Is Net Zero by 2050 Still Possible? Yes, But It’ll Cost 19% More

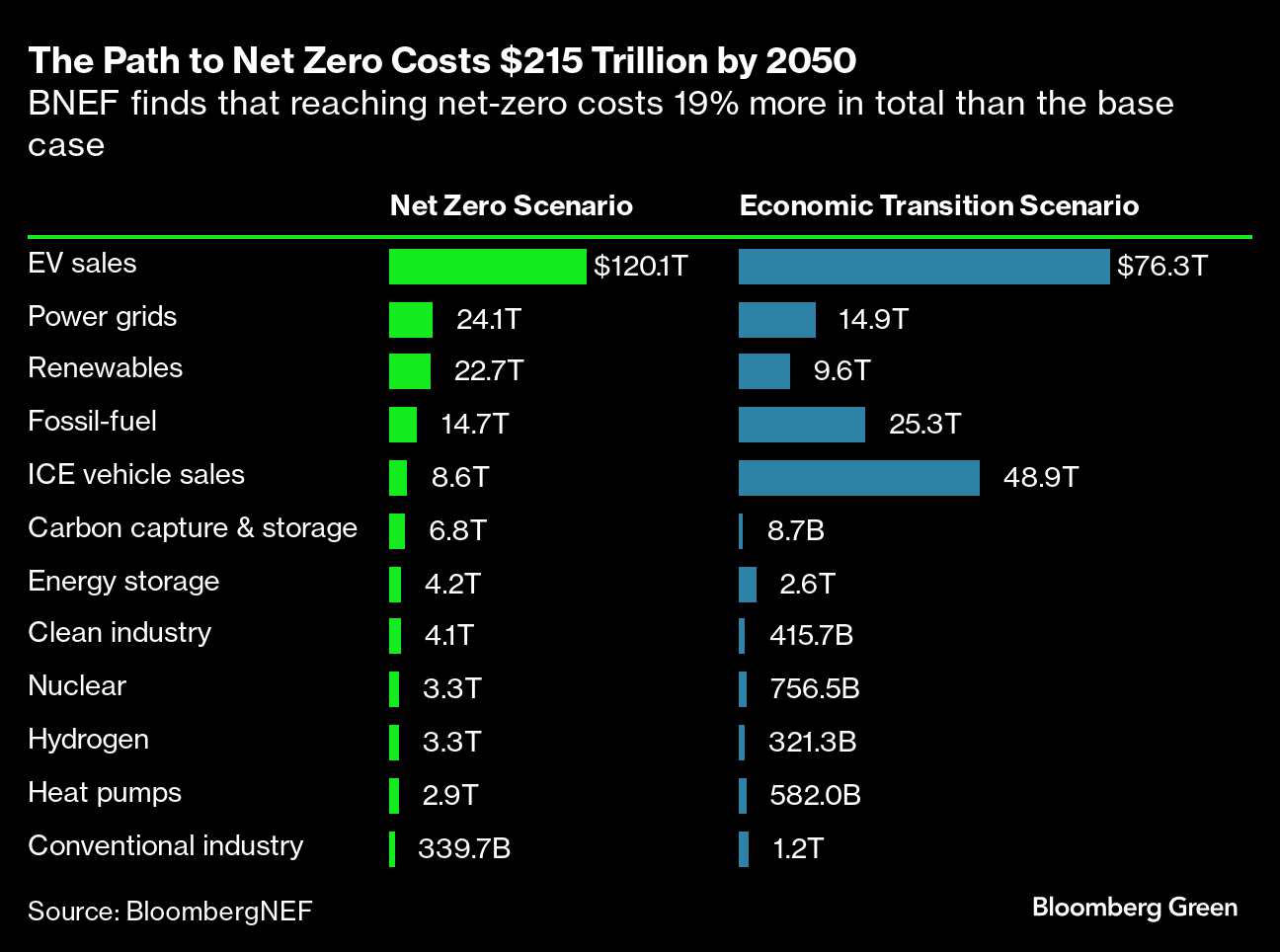

(Bloomberg) -- Governments and companies need to spend an extra $34 trillion on the clean energy transition between now and 2050 to reach net-zero emissions, according to BloombergNEF.

The research group’s 250-page New Energy Outlook report, which crunches 18 million datapoints, says that amount is 19% more than what’s expected in its base case scenario. The finding indicates that sectors from electric vehicles and renewable energy to power grids and carbon capture need extra support.

The clean energy transition has faced resistance in recent years as climate policies have become a political flash point across the US and Europe. At the same time, renewable project developers have come up against higher interest rates and inflation, making the potential return on investments less attractive.

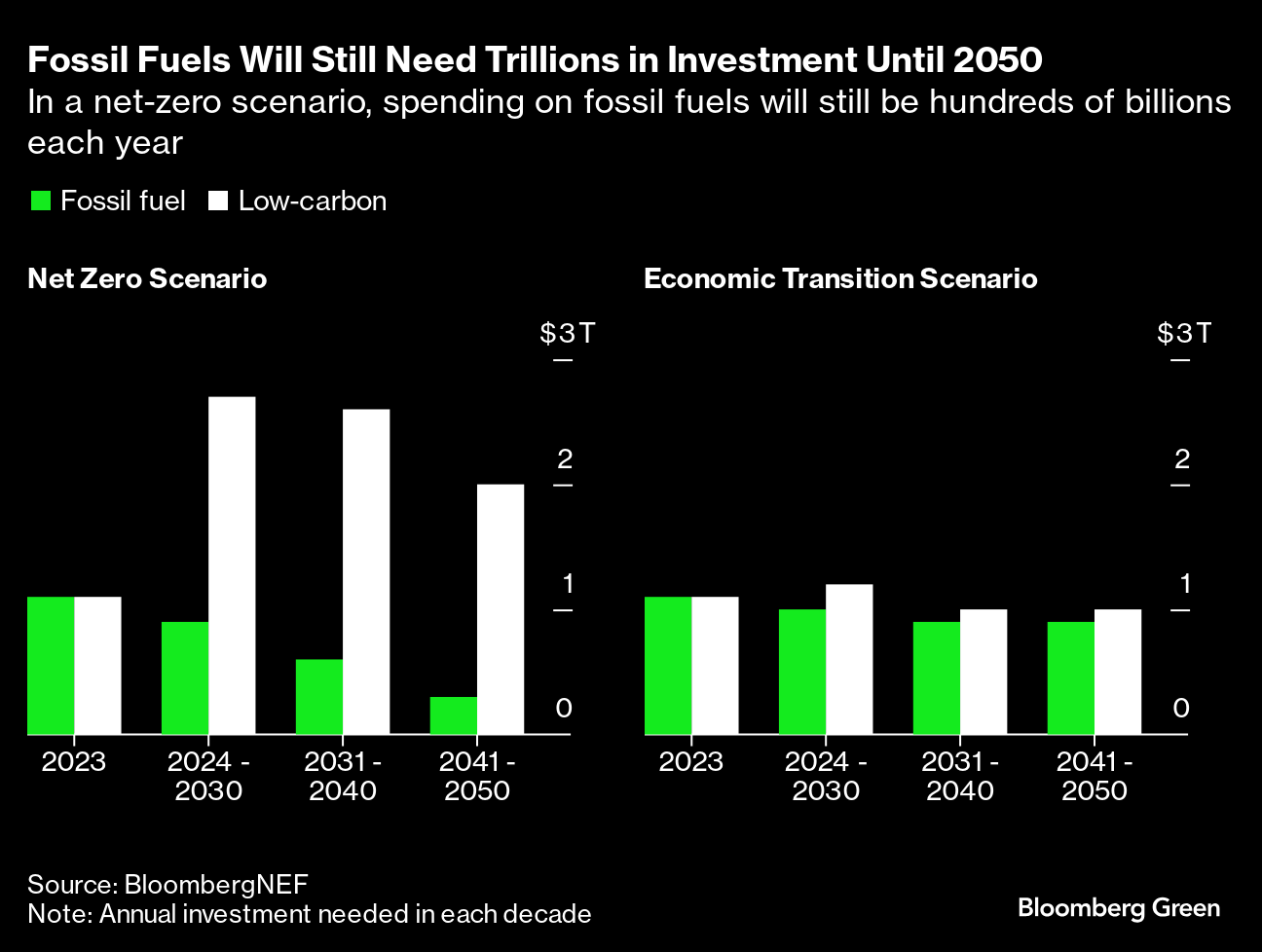

While BNEF earlier this year said global investment in the low-carbon energy transition surged 17% in 2023 to $1.8 trillion, its report Tuesday shows the pace of this spending needs to accelerate as the world continues to warm and bigger solutions are needed sooner.

“It is somewhat encouraging that we’re so near, but at the same time, it’s also so far because a lot of these investments aren't fully profitable without further action,” said David Hostert, global head of economics and modeling at BNEF.

BNEF split its analysis between two scenarios.

-

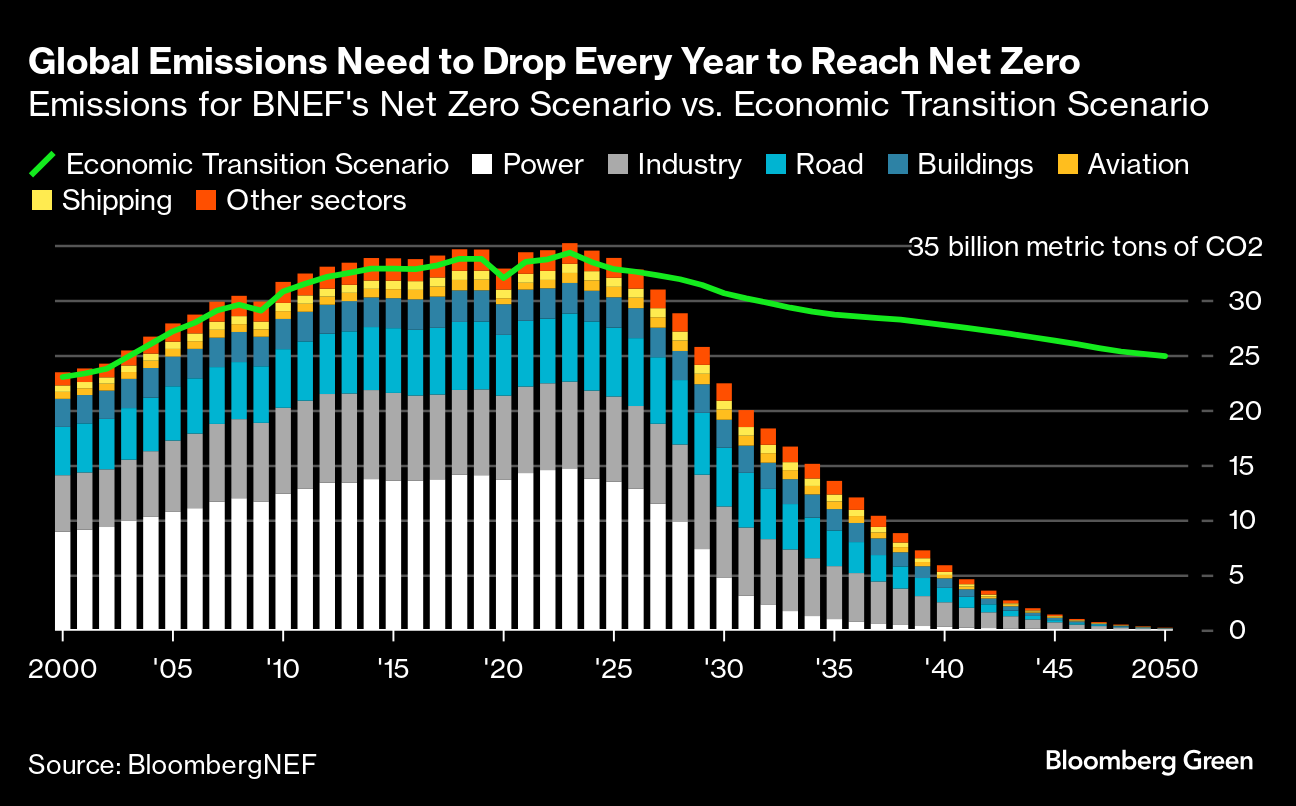

Its base case sees governments relying solely on economically competitive technologies, putting the world on course to warm 2.6C from pre-industrial times. This pathway, dubbed the economic transition scenario (ETS), is still slightly better than what governments are currently committed to doing, but it would lead to catastrophic climate impacts as the world breaches the 2C goal set under the Paris Agreement.

-

Its net-zero scenario (NZS) assumes governments double down on emissions-reducing technologies with an aim to reach net zero by 2050. If the world follows this path, it still might miss the more ambitious Paris goal of keeping warming below 1.5C — edging closer to 1.75C instead. That could still avoid some irreversible climate damages.

Among the big step changes needed to achieve net zero, the report says every new car sold from 2034 onwards will have to be an electric vehicle. Carbon capture technologies will require $6.8 trillion worth of investment to trap emissions not just from industry, but also the power sector. Power grid projects investments will peak at about $1 trillion per year in the 2040s — similar to the investment required for renewable energy generation in that decade.

“There’s definitely a wake up in national grid companies, but the investment isn’t moving as quickly as it should.” Hostert said.

BNEF’s figures are based on the upfront capital needed to build green infrastructure and don’t include operating expenses. This means any scenario that consumes more fossil fuels than needed for being on track to net zero could ultimately be more expensive to implement — though BNEF has not yet run those calculations.

Continuing to heat up the planet will also cost the world in damages from extreme weather events. A study last month from the Potsdam Institute for Climate Impact Research found that annual costs to the global economy could be between $19 trillion and $59 trillion each year by 2050, regardless of emissions reductions. Still, cutting carbon is likely to lower the cost of climate impacts.

What is clear from BNEF’s analysis is that the era of fossil fuels dominating the energy system is coming to an end. Whether countries pursue policies needed to get on track for net zero by 2050 or not, the share of renewables in the global electricity mix could still be higher than 50% by the end of the decade.

The New Energy Outlook this year includes analysis of how major economies can meet their climate goals, covering the US, Australia, Japan, China and India along with regional analysis for Europe, Southeast Asia and Latin America. Hostert said that as more and more companies and financial institutions set climate targets, this kind of granular analysis is needed for them to meet those goals.

At the moment the transition is two-paced, with some technologies clearly ahead, while others in desperate need of a harder push. “For renewables, EVs, batteries, if you squint a bit, you can see it could work,” Hostert said. “But then if you look at hydrogen, carbon capture and storage, or nuclear, there are much bigger steps needed.”

(Adds study on cost of inaction in 11th paragraph.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Malibu Firefighters Make Gains on Blaze as Wind Warnings Persist

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters