Europe’s Atomic Powerhouse Sees Reactor Fleet Return to Strength

(Bloomberg) -- France’s sprawling nuclear energy industry, the backbone of Europe’s power system, is finally back to strength.

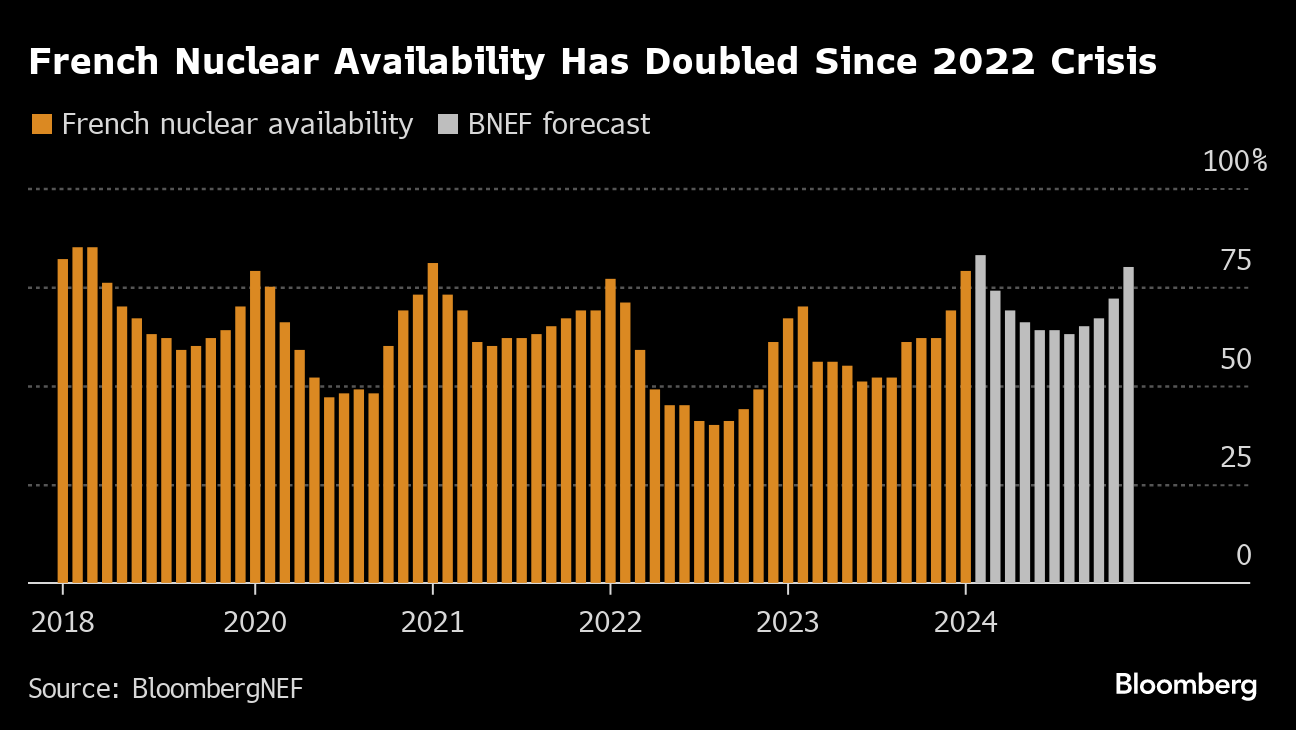

The country’s reactor fleet will boast the most available capacity in at least five years in 2024, according to researcher BloombergNEF. That’s a far cry from the dwindling generation of recent years, when extended plant halts — combined with Russian gas cuts — brought Europe close to blackouts.

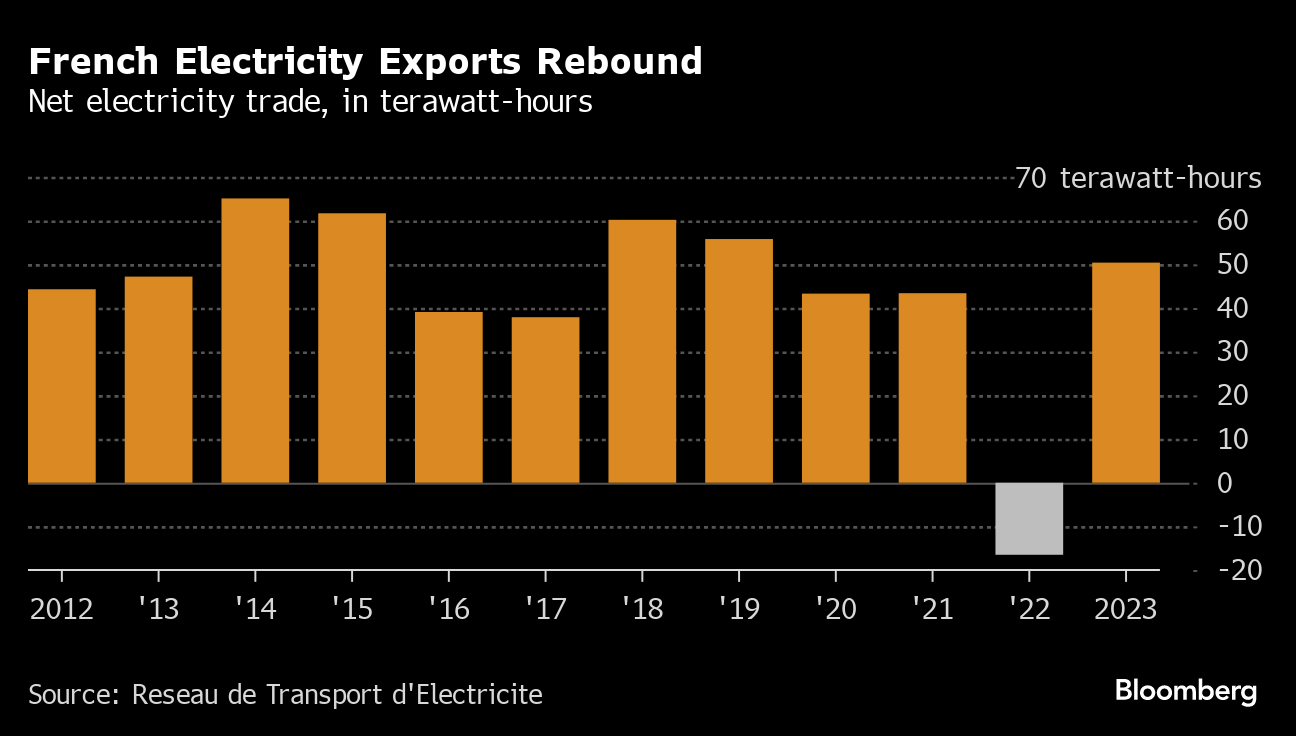

The revival has seen France resume power exports to its neighbors, easing fossil-fuel use and sending carbon emissions to record lows across the region.

“France is now a strong power exporter, which has always been its role before the past 18 months,” said Kesavarthiniy Savarimuthu, an analyst at BloombergNEF in London. The country ran a lengthy reactor maintenance program, aiming to “catch any leakage and cracks,” and “that’s been working.”

In mid-2022, nuclear behemoth Electricite de France SA embarked on a series of works to extend the life of its atomic plants. By August of that year, as little as 40% of the fleet was available, just as gas prices spiked to more than 10 times their regular level. Soaring costs plunged Europe into its worst energy crisis in decades, forcing governments to take sweeping measures to rein in demand.

With France having to import electricity, and the wider region facing the prospect of power cuts, EDF flew in extra welders from the US and Canada to help repair plants. While the effort took longer than expected, ultimately it appears to have worked.

France had 79% of operational nuclear capacity available in January, almost double the low seen in August 2022, and that may rise to 83% in February. With fewer repairs planned this summer than in recent years, reactor availability in 2024 will be the highest since at least 2019, BloombergNEF forecasts show.

The completion of works at EDF plants has helped stabilize European power prices, with French year-ahead futures registering a 13% monthly decline. Contracts in neighboring markets have shown a similar slide.

France’s nuclear comeback has contributed to a broader energy-market recovery in Europe. A drive to secure alternative sources of gas in the wake of Russia’s invasion of Ukraine — combined with a drop in industrial demand, a relatively mild winter so far and strong output from renewable power sources — has left the continent with ample supplies of fuel.

“Alongside structurally weak consumption and high gas storage coming into this winter, the recovery in French nuclear versus the historically low performance in 2022 has been one of the central planks in providing comfort” to markets, said Glenn Rickson, head of European power analysis at S&P Global Commodity Insights.

In the longer term, energy demand is expected to remain muted. While power use in Europe will be 1% higher this winter than last, the modest up-tick shows enduring limits on consumption, BloombergNEF said.

“The small recovery reflects the permanent downward shift in power demand” following the energy crisis, Savarimuthu said. Consumption “appears to have found a new normal.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals