China’s Solar Champion Says Trump Return Wouldn’t Derail US Push

(Bloomberg) -- China-based Longi Green Energy Technology Co., the world’s biggest solar equipment maker, insists a second Donald Trump presidency won’t halt its plans to expand sales in the US.

Production has begun at the manufacturer’s first US plant — a joint venture facility in Ohio — and Longi forecasts trade in the nation to increase this year, despite tensions over imports and a push by Washington to champion domestic supply chains.

“No matter which party is elected, the trend of developing clean energy in the US will not change,” Longi Chairman Zhong Baoshen said in an interview in Davos with Bloomberg Television. “We still have a firm confidence in developing clean energy in the US.”

Trump, whose first term saw a tit-for-tat trade war with Beijing, has proposed the imposition of 10% across-the-board tariffs on imports and already signaled he’d pursue a tough approach on China.

“We think that campaigning is one thing,” and the fact “the country is really developing the clean energy market is another — it’s two different matters,” Zhong said in the Thursday interview. Longi’s shipments to the US increased last year from a low base in 2022, and sales will continue to grow there this year, he said.

China’s solar manufacturers are pushing expansions overseas amid fierce competition in their domestic market that’s squeezing profits, even as the country’s clean energy installations hit new records. Trina Solar Co. and JA Solar Technology Co. have announced plans for US factories, while Longi and local partner Invenergy LLC aim to eventually produce more than 1,000 solar panels an hour at their Pataskala, Ohio facility.

Exports to the US have faced major disruptions in recent years from a series of trade complaints, including restrictions designed to confront alleged human-rights abuses — which China denies — in Xinjiang.

Some manufacturers, including a Longi unit, face levies of as much as 254% from June under separate action related to accusations that plants in Southeast Asian countries have been used to bypass tariffs on Chinese solar equipment.

The impact on supply to the US could be limited, according to Zhong. “Most factories will allocate production resources in accordance with American laws to ensure compliance,” he said. Longi has a whole-supply chain arrangement in Malaysia and production capacity in the region of about 10 gigawatts, that will “entirely comply with the US policies,” Zhong added.

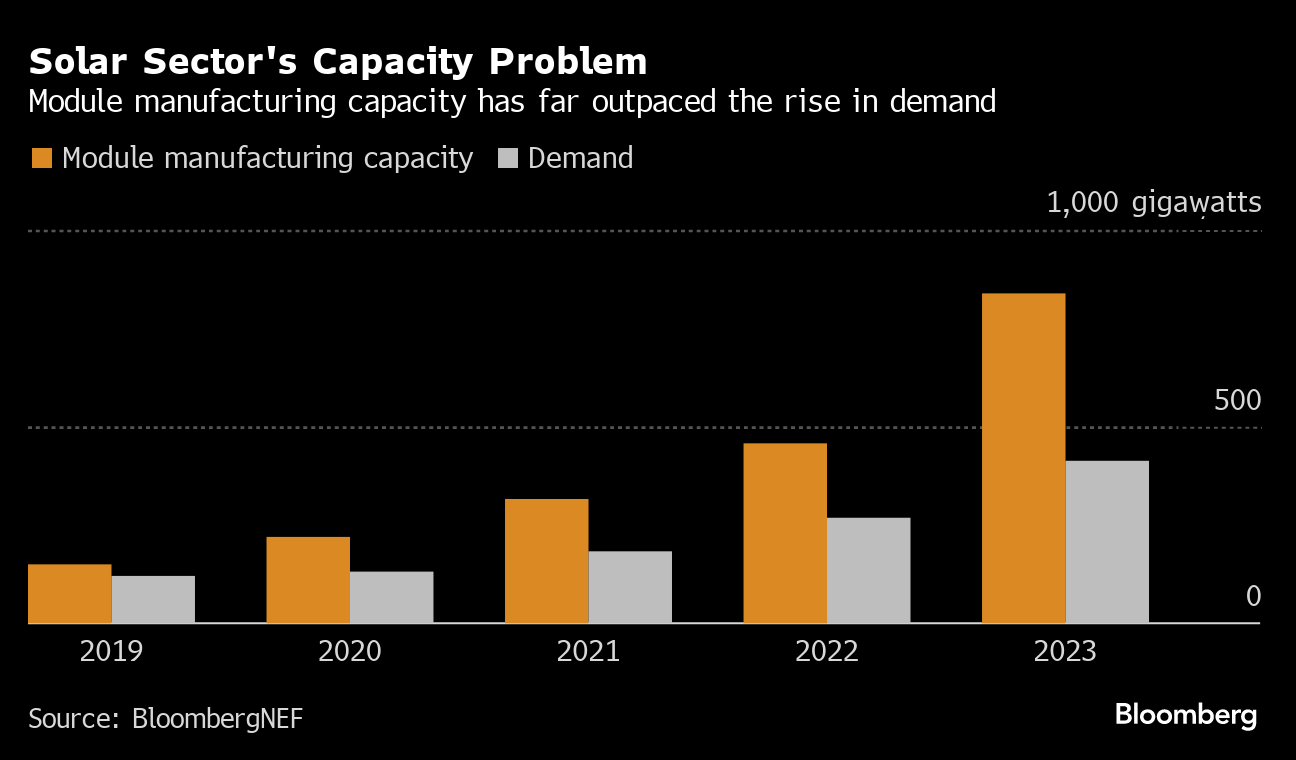

Prices of some solar modules almost halved last year amid a surge in construction of manufacturing plants, according to the International Energy Agency. The downturn — part of a wider retreat for clean energy producers — has prompted warnings over a looming wave of bankruptcies and solar industry failures.

“It’s hard to assess the exact number, but there will be a certain amount of consolidation in the industry,” Zhong said. “There are too many homogeneous participants nowadays.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters