How Three High-Tech Countries Became Laggards in Electric Vehicles

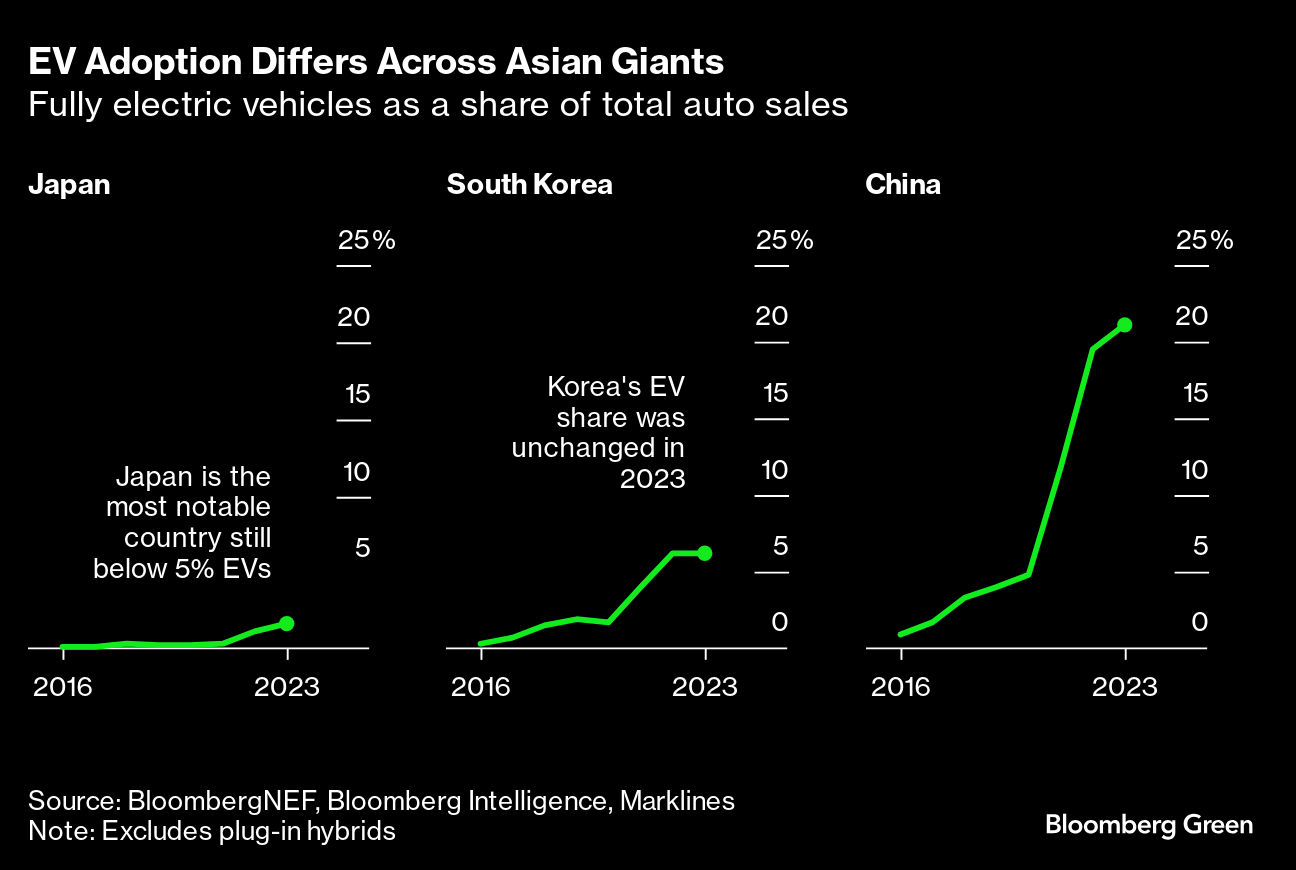

(Bloomberg) -- Japan meets all the conditions that should make it a frontrunner in electric vehicles: above-average incomes, a robust auto industry, high rates of new-car purchases, and a culture that generally embraces technology. Instead, electric vehicles made up a measly 1.8% of new cars sold in Japan last year.Last week, published an analysis of the 31 countries that have crossed the tipping point for widespread adoption of fully electric vehicles. Now it’s time to look at the bottlenecks — the countries that aren’t as far along the adoption curve as one might expect.

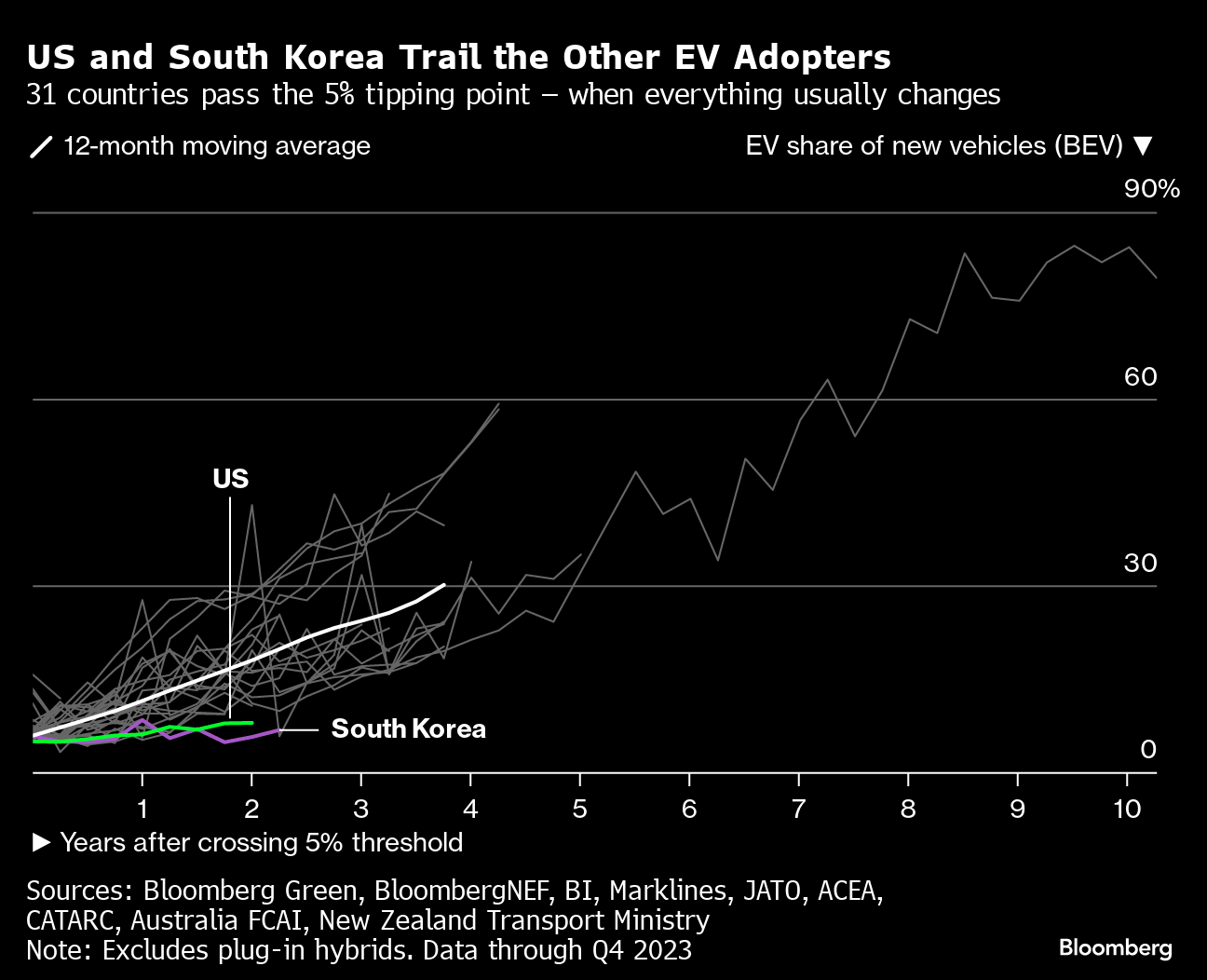

The EV laggards come in several flavors. The US and South Korea, for example, are a category unto themselves for maintaining a relatively slow pace of EV growth even after EVs surpassed 5% of new vehicle sales, which has otherwise been a consistent tipping point for accelerating sales. We’ll get to them in a bit.

Then there’s Latin America, which EV manufacturers have largely ignored — at least until recently — and where not a single country has reached the critical 5% threshold. Despite their middling incomes, Chile, Argentina, Brazil and Mexico should be nearing that point already, according to a analysis of conditions favorable to EV adoption. They aren’t. (In Europe, Russia, Poland and the Czech Republic fit into a similar category of slowpoke.)

But of all the places in the world where EVs should have found a perfect match — but didn’t — it’s Japan that comes out on on top, according to the analysis. It is the one true laggard.

Japan: A bad bet and too few chargers

Japan’s recalcitrance hasn’t gone unnoticed by the world’s largest EV maker. In January, Tesla Inc. Chief Executive Officer Elon Musk blamed a “lack of awareness,” — something he said he’d heard from friends there. “Our market share is remarkably low,” he said on an earnings call in January. “Japan is the third-largest car market in the world, and we should at least have a market share proportionate to, say, other non-Japanese carmakers like Mercedes or BMW, which we currently do not have.”

Japan’s slow adoption of EVs traces back to a bet made a decade ago by Tokyo technocrats and Japanese automakers to invest heavily in hydrogen fuel-cell technology. Toyota Motor Corp., the world’s largest carmaker, has since been a frequent EV skeptic, funding misleading advertisements, and lobbying against government policies that promote them around the world.

Japan’s dreams of leading a fuel-cell revolution haven’t materialized, and now it’s waking up to an automotive transformation that’s passing them by, says BloombergNEF analyst Corey Cantor. “They’re behind now, and that’s a big risk — right as BYD and other Chinese automakers gain prominence,” Cantor said. “It shows that in a major market, the impact that domestic automakers can have is massive.”

Japanese car buyers prefer tiny economical city cars known as cars — “light” in Japanese — to the more expensive long-range family-haulers favored by Americans. Whereas Tesla makes up half of the EV sales in the US, half of Japan’s EV market is taken up by the diminutive Nissan Sakura. The Sakura costs around ¥2 million ($13,300), after federal subsidies, and has a range of about 180 kilometers (112 miles).

It’s difficult for automakers to turn big profits on such small EVs, and sometimes the benefits to consumers of going electric — such as gas savings, reduced noise and improved performance — aren’t as obvious.

One of Japan’s biggest obstacles to catching up is its subpar infrastructure. The country has just 30,000 charging connectors, or about one per 4,000 EVs, according to data from Enechange Ltd., a Tokyo-based infrastructure provider. That’s less than a sixth of the density in the US or Europe, which has led to the some of the worst charger anxiety in the world, according to data compiled by BloombergNEF. The Japanese government last year pledged to increase that number of chargers tenfold by 2030.

South Korea: Shut out of high rises

Unlike Japan, South Korea’s foray into EVs has come with strong backing from its automotive supply chain. Hyundai Motor Group and Kia Corp. are making some of the most competitive long-range EVs in the world, and South Korea is home to three of the world’s five biggest battery makers: LG Energy Solution, Samsung SDI and SK On.

Still, Korea’s domestic demand for EVs is hardly brag-worthy. More than two years after passing the 5% threshold that typically precipitates a shift into rapid adoption, Korea’s EV sales fell flat in 2023, unchanged from the prior year at just 6.2% of new cars. The country currently sits at the bottom of the emerging adoption curve.

Korea has its own charging bottleneck. Many Koreans live in high-rise residential apartment complexes, and don’t have reliable access to at-home chargers. About 34% of consumers in a Deloitte survey rated charger availability as their top concern, compared to just 14% of respondents in the US.

Another 20% of respondents in the Deloitte survey rated safety as their top concern, the highest in the global survey. That response reflects a widespread concern about the potential for battery fires in those same residential high rises. In December, South Korea banned the installation of chargers below the second basement level to ensure emergency access in case of a fire.

Ironically, Hyundai, LG and Samsung played major roles in developing the high-density “apatu” housing developments that are now a standard of Korean residential life. About 61% of Koreans live in apartments or multifamily housing, including residential towers that can reach as high as 50 stories and complexes that accommodate up to 10,000 households.

US: A mismatch of options

Like South Korea, the US has fallen behind the rapid-growth “tipping point” trajectory. Even though sales of fully electric vehicles were up about 50% last year, making up more than 8% of new car sales in the fourth quarter, the trend has been slower than the 20 countries that came before the US.

A further temporary slowdown is underway in the US, driven by high prices, a lack of EV variety, and anxiety about the availability of public chargers, Tom Narayan, an auto analyst at RBC Capital Markets, wrote in a note to clients on Tuesday. Falling battery prices will help, he said, and “public charging fears are largely overblown.”

In the US there’s one high-speed charger for every 555 EVs on the road, which is “essentially at the same density” as its 530 gasoline-powered cars per fuel pump, according to an analysis by RBC. When home charging is taken into account, it’s closer to 202 EVs per charger.

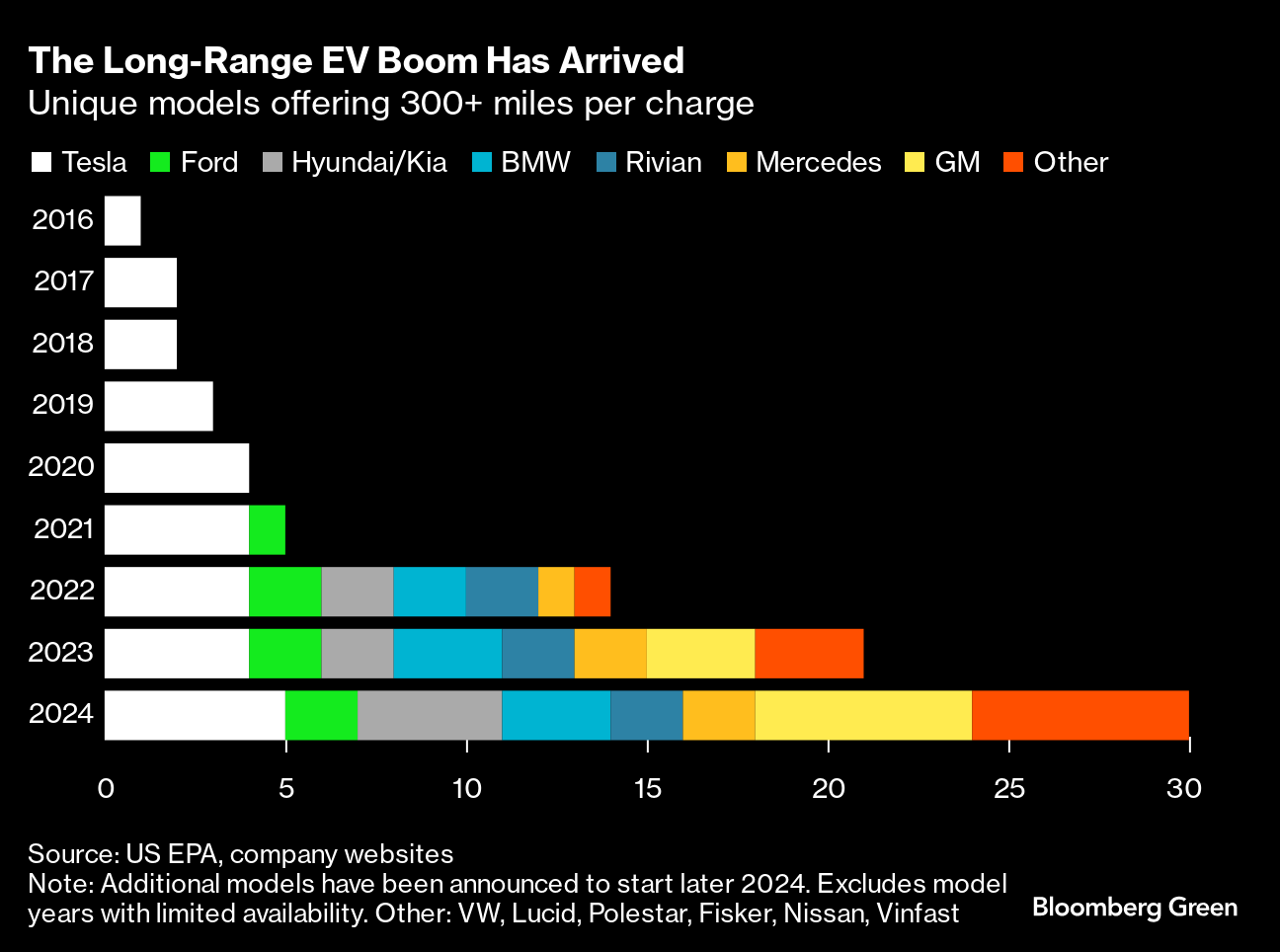

Perhaps America’s biggest holdup has been its obsession with battery range. US drivers demand more range than drivers from any other country. For years, a few models made by Tesla were the only choice for road trippers. Even then, the styles of electric vehicle didn’t match up with America’s longing for large SUVs and pickup trucks.

But the era of scarcity is coming to an end. The number of vehicles that can go 300 miles or more on a charge, which many consider the bar for US range convenience, jumped to 30 models at the beginning of 2024, a 500% increase in three years, according to a separate analysis by . A dozen more are set to go on sale later in the year.

“It’s going to be the year of more,” said Stephanie Valdez Streaty, Cox Automotive’s director of industry insights. “We’re going to see more sales, but we’re also going to see more bumps. We’re going to see more incentives, more price cuts, but also we're going to see the industry build more sales muscle — selling these EVs to the next wave of adoption.”

Countries to watch

A third of the global population still lives in places where EVs make up less than 5% of car sales — including India, Indonesia and the entire continent of Africa. Most of these countries don’t make the laggards list due to inherent impediments to EV adoption, including low per-capita GDP and outsized rural populations.

Even those obstacles are starting to fall away as EVs begin to reach price parity with gasoline-fueled equivalents. A tipping point may be approaching for India and Indonesia, significant auto markets where EVs have been on the rise. In South America, a major push underway by China’s BYD could provide the spark for widespread regional adoption.

Read Next:

- Electric Cars Pass the Tipping Point to Mass Adoption in 31 Countries

- Cheap Chinese EVs Are Putting Pressure on Detroit

- The Long-Range EV Boom Has Arrived

- These Are the Best Electric Cars for High-Mileage Drivers

- How Corporations Created the Prototypical Seoul Apartment

©2024 Bloomberg L.P.