EU Prepares to Rule Out Ukraine Gas Transit Deal With Russia

(Bloomberg) -- The European Union is preparing to rule out a renewal of a key Ukraine gas pipeline deal with Russia when it expires at the end of the year, according to people familiar with the matter.

The rationale of the EU’s executive arm is that even countries most reliant on Russian supplies — including Austria and Slovakia — would be able to find alternative supplies in the event of a cutoff, the people said.

The European Commission has conducted a preliminary analysis of potential scenarios resulting from an end to the transit deal, including modeling the capacities of other interconnections, like TurkStream, to help make up for any shortfall. The bloc’s executive branch will discuss the matter with member states in February before presenting the plan officially to energy ministers at a meeting in Brussels on March 4, according to the people.

One of the people acknowledged that there may still be ways for countries and companies with contracts running beyond 2024 to secure gas through Ukraine. One method would be for Russia to deliver gas to the Ukrainian border and then an EU entity making an agreement with Kyiv’s transmission system operator to transport it to either Austria, Slovakia or Czech Republic — the three countries most dependent on supplies from Moscow.

Ukraine denied this week that it would be ready to renegotiate the transit deal with Russia after Robert Fico, Slovakia’s Prime Minister, said it was a possibility.

Europe still receives Russian gas via Ukraine and through Turkey. The region has been successful in replacing lost flows from Nord Stream. While stopping short of sanctions, the EU has been clear that the bloc should seek to reduce its dependence on Moscow for gas. Russia is the second biggest supplier of liquefied natural gas to the region after the US.

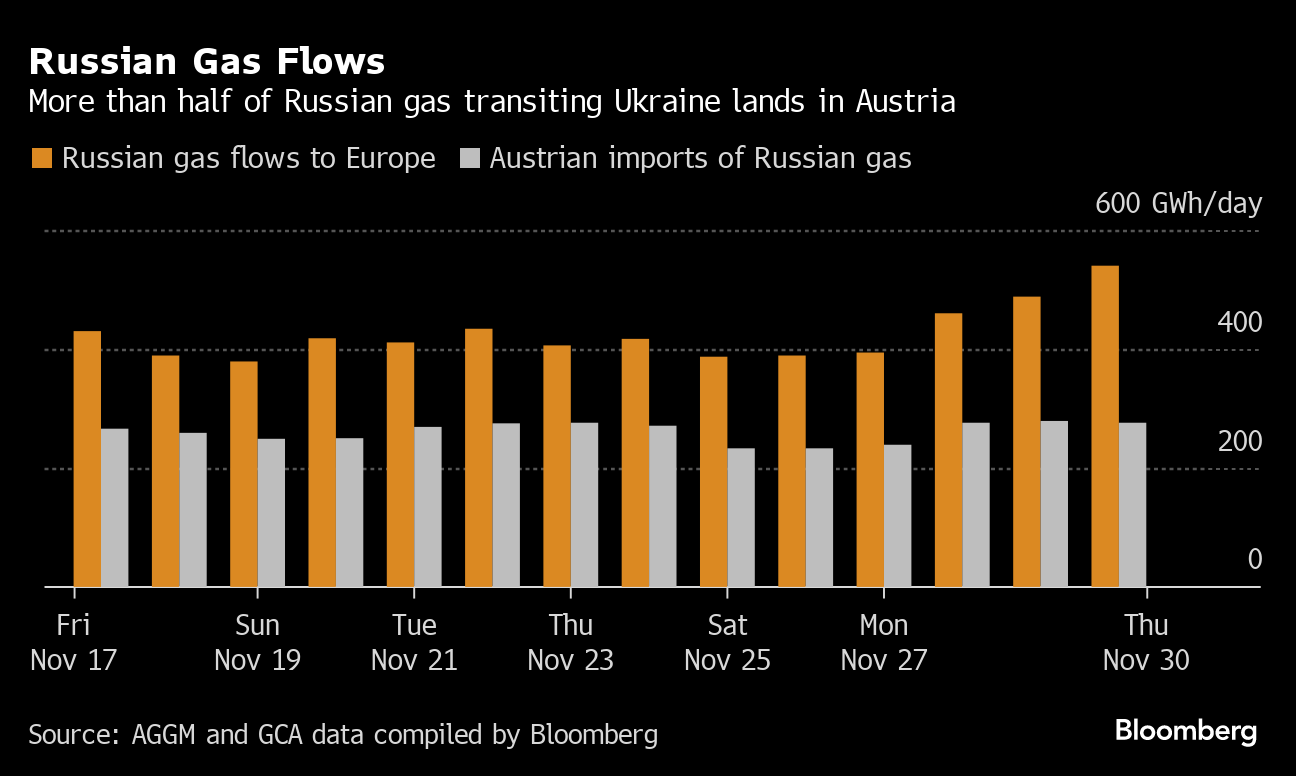

Austria, for example, continues to receive more than half its gas from Russia, with payments to Gazprom increasing under its long-term contract because of higher fuel prices since the onset of the war, according to regulatory data.

Ukraine is still a key route even though actual flows on the transit pipeline have been less than 40% of contracted volumes since May 2022 after Moscow launched a full-scale invasion. Ukraine lost control of a key cross-border entry point because of Russian occupying forces in the east of the country.

Even without a new deal, there is the possibility that Gazprom maintains supply to willing EU buyers by booking short-term capacity in Ukraine — an option the Russian company can use via capacity auctions, analysts at consultant Energy Aspects Ltd. wrote earlier this month.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals