A Rare South African Export Success Is Threatened by Crumbling Ports

(Bloomberg) -- At a packhouse at Blydevallei Boerdery, near South Africa’s eastern border with Mozambique, workers pluck unripe grapefruit off a conveyor belt. It’s the best chance of getting them to export markets thousands of miles away before they spoil.

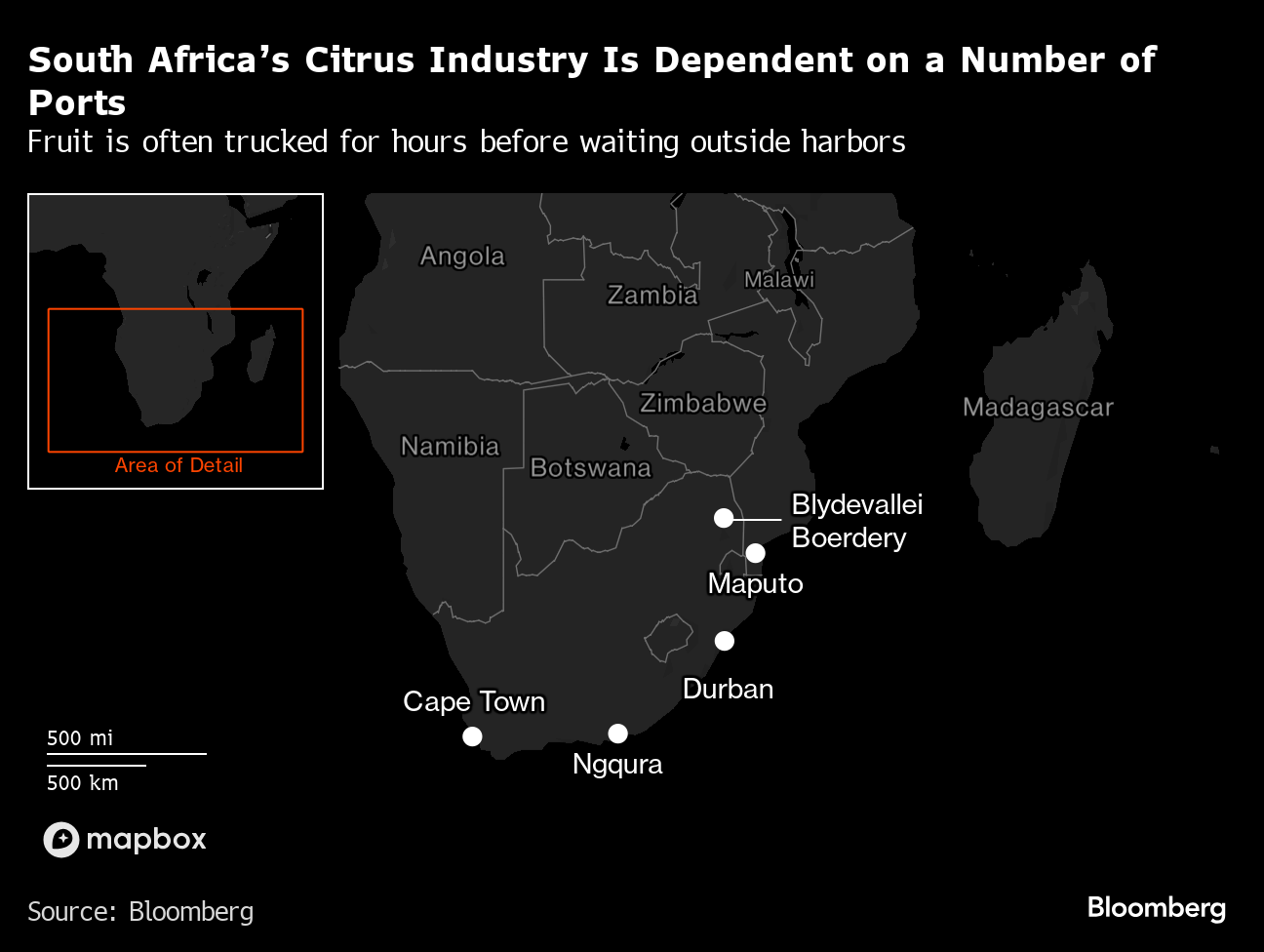

The citrus farm is just one of many fruit producers in South Africa threatened by the near collapse of the state rail and ports company, Transnet SOC Ltd. Instead of railing its grapefruit, lemons and oranges to the port of Durban, it sends them on 20-hour truck trips. Then they can spend days in queues outside the harbor before being shipped to countries such as South Korea and nations in the Middle East.

“There’s no Transnet, that’s the problem,” says a visibly agitated Gert Cloete, the operations manager at the packhouse, as he watches over teams of workers clad in blue overalls from his mezzanine office and explains how refrigerated trucks can sit in queues of as many as 400 vehicles at the port. “You never seem to win. It’s quite frustrating.”

The chaos that’s enveloped Transnet — beset by corruption, theft and dilapidated equipment — is the biggest threat to a rare economic success story in South Africa’s ailing economy. While the inefficient rail lines and ports have sent coal and iron ore exports to multi-decade lows, agricultural products last year hit a record $13.2 billion.

Now the fruit industry, which makes up a third of farm exports, is in peril as well.

“South Africa is not deemed to be a reliable, on-time supplier anymore and suffered great reputational damage,” said Fhumulani Ratshitanga, chief executive officer of Fruit South Africa, which represents farmers. “In meetings held with various retailers in the UK, Germany and the US, among others, late last year, the condition of South Africa’s logistics emerged as a significant concern.”

The gravity of the situation was spelled out in last month’s release of an annual World Bank and S&P Global Market Intelligence report on container-port efficiency. Cape Town ranked last out of 405, while Ngqura, another facility used to ship South African fruit, was second worst. Durban came 398th.

While Transnet disputes the methodology of the study, the company admits that there are deep-seated problems mainly related to dilapidated equipment that struggles with adverse weather and concedes that there have been years of underinvestment.

“It really hit us in terms of equipment needs, the fruit industry had to make choices to divert fruit to the Eastern Cape and Durban” during the recently ended export season, said Oscar Borchards, Transnet’s acting managing executive for terminals in the Western Cape, where Cape Town is located. “You can’t stop the wind, but you’ve got to work around it.”

As Borchards spoke, dozens of trucks waited in a yard before going into the port where containers were being stacked before being loaded onto waiting multi-deck cargo ships.

During the last fruit season alone, the delays cost producers an estimated 1.8 billion rand ($98 million) as crops such as apples and plums spoiled before they could be shipped or trucks had to be diverted to more distant ports, said Jacques du Preez, general manager for trade and markets at Hortgro, which represents the industry.

If the port at Cape Town works efficiently, the fruit offloaded there has the chance of getting to markets quicker than that taken to others, because of its location along one of the world’s busiest trade routes. Efforts are being made by its management to improve the situation, according to Du Preez.

“There is no quick fix or silver bullet,” he said. “The industry is still extremely concerned – planning for the worst but hoping for the best. Realistically speaking a slight improvement is expected, but not close to an optimal level.”

With the citrus-export season under way, the stakes are even higher. South Africa is the world’s second-biggest exporter of the fruits such as oranges, lemons and grapefruit after Spain and the industry, which shipped $1.84 billion of produce last year, is the country’s single biggest agricultural export.

While the economy has stagnated over the past 15 years, the value of citrus exports has risen nine-fold since 2001 and the sector is now the fourth-largest agricultural industry in the country by economic value, compared with ninth 25 years ago. That growth has seen it clash with the European Union at the World Trade Organization, with the European bloc being accused of protectionism because of the pest control measures it has imposed on South Africa. The nation competes with Spain as an exporter of the fruits.

“It’s very critical that we see the success at the ports,” said Wandile Sihlobo, chief economist at the Agricultural Business Chamber of South Africa. “In citrus, you would not have a robust industry without ports.”

Aside from the chaos at harbors, which Transnet has said it’s trying to address by seeking to bring in private operators and immediately improve its performance with some new equipment, the lack of a reliable rail service is pushing up costs for farmers.

“Because of a dysfunctional rail system, 90% of citrus is being exported to ports with trucks,” said Justin Chadwick, CEO of the Citrus Growers Association. This “doesn’t make as much economic sense as freight rail,” he said.

For Blydevallei alone, the logistical challenges that affected its shipments of 30,000 tons of citrus and mangoes cost it 4 million rand last season.

“Some of our pallets don’t even get to Durban,” Cloete said, bemoaning the state of South Africa’s truck-burdened roads. “They’re damaged when they get there.”

Over the last two years it’s been trialing a new route through Maputo in neighboring Mozambique. While that port is closer than Durban there are challenges in crossing borders and the terminal there is much smaller than its South African competitors.

“The containers get processed quicker,” Emile van der Westhuizen, managing director for production at Blydevallei, said. This “doesn’t put our fruit at risk,” he said.

Michelle Phillips, who took over as CEO of Transnet in February after her predecessor resigned following intense criticism, on April 26 pledged to procure more equipment to support the industry. With South Africa just having been through a bruising election, which cost the African National Congress its majority for the first time, the pressure to boost performance will only grow.

“We’ve got a citrus season that cannot fail,” Phillips said. “We’ve made a lot of commitments and promises.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture