European Nuclear Plants Put Out of Work by Green Power Surge

(Bloomberg) -- The drive to promote renewable energy is turning the screws on Europe’s nuclear industry.

While churning out fossil-free electricity has never been more urgent, surging renewables and a slump in power prices are undermining operations of atomic plants that are still the cornerstone of electricity grids in several parts of the continent.

The signs are that they are facing some tough times ahead. Demand hasn’t recovered fully since the energy crisis and the region’s wind and solar parks are producing more power than ever, which is eating into the share that both nuclear and coal plants send to national grids.

“With current power prices, the traditional baseload plants will struggle, unless we face longer periods with very unfavorable solar and wind conditions, drought or strong heat,” said Sigurd Pedersen Lie, a senior analyst at StormGeo Nena A/S in Oslo.

Longer term, it’s a warning sign that reactors might get increasingly squeezed out, even as countries such as France and the UK plan to spend huge sums on new plants, having identified the technology as a key element in the fight to limit global warming. At the United Nations climate meeting in Dubai late last year, they were joined by more than 20 nations including the US, the United Arab Emirates, Japan and South Korea in calling for a tripling of global nuclear generation by the middle of the century.

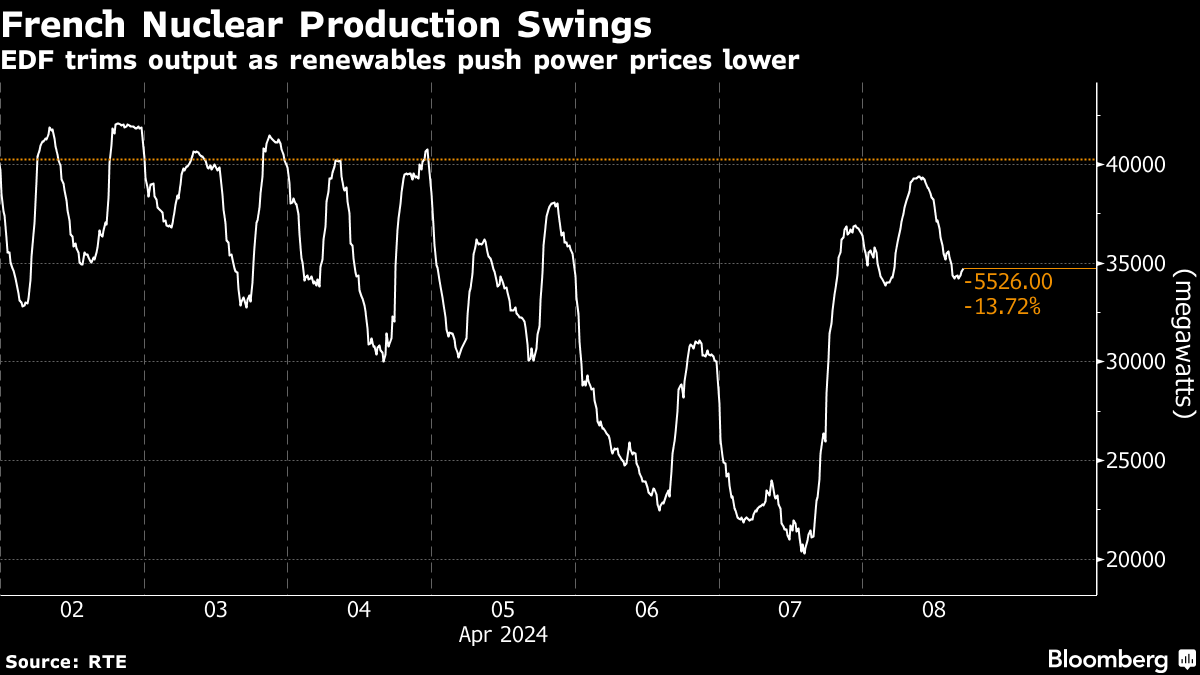

Electricite de France SA, which is just getting its fleet of nuclear plants back on track after years of lengthy outages for repairs and checks, has already had to reduce output and halt plants, or extend stoppages. Over the weekend, the firm idled half a dozen plants as prices turned negative.

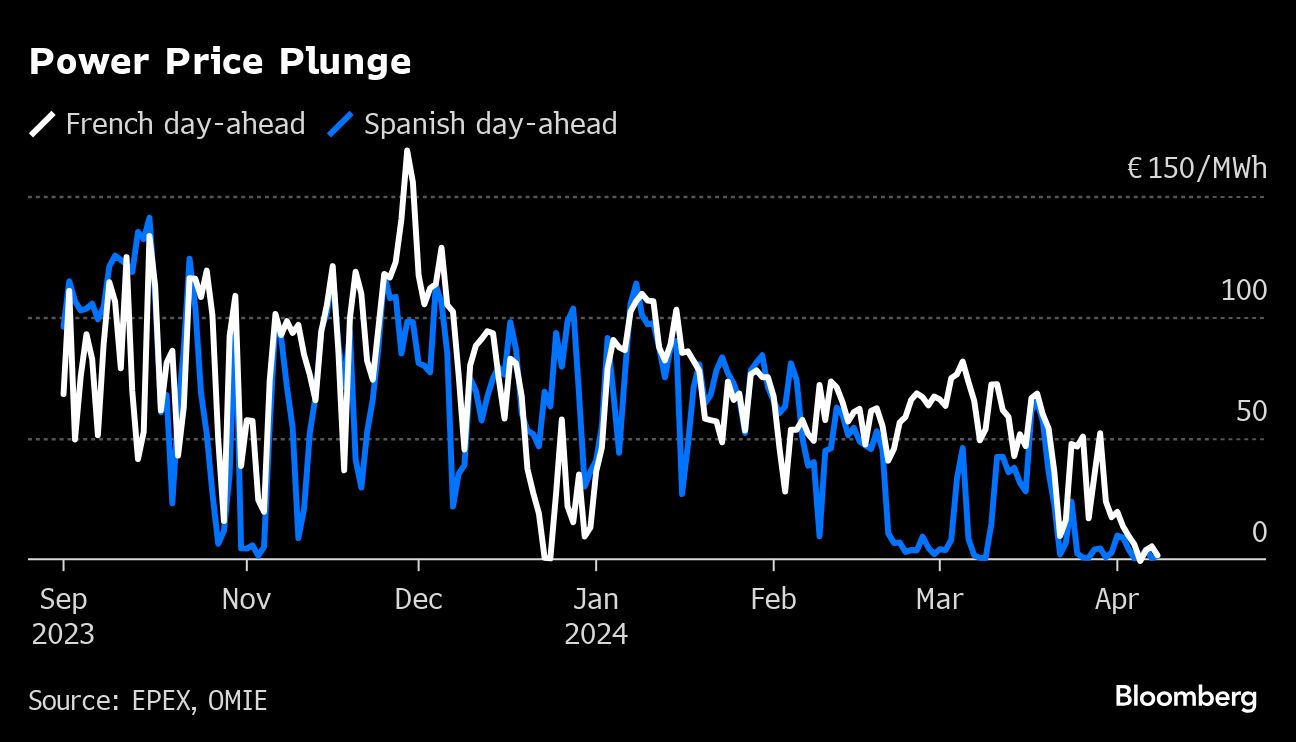

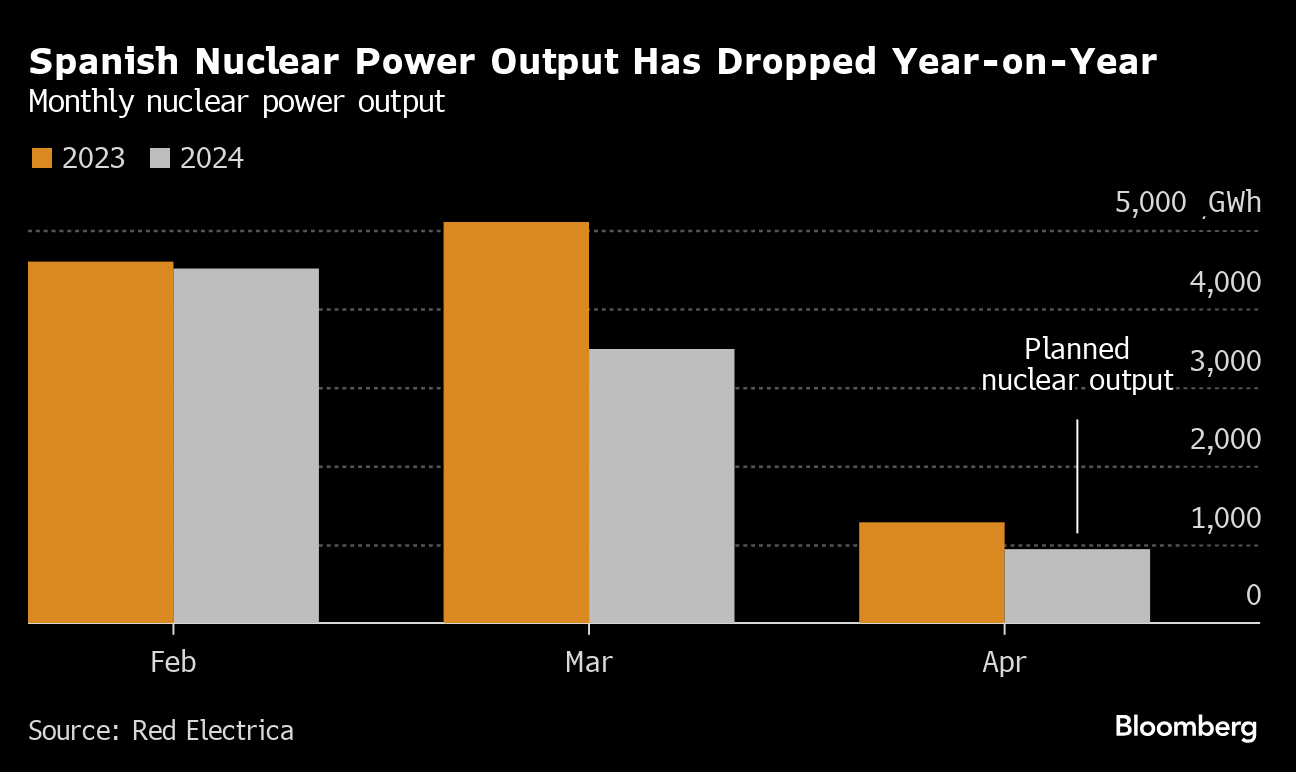

To the south in Spain, electricity prices for Friday plunged to the lowest level since 2013 and have barely settled above zero for weeks. The country’s Asco I and Asco 2 reactors cut output on a regular basis in the past five weeks. In the Nordic region, operators are also curbing output more often.

While EDF’s reactors were designed with some degree of flexibility, the company is looking at current developments “with extreme care,” Cederic Lewandowski, the company’s head of nuclear and thermal generation, told a senate hearing on Thursday.

European Union nations added a record amount of wind power capacity last year. The growth of solar capacity exceeded 40% for a third year running, lobby group data showed.

It’s not unusual for nuclear operators to dial down output when demand is low and supplies of solar and wind energy surge, but shutting down units completely is rare because of the time it takes to ramp back up again and the complexities involved.

“What we dread the most is reactor stoppages,” Lewandowski said. “If we were to have more frequent halts tied to renewables, climate change and so forth, we would have to look at that very closely.”

Pressure to curtail nuclear output, which often materializes when industrial activity slows during weekends and holidays, may show up again soon. Consumption in France dropped to just 33 gigawatts in pre-dawn hours on Sunday, according to grid data on Bloomberg. A Bloomberg model indicates that usage will slide below 35 gigawatts again next weekend. That’s a level more normally seen in May when the weather is warmer.

Since Thursday, French day-ahead prices have been below €10 per megawatt-hour, in addition to going negative for Saturday in an auction on Epex Spot SE in Paris.

According to Sabrina Kernbichler, lead power analyst at Energy Aspects Ltd., EDF needs to recoup about €22 ($23.80) per megawatt-hour in the wholesale market to operate economically. EDF declined to comment.

It’s not just nuclear plants that will suffer. Some German coal stations are also likely to face months on the sidelines, according to StormGeo’s Lie, as they are outmaneuvered by gas plants that are cheaper to operate after a plunge in the price of that fuel.

The current concerns for producers have also been exacerbated by a mild, windy and rainy winter, which is pushing hydropower operators to empty reservoirs to make room for the melting snowpack, said Emeric de Vigan, vice president for power markets at industry consultant Kpler SAS.

The issue for nuclear generators will only become more acute as the green expansion continues, especially if power demand remains lower for longer. The European Union’s target of a 42.5% share for renewables in the EU’s energy mix by the end of the decade raises the stakes further for legacy plants ranging from nuclear to coal and even gas.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters