Uber Urges Carmakers to Keep Pressing the Accelerator on EVs

(Bloomberg) -- Uber Technologies Inc. set a goal at the beginning of the decade for 100% of its rides in US, Canadian and European cities to take place in electric vehicles by 2030. Early this year, its chief executive officer cast some doubt on the practicality of that pledge.

“The stark reality is that Uber will not reach our zero-emission goals without stronger action from policymakers and businesses,” CEO Dara Khosrowshahi wrote in a column. “Unfortunately, right at the moment we need to accelerate through the turn, many governments and automakers are slowing down.”

Examples of the deceleration Khosrowshahi was referring to were manifold the last six months. UK Prime Minister Rishi Sunak extended a longer leash to internal combustion engines, and the European Union drafted rules allowing cars to run on e-fuels. Volkswagen AG, Toyota Motor Corp. and Ford Motor Co. are among the carmakers that have pared back EV sales and production plans, or that have canceled projects altogether.

To help press its case that manufacturers and policymakers should keep forging ahead, Uber commissioned a report from BloombergNEF that identifies various roadblocks to its drivers going electric in Europe, where the company has made the most headway with its EV push. BNEF’s analysts break down how few battery-electric models are good fits for ride-hailing, and how much more still needs to be done to make charging accessible and affordable for drivers.

“The external context has not been very favorable for companies and governments to invest all together so that this happens,” Thibaud Simphal, Uber’s global head of sustainability, said in an interview. “Precisely because it’s going to get harder, we think it’s on us to send the signal to everybody in the ecosystem that we are going to continue to push forward.”

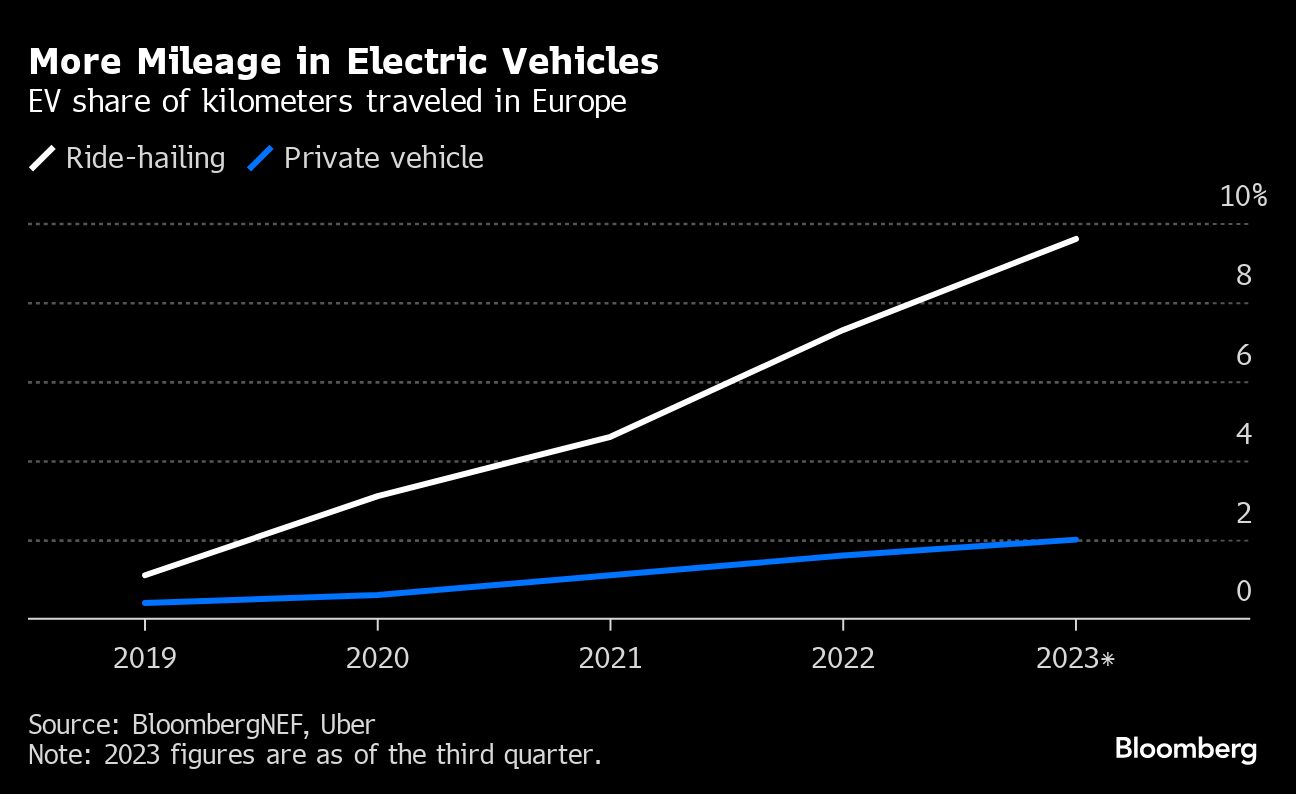

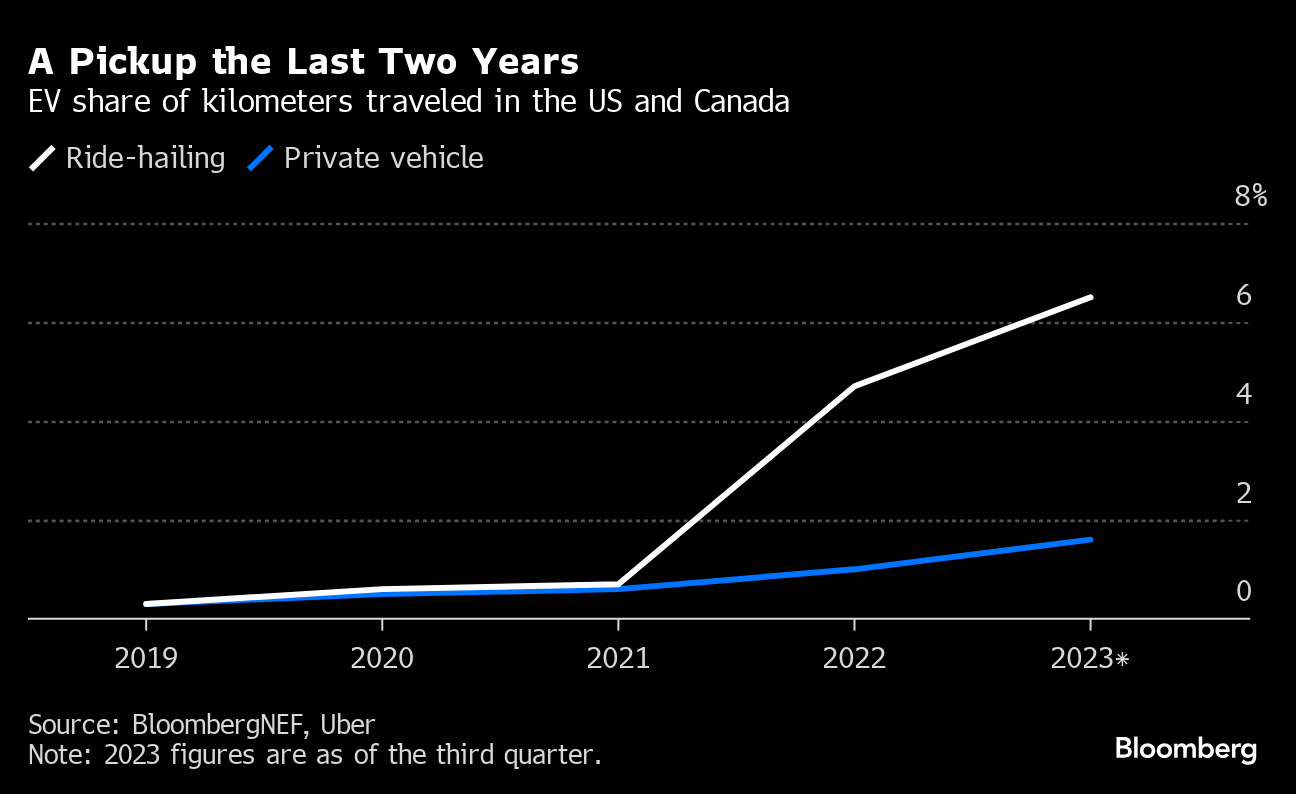

Back when Uber took aim at reaching 100% zero-emission rides in major markets by 2030, the company also committed $800 million to helping drivers transition to EVs by the end of next year. The money it has set aside or distributed to drivers has helped bend the curve of kilometers traveled in EVs — first and most dramatically in Europe.

By the third quarter of last year, almost 10% of ride-hailing kilometers were in battery-electric vehicles in seven European capitals. This share is lower in the US and Canada, but is still well ahead of passenger-vehicle kilometers traveled in those markets.

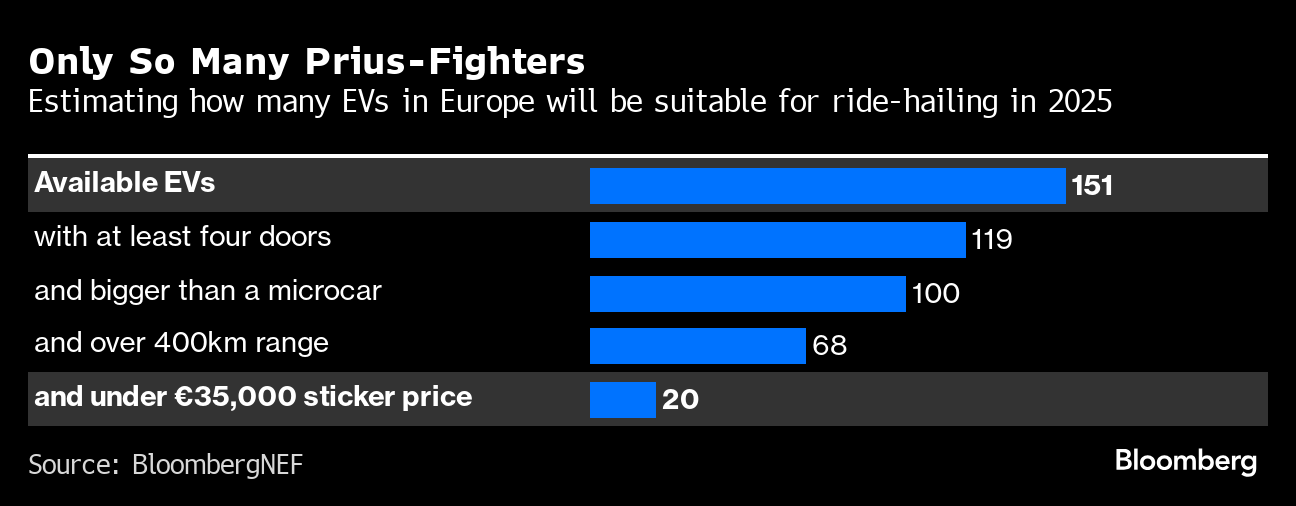

To drive those shares higher, Uber is still waiting on the EV equivalent of the Toyota Prius — a spacious, affordable vehicle with four doors that can hold up to the daily rigors of ride-hail driving. The Prius has been a popular choice among drivers by ticking all those boxes and lowering cost of ownership in part thanks to its gas-electric powertrain boosting gas mileage.

BNEF estimates that while there will be more than 150 EVs on the market in Europe by next year, only around 20 models will be well-suited for ride-hailing.

Simphal said he’s been selling manufacturers on the merits of building vehicles tailored to what Uber drivers want for a decade, and believes there are reasons to think the pitch is becoming more persuasive.

“We’re now starting to be big enough — with several million drivers on the platform who renew their cars maybe every year, every two years, every three years, so more frequent renewal rates than the general public — that carmakers are listening to us,” he said. Kia Corp. signed a preliminary deal with Uber in January to collaborate on the development and deployment of vehicles customized for ride-hail drivers.

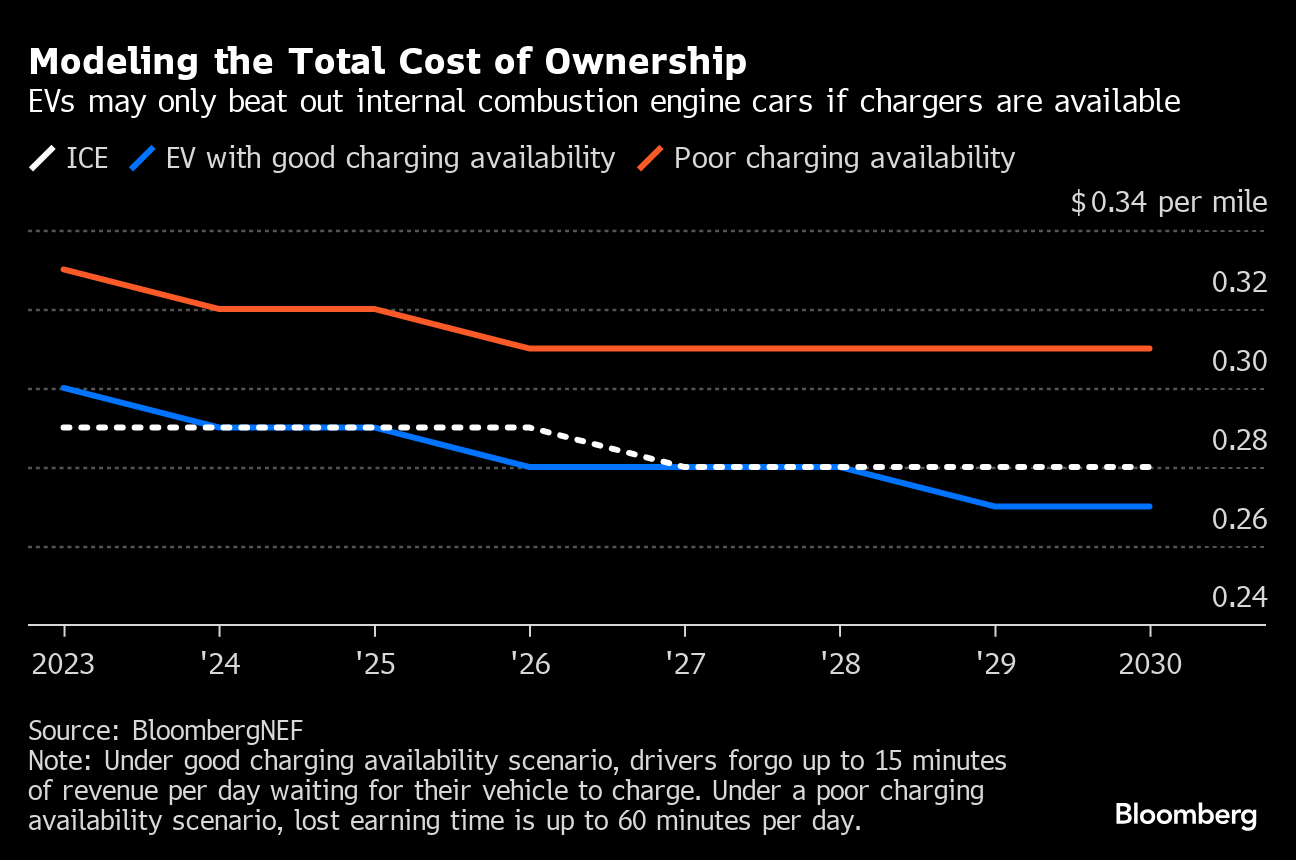

Of course, those EVs only will work out well for ride-hailing drivers if public charging is both more accessible and affordable.

While ride-hailing drivers tend to drive more miles than the typical consumer, and therefore save more from fewer trips to the gas station, they also risk forgoing potential revenue from having to seek out and queue at plugs, then wait for their vehicles to charge. This opportunity cost could be detrimental to the business case for using EVs as ride-hailing models.

In addition to EV model and charger availability, BNEF’s report speaks to the trend of governments including Germany and France dialing back some purchase incentives for electric vehicles, and makes the case for sparing high-mileage drivers from this pullback. Uber estimates that when one of its drivers starts using an EV, they deliver up to four times the emissions benefits compared to regular motorists.

“If you focus on these segments of the driving population, this is going to give you a much bigger bang for your buck,” Simphal said.

(Adds Bloomberg TV interview after the fourth paragraph and tout to story on Uber’s partnership with Revel.)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry