Tycoon Adani Focuses on Energy as Green Unit Profit Soars

(Bloomberg) -- Billionaire Gautam Adani’s clean energy unit reported fourth-quarter profit surged as the conglomerate prioritizes renewable power amid its response to the impact of Hindenburg Research’s explosive report.

Adani Green Energy Ltd., India’s top renewables company, saw net income in the three months through March more than quadruple to 5.07 billion rupees ($62 million), according to a statement released late on Monday.

The business is “expediting the transition to sustainable energy and playing a pivotal role in fulfilling India’s obligations to a greener future,” Chairman Adani, who has been closely associated with Indian Prime Minister Narendra Modi, said in the statement.

Renewables initiatives remain a core focus for Adani, along with power generation and ports, even as his sprawling empire pulls back on ambitions in some other areas. Adani Group has lost billions of dollars in market value and reviewed its plans following allegations of corporate fraud made in January by Hindenburg, which the company denies.

Shares rose as much as 5% in early Mumbai trading and were 2.3% higher as of 10:39 a.m. local time. Adani Green’s market value has almost halved this year, dragged down by the short seller’s report.

The group is aiming to raise about $800 million for new green energy projects and has had discussions with global banks including Sumitomo Mitsui Banking Corp., DBS Bank Ltd., Mitsubishi UFJ Financial Group and Standard Chartered Plc, people familiar with the details said last week.

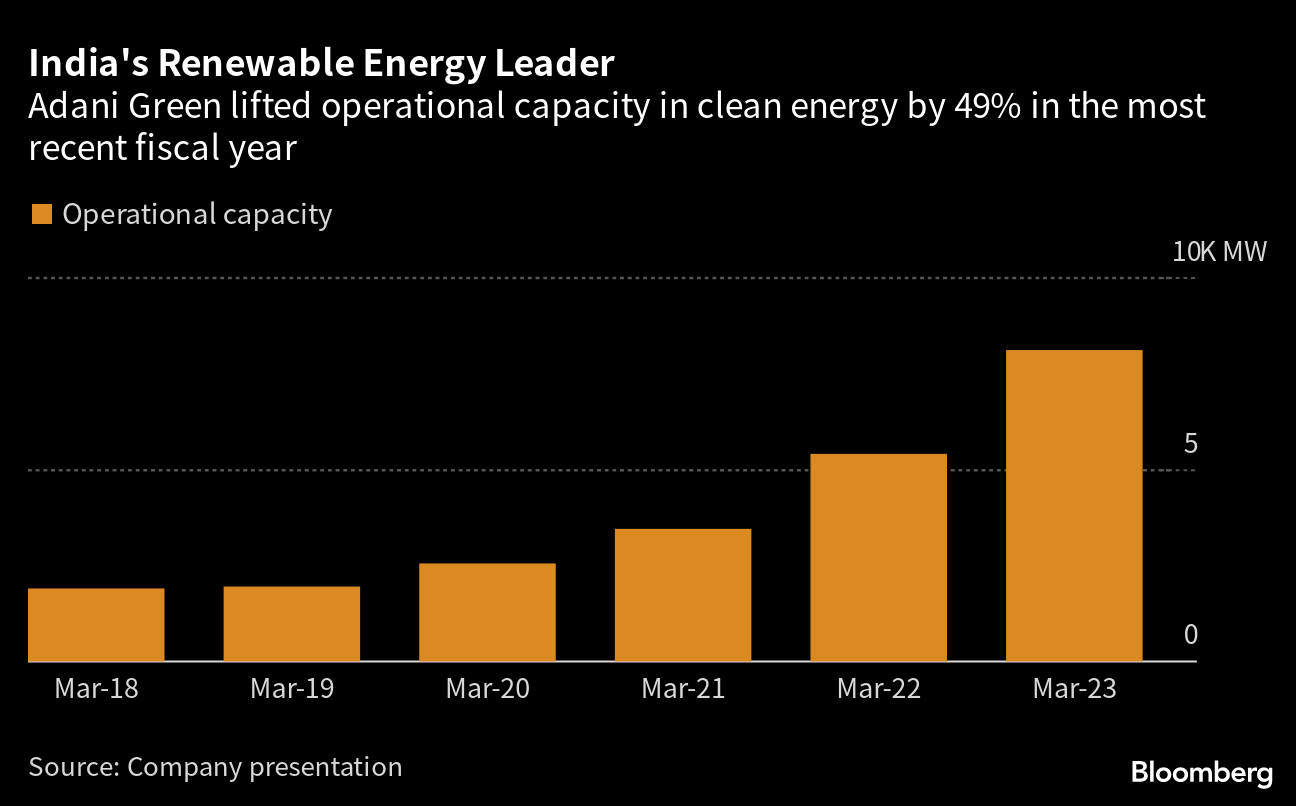

Adani Green’s operational capacity increased by almost half to more than 8 gigawatts in the financial year ended in March. The firm is targeting renewable energy capacity of 45 gigawatts by 2030, a goal that’s aligned with India’s aim to almost triple clean power generation capacity by that date.

Total costs rose 44%, driven by factors including higher borrowing costs, the company said in its Monday statement.

(Updates with shares in fifth paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains