Struggling Thai Firm Gets Loan Deal, Bond Payment Extension

(Bloomberg) -- Energy Absolute Pcl, the Thai renewable energy company grappling with a fraud probe, signed a loan agreement for more than 8 billion baht ($227 million) and secured bondholders’ nod to extend the maturity of a note due later this month to ease a short-term liquidity crunch. The stock surged.

Nine domestic and international financial institutions, including four funds under Asset Plus Fund Management, signed a 3-year loan agreement, Chief Financial Officer Vasu Klomkliang said in a statement Friday. The repayment of the loans will be backed by cash flows from power sales to the government, he said.

Energy Absolute’s shares climbed as much as 13.5%, extending gains this week to almost 17%.

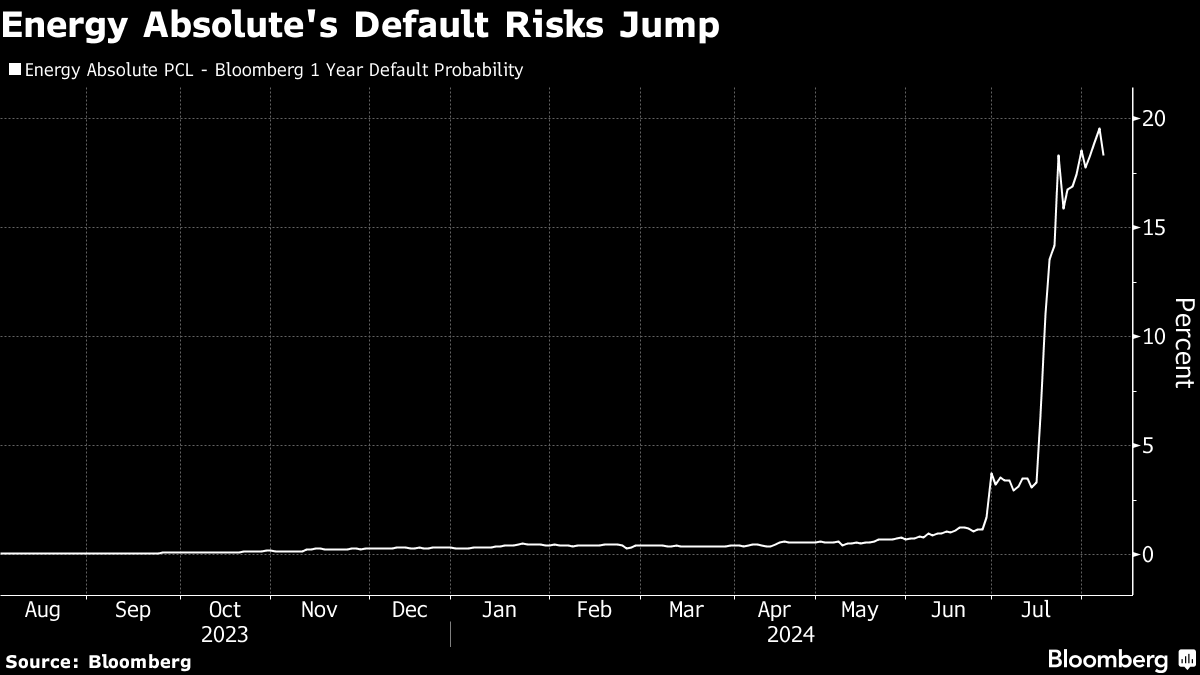

Energy Absolute, which does everything from power generation to assembling trains, ferries and buses, is facing a cash crunch after a regulator’s accusation of fraud against key officials triggered a credit rating downgrade and derailed a bond sale. Its market value has plunged 90% this year and the local mutual fund industry group banned new investments in its securities, creating a major hurdle for raising capital.

The announcement of the new credit line came before the bondholders approved the company’s request for an extension on 1.5 billion baht of notes due Aug. 15 to avoid default. More than 90% of bondholders approved the proposal as against the minimum threshold of 75%, according to Vasu. The company has asked for an additional 10 months and 15 days and offered to raise the debt coupon to 5% from 3.11%, it said in a previous statement.

Founder Somphote Ahunai resigned as chief executive officer last month after the Securities and Exchange Commission said it was probing him and other executives for possible fraud. Somphote has denied wrongdoing. With total debt of 64 billion baht, Energy Absolute’s market value has plunged to roughly $405 million from more than $11 billion at its peak.

In a separate meeting on Aug. 14, the company will ask investors to give it nine months to repay 4 billion baht of green bonds due Sept. 29, offering them a coupon rate of 5% during the period from the current 3.2%. In another statement this week, the company said it also plans to seek Aug. 27 meetings with bondholders holding about 23 billion baht of debt.

The company is taking steps to bolster its financial stability by negotiating with new strategic partners, and is also weighing the sale of some assets to an infrastructure fund, Vasu said.

“The company is confident that if everything proceeds according to plan, its performance will return to a growth stage and will be able to repay all loans, including debentures due in the future,” Vasu said. This will be a long-term solution for the company and a win-win solution for financial institutions, debenture holders, and the company.”

(Adds CFO’s comment on bondholders’ approval in fifth paragraph)

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry