-focused companies, the report said.

hereNext Africa newsletter,AppleSpotify anywhere you listen

©2026 Bloomberg L.P.