Colombian Companies Face Energy Crunch as Gas Reserves Plunge

(Bloomberg) -- Colombia’s biggest companies are bracing for energy costs to soar in the months ahead as dwindling natural-gas production forces the nation to turn to costly imports to avoid shortfalls.

President Gustavo Petro, who has made fighting climate change a priority, is refusing to grant licenses to explore for new sites to drill even as reserves wither. And production from wells being explored in the Caribbean won’t come online until at least 2027.

That’s prompting state oil company Ecopetrol SA to consider ways for the country to purchase cargoes of liquefied natural gas from abroad that could be two or three times more expensive than current domestic supplies.

The situation risks hobbling Colombia’s already listless economy, which expanded last year at its weakest pace since 1999 excluding the pandemic. It could also significantly erode the profitability of companies since sluggish economic growth makes it hard for them to pass higher costs on to consumers.

And while reserves were dropping for years before Petro came to power, the energy crunch represents another hurdle in his bid to transform Colombia’s business-friendly model. With many of his ambitious reforms stalled, his government is also now grappling with a deteriorating fiscal outlook.

“We’re going to face a very serious problem, very fast,” said former Mines and Energy Minister Tomás González, who now leads the Regional Center for Energy Studies, a Bogotá think tank. “You can’t leave industry without natural gas for any period of time — it would have a huge impact on the economy.”

When gas supplies are tight, Colombia’s government requires priority be given to households, small businesses and transportation over industry. So companies are trying to figure out how to cope.

“You’d be crazy to try and increase prices in this environment,” said Diego Jaramillo, who heads an industry group that represents the country’s largest energy and natural gas consumers.

Even at current rates, power and gas account for between 25% and 40% of total costs for these firms, according to Jaramillo. Should they spike once imports begin, he warned that Colombia’s industry just “won’t be competitive.”

Gas reserves dropped to the equivalent of 6.1 years of output at the end of 2023, the National Hydrocarbons Agency reported last month. That’s down from 7.2 years in 2022 and half of what it was a decade ago.

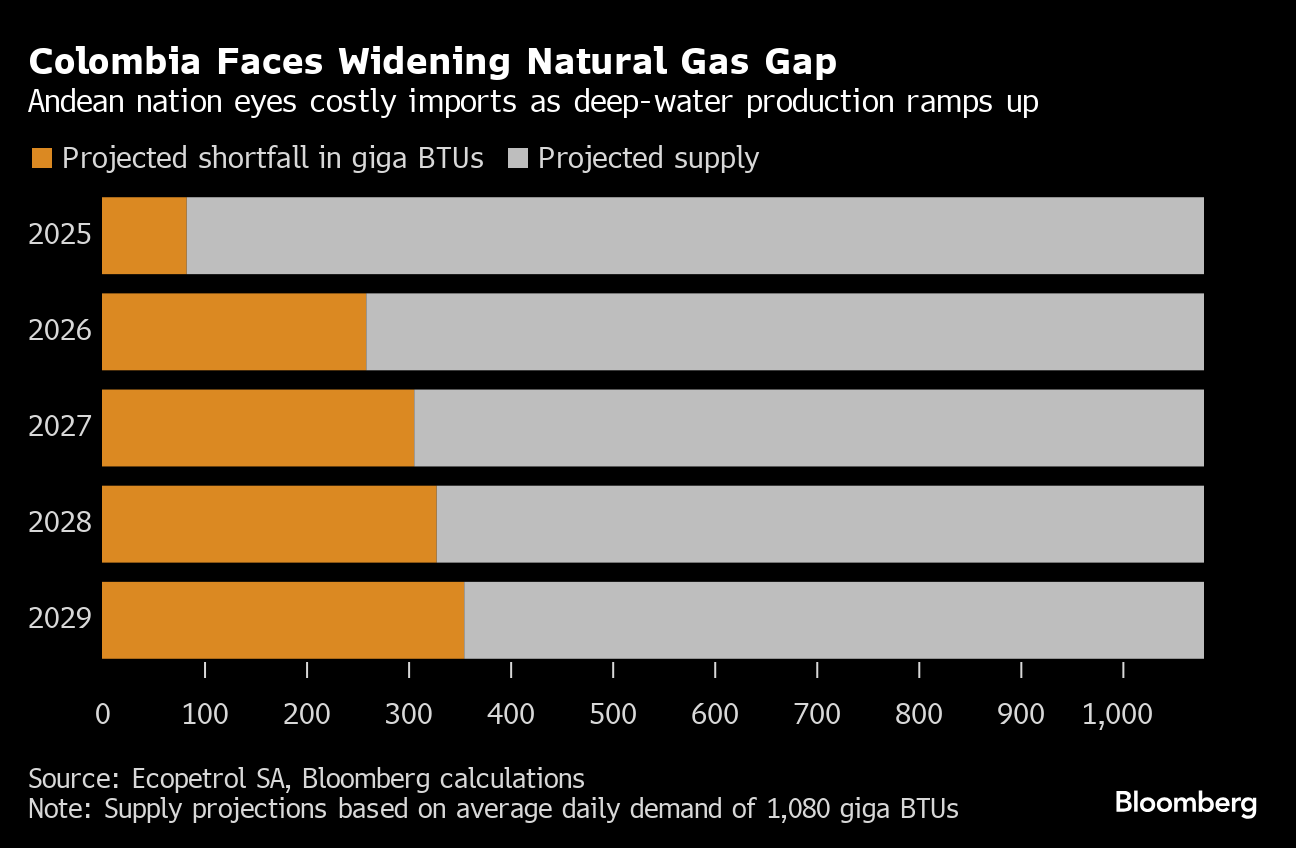

Even with some runway left, Ecopetrol sees an 8% gap between the gas supply and total demand beginning next year, widening to around 25% in 2026 and 30% the year after. The firm’s forecasts imply shortfalls will continue above that level until around 2030 when underwater deposits begin to meet demand.

Chief Executive Officer Ricardo Roa argues Ecopetrol is doing all it can to avoid rationing. “We’re working to guarantee the supply of gas,” he said in an interview. “We understand the implications for industry.”

For one, the state company is looking to restart projects that were suspended for a lack of security or of environmental licenses. In April, it announced an agreement with Parex Resources Inc. for exploration in the central Piedemonte Llanero area. It’s also focusing on northern Cesar province, near the Caribbean coast, where gas deposits have previously been found.

Increasing output from small fields can help Colombia buy time and may even be enough to avoid a shortfall next year, according to David Angel, co-founder of Bogotá consultancy Energy Transitions SAS. But with the deficit widening, he expects imports will be needed by 2026 at the latest.

Average daily natural gas demand so far this year is around 1,080 giga British thermal units and the shortfall in 2026 is estimated at about 250 giga BTUs. Industry typically accounts for 30% of total demand.

A near-term alternative is boosting output at a private liquefied natural gas port in Cartagena, known as SPEC. While current re-gasification capacity is slated solely for thermal plants, it could be expanded — though that would require infrastructure and regulatory changes.

Then there’s potential imports from Venezuela. Depending on availability, Roa initially expects some 50 million cubic feet a day — or around 50 giga BTU. Though with US sanctions having been reimposed, Ecopetrol first needs its request for a waiver approved.

Unfortunately, the 224 kilometer (139 mile) pipeline that connects the two neighbors has been out of service for years. And on the Colombian side, a stretch of it has been picked apart by bandits seeking scrap metal. Repairs haven’t started and could take 10 to 12 months.

It’s not just having infrastructure for imports, however. Colombia also needs to be able to get the gas to end users.

Because of how its pipeline network is set up, and given the only existing LNG port is on the Caribbean coast, industry in the country’s interior is at greatest risk. That includes the three biggest cities: Bogotá, Medellín and Cali.

One of the most pressing issues is increasing pumping capacity so that more gas imported through Cartagena can make its way to the pipeline that feeds the interior, according to Juan Ricardo Ortega, the CEO of Grupo Energía Bogotá, a unit of which owns the conduit.

Some companies don’t see a dependable source of gas in 2026, he said. “There is no clarity on the price or if volume will be sufficient,” Ortega said. “Liquefied gas is always going to be more expensive.”

Even with reserves dropping, Mines and Energy Minister Andrés Camacho defends Petro’s stand against new drilling. “More contracts don’t necessarily mean more exploration,” Camacho said in an interview. “Our policy is to boost exploration with what’s already there.”

The government is also pushing for more renewable energy development, such as wind and solar, to curb future gas demand and bridge the gap as offshore production takes off, the minister said.

Much depends on those deep-water wells. Ecopetrol said this year that the Orca-1 deposit on which officials were counting was significantly smaller than initially estimated. The company is set to begin drilling the offshore Uchuva-2 well and plans to explore an even deeper one by the end of the year.

In the meantime, Jaramillo, of the industrial gas consumers group, sees higher prices prompting some companies to fold and others to flee Colombia. Which is precisely what Ana Fernanda Maiguashca, a former central banker who heads the Private Competitiveness Council, fears will happen.

“You have to have reliability when it comes to your source of energy,” she said. Companies “will prefer to invest where the energy matrix offers that reliability.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture