Santos Starts Barossa Project Days After Failed $19 Billion Sale

(Bloomberg) -- Santos Ltd. has begun production at its $4.5 billion Barossa field off northern Australia, a move toward a much-anticipated increase in output as the group recovers from a third failed takeover bid under its current boss, Kevin Gallagher.

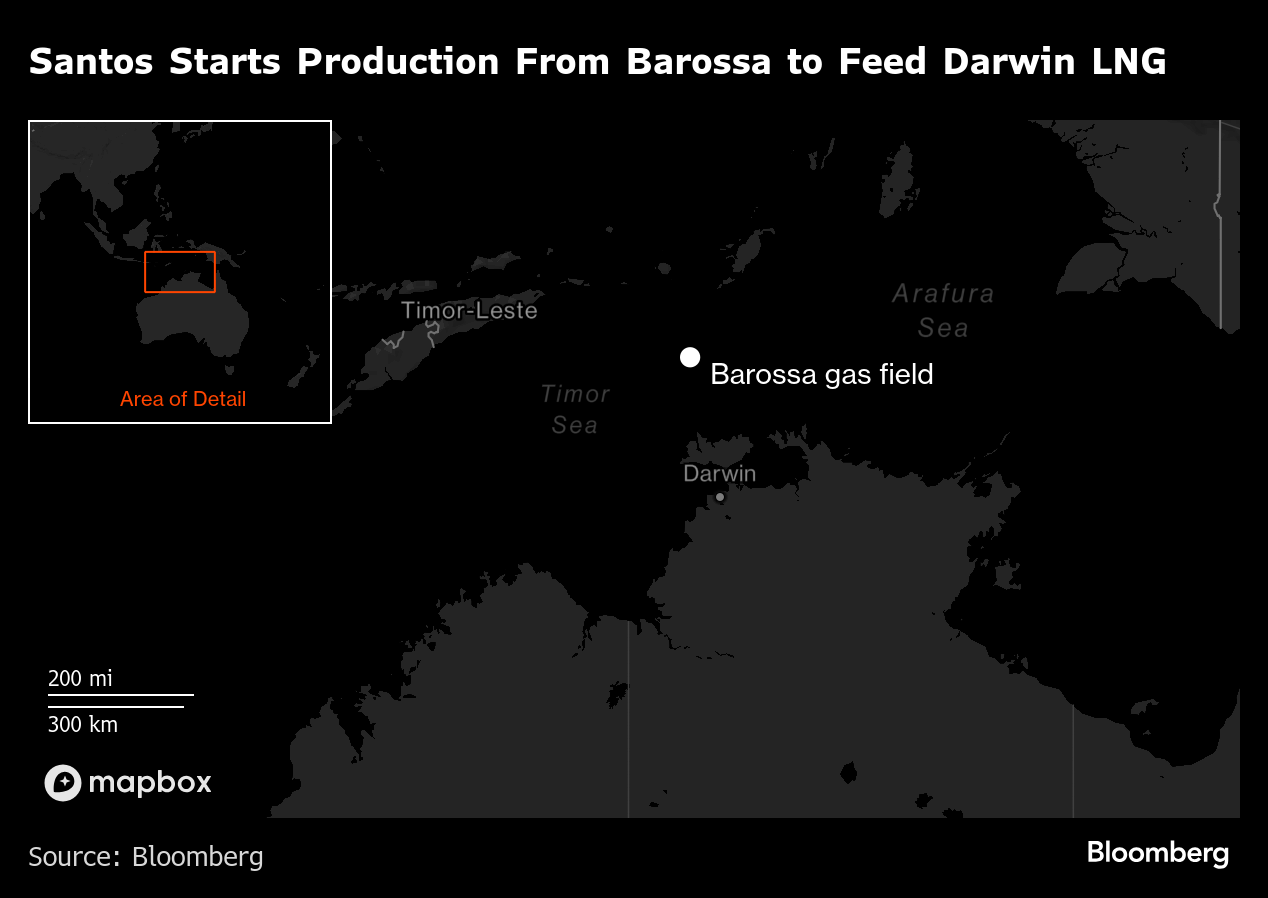

The project has delivered its first natural gas into the BW Opal floating production, storage and offloading vessel, the company said in a statement, allowing Santos to restart its Darwin liquefied natural gas export plant, which ships fuel to mainly Japanese buyers.

Santos saw shares drop by more than a 10th last week after an Abu Dhabi National Oil Co.-led consortium scrapped a $19 billion takeover offer — raising pressure on the company to boost its valuation and returns independently or find an alternative partner. On Monday, shares were steady at A$6.76 apiece around 12:45 p.m. in Sydney.

Monday’s announcement will likely increase revenue and free cash flow, helping Santos to meet a long-standing demand for increased shareholder payouts, said Joshua Runciman, gas analyst at the Institute for Energy Economics and Financial Analysis. RBC Capital Markets upgraded its rating to outperform following Barossa’s first gas, pointing to higher returns expected from 2027.

The start of production at Barossa — one of Australia’s highest-emitting natural gas projects and one of the dirtiest globally — comes after the Northern Territory Environment Protection Authority last week renewed the Environment Protection License for Santos’ Darwin LNG facility.

The restart of the Darwin plant, which shut in 2023 after another gas field was depleted, will provide relief to the global LNG market, which has grappled with tight supply and high prices since Russia’s invasion of Ukraine. Barossa will feed the Darwin LNG plant for the next two decades, Santos said on Monday.

It is likely to be less positive for Australia’s climate goals, as the country edges toward net zero emissions. Barossa has faced criticism because of a high carbon dioxide content, making it a flashpoint in a national debate around fossil fuel exports from a nation that is also among the hardest hit by climate change. Australia last week pledged to cut greenhouse gas emissions within a range of 62% to 70% by 2035, from 2005 levels.

Environmental groups and Tiwi Islands traditional owners waged a protracted legal campaign to halt the project, forcing Santos to reroute the pipeline and redo consultations.

Barossa is one of Santos’s cornerstone assets. The project, which includes a 262-kilometer (163-mile) undersea pipeline, will deliver as much as 3.7 million tons of LNG a year — about 4% of Australia’s total export capacity. Santos operates and owns half of Barossa, with the rest held by South Korea’s SK Innovation E&S and Japan’s Jera Co.

“It puts us on track to deliver reliable energy to our customers and long-term value to our shareholders from Barossa LNG,” Gallagher said in the statement.

The project will enter Australia’s Safeguard Mechanism, which caps industrial emissions. Santos plans to rely on offsets and carbon capture to meet those limits and says the project will be net zero reservoir emissions from day one.

(Updates with analyst comments and additional details on Adnoc deal collapse.)

©2025 Bloomberg L.P.