Coal, the Dirtiest Fossil Fuel, Prepares for a Long Goodbye

(Bloomberg) --

More than two years after climate negotiators first attempted to consign coal to history, the dirtiest fossil fuel is having a moment.

Thanks to a combination of China’s energy insecurity — pushing Beijing back to trusted power sources — plus rising Indian demand, the continued fallout from the war in Ukraine and faltering international programs to wean developing economies off fossil fuels, coal is proving remarkably resilient. Output hit a record last year, and producers are preparing for a future where they will be required for decades yet to balance renewable energy.

Even prices are holding up. While thermal coal is trading at just a fraction of the lofty levels reached in 2022, after Russia’s invasion of its neighbor, prices are still well above historic norms. Benchmark Newcastle coal futures are changing hands just under $130 a ton, roughly a quarter of the peak but higher than any level between 2011 and 2020.

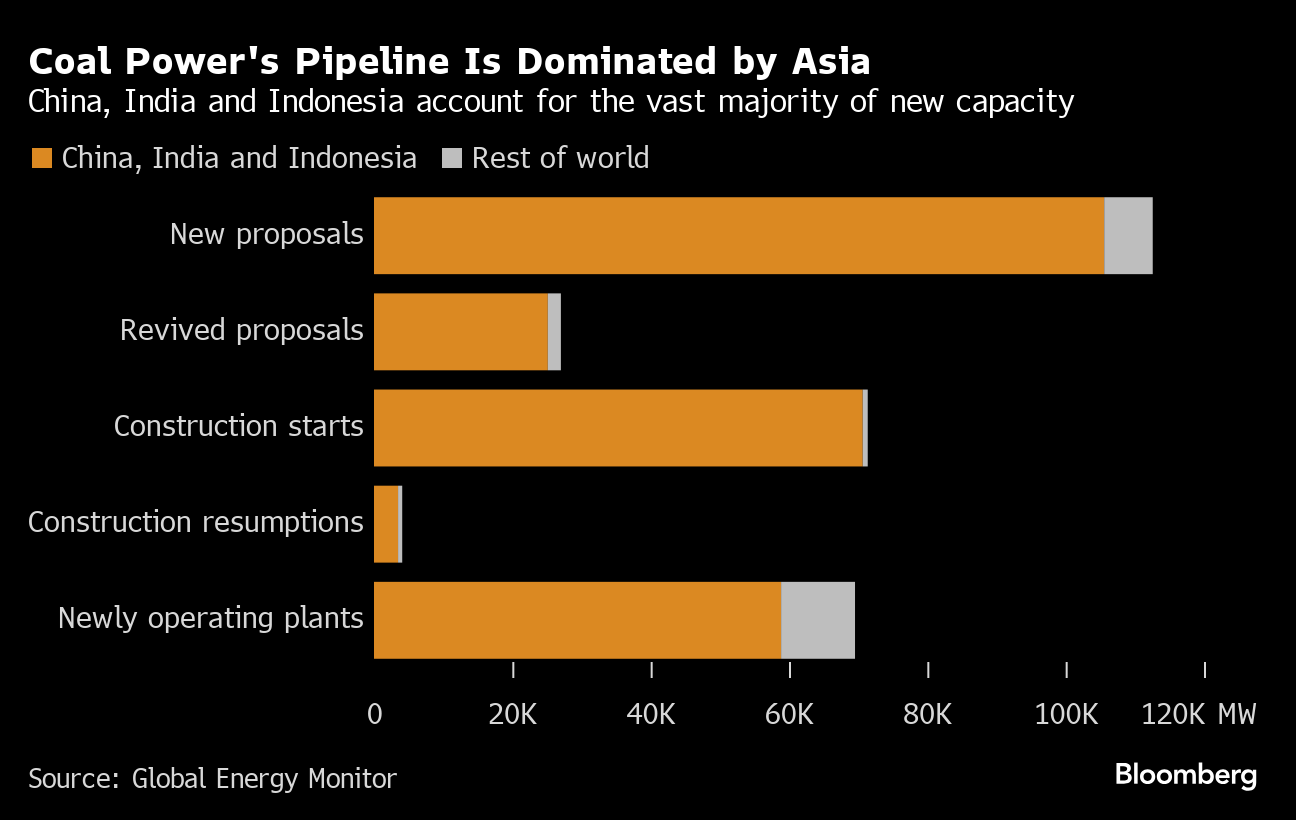

Much of this second wind is down to Asia. In 2000, the International Energy Agency estimated advanced economies accounted for almost half of coal consumption. By 2026, China and India alone will make up more than 70%. Those two heavyweights and Indonesia started operating new coal power plants amounting to 59 gigawatts last year, and either launched or revived proposals for another 131 gigawatts — about 93% of the world’s total, according to Global Energy Monitor.

“You look at Asia, the demand and the build out of coal-fired power plants, particularly in India — coal’s not going anywhere anytime soon,” Rob Bishop, chief executive officer of Australian miner New Hope Corp., said in an interview.

The extended final act will be a vindication for fossil fuel executives, who have long argued against the feasibility of shifting swiftly out of carbon-intensive power, pointing out benefits in terms of reliability and cost. A mention of coal’s buoyancy earned Saudi Aramco CEO Amin Nasser a round of applause at a major energy conference in Houston last week.

It’s less good news for efforts to curb carbon emissions and reach global climate goals.

For years, analysts expected coal production to plateau after it hit a then-record in 2013. Funding, after all, was drying up. Then came 2021, when power shortages in China set Beijing on a path to order more mining to ensure energy security.

In 2022, Russia’s invasion of Ukraine and blackouts during heatwaves in India further bolstered coal demand. By last year, output had risen to a record 8.7 billion tons, according to the IEA.

That figure is expected to drop this year. But the agency expects it to stabilize through 2026 — in line with industry forecasts of a long goodbye.

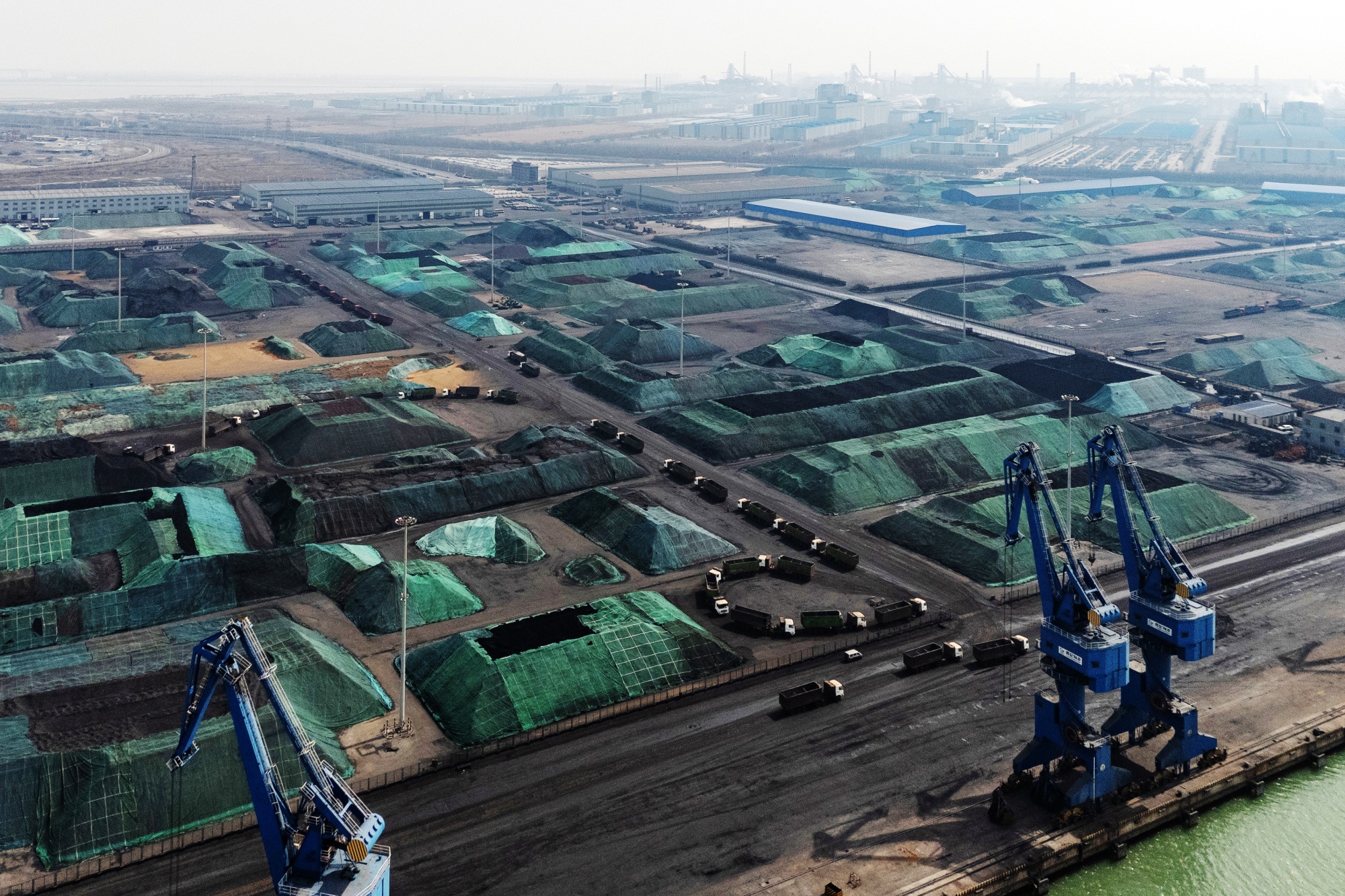

All of this is visible on the ground. In China, which produces and consumes half the world’s coal, miners are struggling to maintain growth rates after boosting output 21% over the past three years to 4.7 billion tons. Low-cost reserves have mostly been tapped, leading companies to dig deeper, more expensive mines. Fatalities have also started rising after years of declines.

China Shenhua Energy Co., the nation’s largest publicly traded miner, expects its coal output to fall 2.6% this year, while the per-unit cost of mining could rise by about 10%, according to its annual report Friday.

Record Renewables

Record amounts of new solar panels and wind turbines, along with a rebound in hydropower and steadily growing nuclear generation, mean low-carbon energy will likely exceed the growth in electricity consumption, according to the Centre for Research on Energy and Clean Air.

But that clean energy will also be coal’s lifeline, said Zhang Hong, deputy secretary-general of the China National Coal Association. Renewable power only generates when weather permits, so even as other baseload options emerge, cheap and reliable coal will still play a role.

“The next 10 to 15 years will remain a crucial strategic window,” Zhang said.

India is the one country where the IEA forecasts coal output to grow this year, with production set to top 1 billion tons for the first time. Prime Minister Narendra Modi needs to meet growing energy demand while reducing reliance on expensive imports. Yet even after a surge in renewables, nuclear, hydropower and other baseload options have fallen short — so coal is expected to remain the dominant source of power at least until the end of this decade.

Meanwhile, Indonesia, the world’s top thermal coal exporter, expects stable production for the next two years. That’s partly to feed surging domestic demand from a booming, power-hungry nickel processing sector, even if lower prices eventually cool enthusiasm.

But it’s also evidence of the difficulty of accelerating the end of coal where economies have newer plants, rising energy demand and an urgent need to create jobs. In 2022, Jakarta agreed to a $20 billion green deal with wealthy governments and financial institutions that would, among other things, close coal power stations early. Coal phaseouts, however, have proved far more challenging than anticipated. Landmark deals remain on the negotiating table.

Coal’s days are numbered, of course. Advances in solar and wind have made those technologies far cheaper than coal power in most parts of the world, and similar gains for batteries and energy storage systems could finally make around-the-clock renewable power affordable enough to transform the energy mix.

But for now, the transition is testing years-long expectations of rapid peaks and subsequent steep declines.

“We see that the world needs more operators to mine coal and support the transition over many decades to come,” New Hope’s Bishop said.

On the Wire

China’s EVE Energy Co. is in advanced talks to invest at least £1.2 billion ($1.5 billion) to build a factory for electric vehicle batteries in the UK, according to The Times.

Sinopec’s annual profits declined 13%, after oil prices fell and Chinese refiners posted a record year for processing and imports.

China’s steel industry is young compared to Europe’s, and its transition to net zero may be slower as it takes a different path to reach government-mandated decarbonization goals, according to BHP Group Ltd.’s Chief Executive Officer Mike Henry.

Chinese Premier Li Qiang downplayed investor concerns of challenges facing the economy, saying Beijing is stepping up policy support to spur growth and systemic risks are being addressed.

The Week’s Diary

(All times Beijing unless noted.)

Monday, March 25:

- Sinopec earnings briefing in HK, 15:00

- Beijing international hydrogen exhibition, day 1

- China Development Forum in Beijing, day 2

- EARNINGS: PetroChina, Kunlun Energy, TCL Zhonghuan

Tuesday, March 26:

- Boao Forum for Asia in Hainan, day 1

- China clean energy expo in Beijing, day 1

- Beijing international hydrogen exhibition, day 2

- China Photovoltaic Industry Association solar development forum in Beijing

- EARNINGS: China Oilfield, BYD, Flat Glass, Datang Renewable, WH Group

Wednesday, March 27:

- China industrial profits for Jan.-Feb., 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- PetroChina earnings briefing in HK, 16:00

- Boao Forum for Asia in Hainan, day 2

- China clean energy expo in Beijing, day 2

- Beijing international hydrogen exhibition, day 3

- EARNINGS: Chalco, CGN Power, Tianqi Lithium, Longyuan

Thursday, March 28:

- China copper smelters quarterly meeting in Shanghai

- Boao Forum for Asia in Hainan, day 3

- China clean energy expo in Beijing, day 3

- EARNINGS: Maanshan Steel, Angang Steel, Metallurgical Corp., Ganfeng Lithium, Citic Ltd., Cosco Shipping, Yankuang, Goldwind, China Resources Gas

Friday, March 29:

- Boao Forum for Asia in Hainan, day 4

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Jiangxi Copper, Shandong Steel

(Updates with Shenhua statement in 12th paragraph)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

House Committee Says It Finds Evidence of ‘Climate Cartel’

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid