Cocoa Farming Lures New Money as Brazil Is Set to Revive Exports

(Bloomberg) -- Cocoa farmers in Brazil are getting ready for a dramatic comeback.

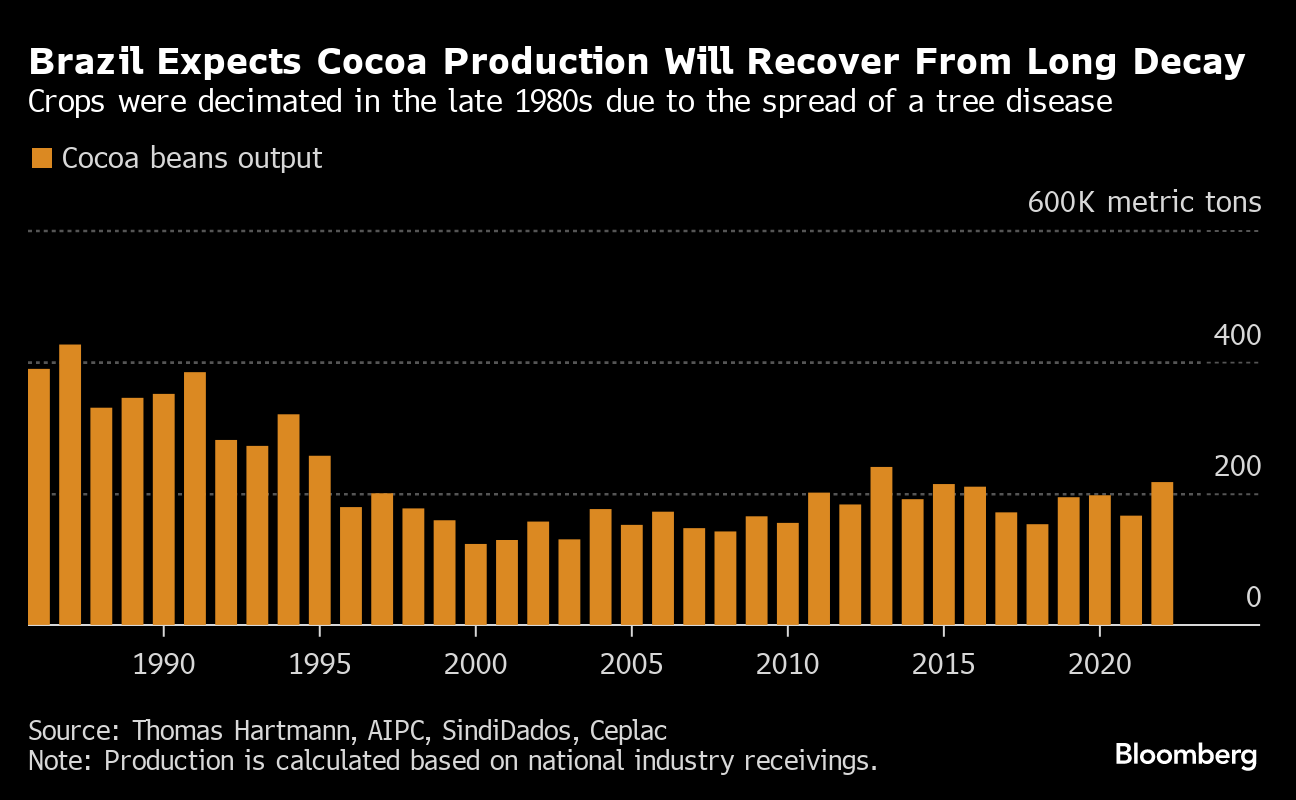

Once a prominent global supplier, the country lost it all to a tree-killing disease that decimated crops back in the 1980s. Now, it’s planning a revival. There’s fresh money flowing in, producers are venturing into new areas and traditional growers are receiving financial aid.

“There is a huge opportunity for Brazil to regain a leading role in the global cocoa supply chain,” said Valmir Ortega, the founder of Belterra Agroflorestas, a company planting cocoa trees across degraded rainforest areas. They have the support of giants like Cargill Inc. and an investment fund created by Vale SA.

Brazil is looking to double cocoa production by 2030. That’s one of the goals from a plan the country’s cocoa commission Ceplac is announcing this week. As soon as 2025, Brazil should be producing enough to satisfy domestic demand, according to director Lucimara Chiari. That would reduce Brazil’s need to import beans, helping ease a severe global shortage of the chocolate ingredient.

“Of all cocoa producing countries, Brazil has the greatest growth potential,” Chiari said.

The development is much needed relief for the cocoa market, which has suffered from bad weather and crop disease in top growers Ivory Coast and Ghana. Such setbacks have dramatically shrunk global inventories, causing cocoa futures to soar almost 70% this year. The price for the most-active contract in London climbed for a second straight day on Friday to as high as £3,476 per metric ton.

CocoaAction Brasil mapped at least 24 ongoing projects to aid the local cocoa supply chain, with a total investment of over 150 million Brazilian reais ($30.6 million).

The Brazil cocoa boom is already more than just a promise. Farmers in different areas of the country are planting new trees, which will bear fruit in the next two to three years.

One of those farmers is Moises Schmidt, who recently planted cocoa in Barreiras, a municipality of Bahia state located almost 600 miles (966 kilometers) away from traditional cocoa areas. He is now expanding plantations in partnership with Cargill. It’s a marked shift for the family business Schmidt Agricola, which for over forty years specialized in growing cotton, soybeans and corn.

“Cocoa farming was stuck in the past,” Schmidt said. In contrast to the more traditional craft methods, his company made efforts to use new machinery and invest in seedlings that can resist the drier weather of his region. “That’s the future.”

Cocoa has become such a hot topic that even a biofuels company is now looking to produce the chocolate ingredient. Brasil Biofuels SA focuses on fuel made from palm oil, but started to add cocoa plants to its tree nursery, hoping to cultivate 1,000 hectares next year.

To be sure, Brazilian cocoa production is still a fraction of what is grown in Africa, a continent that accounts for almost three quarters of global supply. What makes Brazil relevant is the fact that at least some of its farmers have the means to respond to heightened global demand by boosting supplies, whereas in Africa many farmers live below the poverty line and their pay is set by authorities, so they don’t immediately benefit from higher futures prices. Producers need money to invest, especially as new European rules require spending on traceability to prove crops weren’t grown in deforested land.

A larger Brazilian production could bring down cocoa prices, although that would only be a factor in the long term, analysts at the Hightower Report said Friday. For now, prices continue to be driven by the poor outlook in West Africa.

Productivity of Brazilian farms is also lower than in Africa, but it has been improving, said Pedro Ronca, an agronomist and manager at the CocoaAction Brasil initiative. Many areas were still lacking the basic investments in soil treatments, as well as proper tree care. Providing farmers with access to financing and technical assistance is leading to significant yield gains, he said.

Perhaps the biggest threat to Brazil’s ambitious cocoa plans still lies in tree health. More than 30 years after the first deadly outbreak, a new disease called frosty pod rot is haunting farmers. Fighting such risk will require even more investments, said Anna Paula Losi, chief executive officer of industry group AIPC. She believes Brazilians are up for the job.

“We have better knowledge and resources now,” she said. “We are not the same.”

(Updates cocoa futures price in sixth paragraph, adds analysts comment in 13th paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals