Al Gore Calls Out the Bankers ‘Profiting Hugely’ From Big Oil

(Bloomberg) -- Al Gore, the former US vice president turned climate crusader, says Big Oil and the banks backing it still have huge financial incentives to stick with fossil fuels, even though their decision to do so is the leading cause of the climate crisis.

Bankers “are profiting hugely” from their role as lenders and advisers to fossil fuel companies, Gore said in an interview ahead of Climate Week, the annual gathering in New York of business and government leaders that occurs in conjunction with the UN General Assembly. Just as it’s “a bit unrealistic to expect fossil fuel companies to solve this crisis for us when they’re incentivized to do otherwise,” the business case for banks is the same, he said.

But the climate crisis is “a fossil fuel crisis” and that means the world needs to find a way to slash greenhouse gas emissions without assuming the oil industry will help, Gore said.

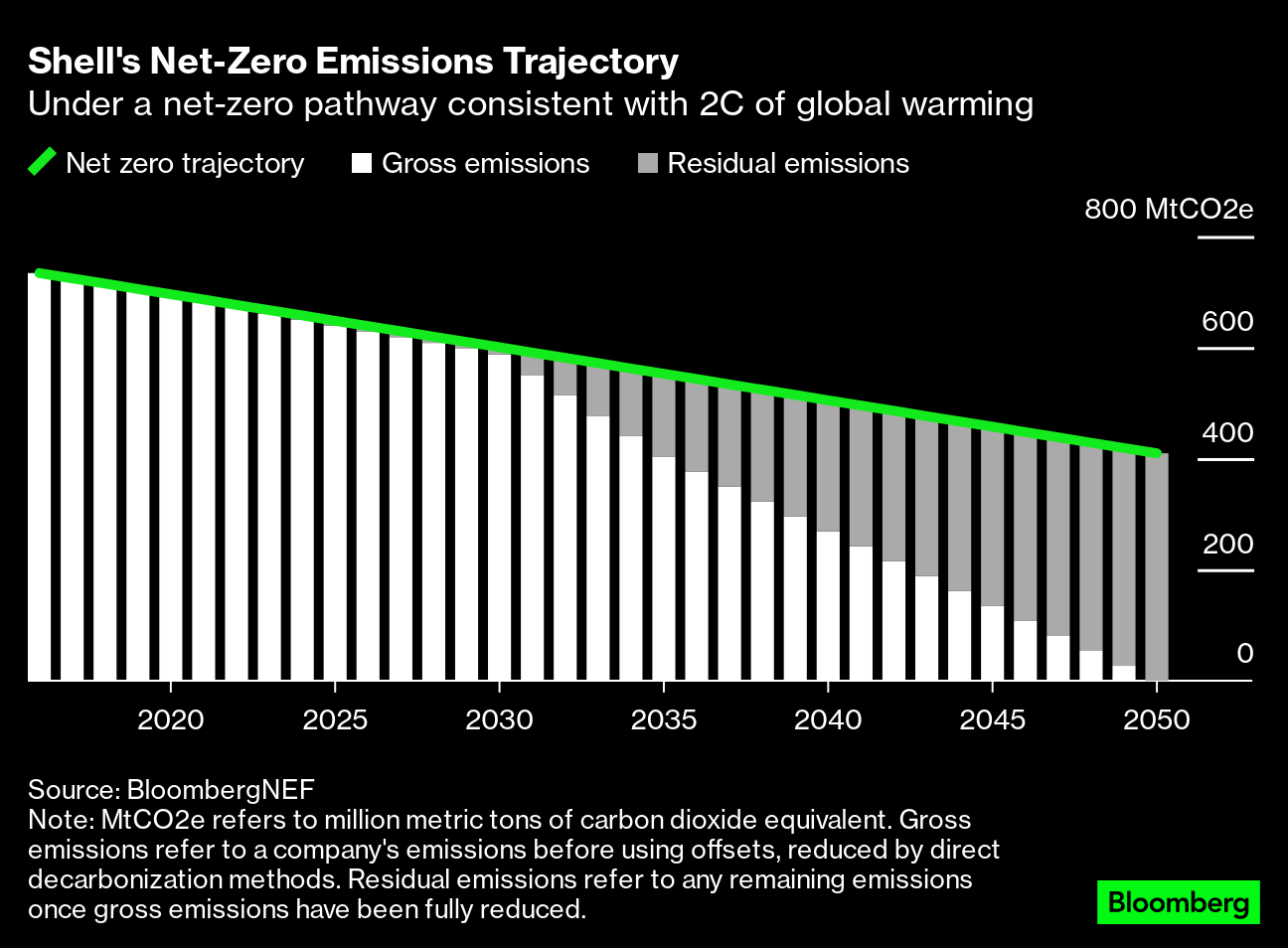

The verdict comes as energy companies double down on their fossil fuel businesses and scale back ambitions for renewables, with Shell Plc standing out as the latest example. In June, the company said it will devote an ever larger chunk of annual spending to oil and gas, a strategy that’s been dubbed “catastrophic” by climate activists but that coincided with a 10% bump in its share price.

And oil analysts are already suggesting that this week’s departure of BP Plc Chief Executive Officer Bernard Looney, who had stood out among peers for his efforts to push the company toward a greener strategy, will be welcomed by BP investors.

Meanwhile with continued output cuts from OPEC+, the prospect of higher oil prices remains. Bloomberg Intelligence analysts say $100-a-barrel Brent crude is now "on the horizon again."

The development suggests that Big Oil—which has repeatedly been accused of failing to walk its transition talk—is now also losing interest in even talking the talk. Meanwhile, banks aren’t providing stakeholders with the information they need to assess their carbon footprints, according to a recent study.

BloombergNEF estimates that for the world to have a chance of achieving net zero emissions by mid-century, banks need to channel four times as much capital into renewable energy as they do into fossil fuels by the end of the decade. The latest estimate suggests that figure is closer to 0.8 to 1.

The banks financing oil “are earning big profits from continuing what they’ve done for so long,” Gore said. “And yet they know they have to change.”

Executives from the world’s biggest banks and oil producers are among stakeholders heading to this year’s COP28 climate summit, which will be hosted by the United Arab Emirates and be presided over by Sultan Al Jaber, the CEO of state-backed Abu Dhabi National Oil Co.

The setup has drawn fury from climate activists who point to Adnoc’s goal of ratcheting up capacity. The company, which is the UAE’s biggest oil producer, claims it can raise production and cut emissions at the same time by investing in carbon capture technology that’s still being developed.

Gore said putting an oil executive from a petrostate in charge of climate talks represents a “dubious proposition, at best.”

Still, Gore was keen to underline that he thinks there are actually a few bright spots in the fight against global heating. The 75-year-old pointed to the findings in a report published by the firm he chairs, Generation Investment Management, which indicates that global emissions from electrical grids will soon “peak and begin to fall.”

“A cleaner electric grid is the key to the energy transition, the single most important requirement if the rest of the program is to succeed,” it said.

The report also says the annual flow of investment funds into clean energy is now 70% larger than the flow into fossil fuels. “However, the flows of capital are still not large enough overall, nor are they going everywhere they need to go,” it said.

Even so, “we don’t have time for climate despair,” Gore said. “The antidote to despair is action, and the world is now taking action.”

Examples of that include the Biden administration’s landmark climate bill, known as the Inflation Reduction Act, according to Gore. “We’ve been understating the impact” of the IRA, he said. That’s on top of huge investments in green technology taking place in Europe and China.

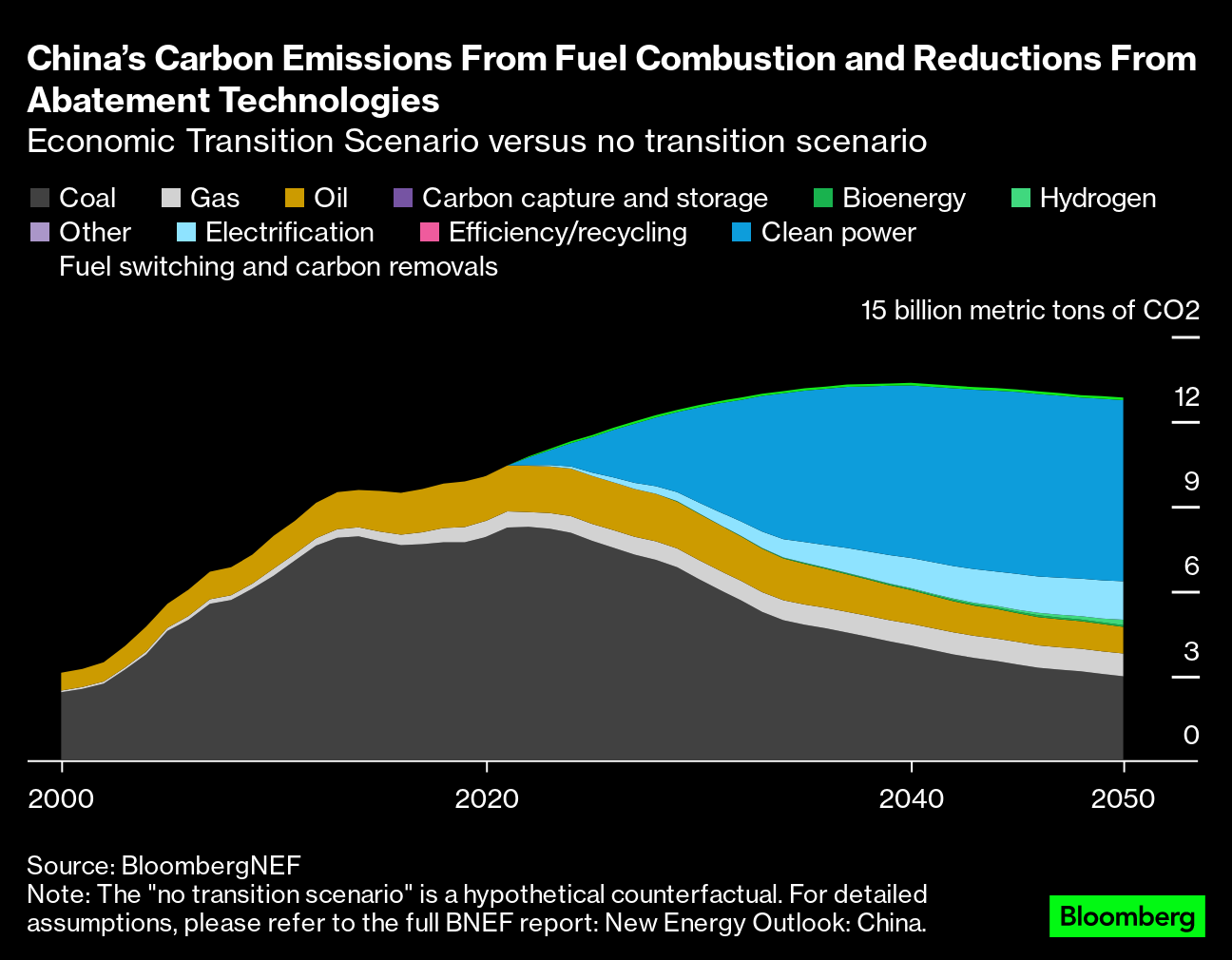

China’s role in the energy transition is “paradoxical,” Generation said in its report. The country is spending more on clean energy than any other nation, even as it builds more coal-burning power plants than anyone else, it said.

But when it comes to green spending, China tends to “under-promise and over-deliver,” Gore said.

India is catching up too.

“If you ask what percentage of their new electricity generation was solar and wind last year, most people would be surprised to hear the answer is 93%,” Gore said. “It’s quite a dramatic change there.”

New governments in Australia and Brazil also have led climate advocates to become more hopeful, Gore said.

“We need to do much more,” but “the progress is quite impressive and encouraging,” he said.

(Adds more references to the Generation IM report throughout.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture