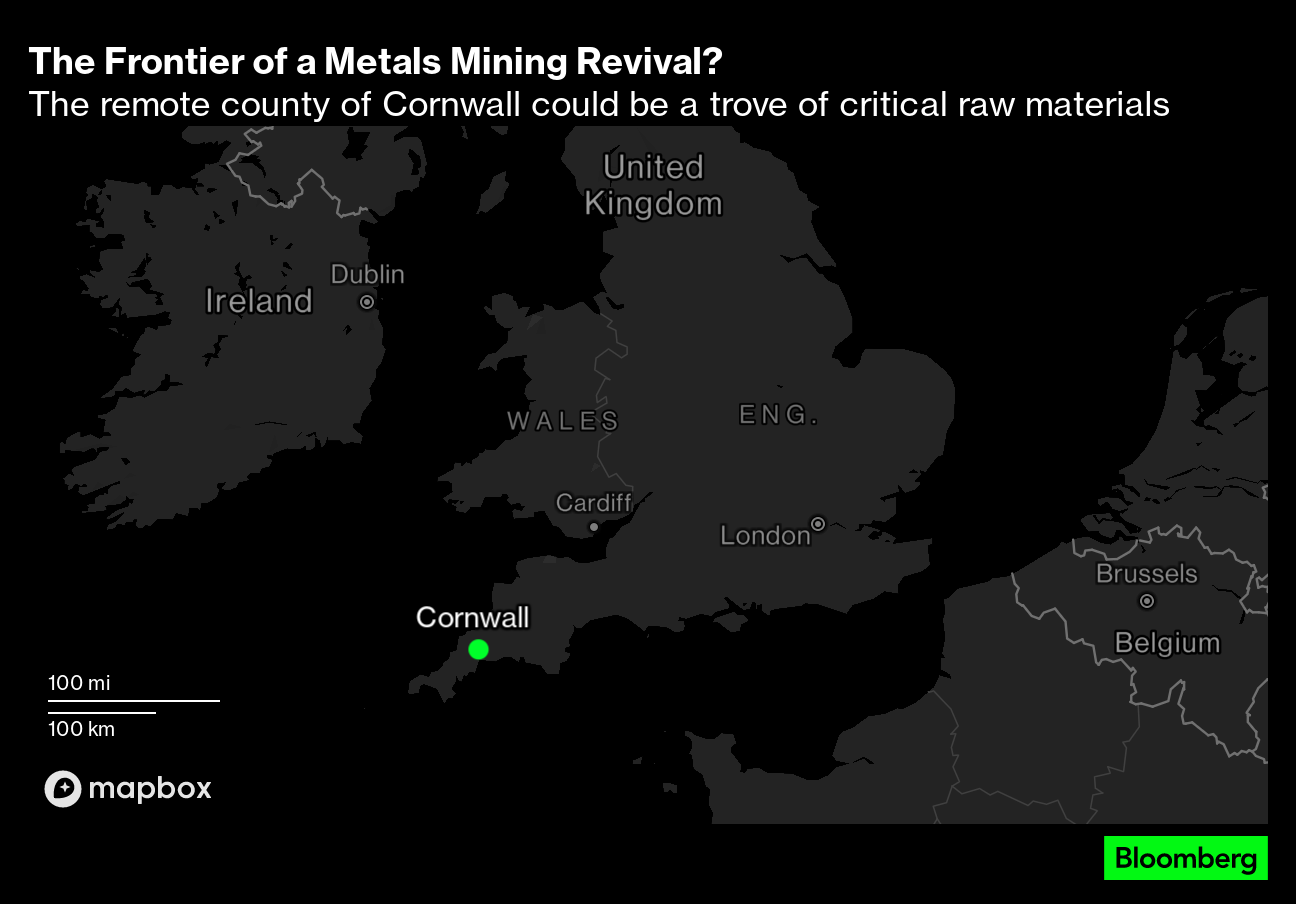

UK Needs to Revive Rich Mining Past to Counter China’s Minerals Grip

(Bloomberg) -- When work began at the South Crofty tin mine in Cornwall, Queen Elizabeth I was on the throne, the first English settlement in America had only just been established, and the world’s trade with the Far East was controlled by Portugal. It shut in 1998 after more than four centuries of continuous operation, a victim of sinking prices.

Now, South Crofty is part of a wave of mining activity across England’s southwestern tip aiming to resuscitate an industry that until recently looked all-but dead. Tin, copper, tungsten and lithium, along with associated geothermal energy, are the focus of companies trying to capitalize on the surge in demand for the raw materials that are key to the shift to clean energy.

For Cornwall, it’s the chance to use past strengths to secure its future in a new world where minerals are strategic, ideally responsibly sourced, and self-sufficiency is key. For the UK, it’s a test of the government’s ability to come up with the money and vision quickly enough to ensure the country doesn’t get left behind.

The evidence on — and under — the ground suggests things are moving, even if hurdles remain for the viability of some projects. “Most of the questions revolve around, why is it taking so long?” said Richard Williams, chief executive officer of Cornish Metals, the owner of South Crofty. “It now just seems to be taking off. Not just here, but around Cornwall.”

Tin’s comeback is thanks in part to a European Union regulation from 2006 that banned lead in solder, meaning it became ubiquitous in electronic circuits rather than the sardine cans of old. But it’s recent geopolitical tension between the US and China that’s raised the stakes further, particularly for a Britain now outside the EU.

President Joe Biden turbocharged the push to clean technologies with $369 billion of subsidies in his Inflation Reduction Act for projects such as electric-car battery plants that Washington sees as the bedrock of its competition with Beijing. Governments the world over are now figuring out how to respond, while securing the critical raw materials needed to compete.

The global shift to cleaner energy will need an estimated $6 trillion worth of metals, according to BloombergNEF. Much of that is destined for battery plants, with governments and automakers “increasingly seeking to localize their respective supply chains” through policies from direct subsidies to battery “passports,” it says.

Why the Fight for ‘Critical Minerals’ Is Heating Up: QuickTake

The UK government released a minerals strategy last year in which it committed to maximize domestic production and rebuild skills in mining, including supporting the development of industrial clusters in Cornwall. A subsequent report by the British Geological Survey identified southwest England as one of eight key areas “particularly worthy of further investigation” for critical raw materials.

The complaint is that not much has been done since. After a rotating door of ministers in recent years, London has to come up with a “very coherent approach to where the UK wants to be,” said Ryan Law, founder and CEO of Geothermal Energy Ltd (GEL).

The Cornwall-based company is about to produce the UK’s first electricity from water heated deep underground, a process that also enables it to extract lithium for batteries. The US “has completely changed how companies are thinking about investment,” said Law.

A long toe of land stretching into the Atlantic, Cornwall lies closer to France or Ireland than it does to the UK capital and boasts its own Celtic roots and language. It was synonymous with the exploration and extraction of mineral wealth going back to at least Roman times.

Yet Cornwall’s tin was never mined out, it simply became uneconomic. Today, China controls most global production, with none at all in North America, leaving the world largely dependent on Beijing for a metal required in everything from robotics to components for solar panels. The risk of such a reliance was underlined by China’s move to control the export of two key metals, germanium and gallium.

South Crofty was the last Cornish tin mine to close. Canadian-owned Cornish Metals, which is also listed on the London Stock Exchange, saw the potential and bought it out of administration in 2016. The idea was to wait it out until the price rose and it became possible to raise money to refit the kilometer-deep mine for work.

That moment arrived last year — when Biden’s IRA was passed — with a £40 million ($51 million) funding round including a £25 million investment by Vision Blue Resources, a firm headed by Mick Davis, the former CEO of mining giant Xstrata Ltd. Focused on the metals needed for the energy transition, its investments include a vanadium project in Kazakhstan, silica in Canada, graphite in Madagascar, rare earth elements in Brazil — and now tin in Cornwall.

Climbing out of the Land Rover into a tunnel 150 meters (492 feet) below ground, the main impression is not the dark, the temperature — it’s pleasantly mild — or even the weight of rock that lies above. It’s the wet.

Water streams down the tunnel walls and collects noisily in black puddles of mud, making walking even more awkward for anyone unaccustomed to wearing a hard hat with headlamp, protective overalls, steel toe-capped rubber boots and carrying a “self-rescuer” respiratory device slung on a heavy leather belt.

At the tunnel’s end, a brightly-lit cavern opens up where two men are operating a drilling rig boring far below to assess the extent of the ore. The tin at South Crofty is very high grade — a world class deposit, according to Williams, a geologist who conducted his undergraduate mapping project in Cornwall. But before any mining can be done the workings have to be “dewatered,” or pumped out.

A treatment plant newly constructed above ground will process the mine water before it gets pumped into the nearby Red River, so-called for the metallic stain it leaves — cleaning the river in the process.

The project employed just eight people as recently as last year. Now there are 45 staff on site, with projections for 250 to 300 direct jobs plus associated services once the mine is working. Williams is looking at an initial 10-to-12-year lifespan extracting the current resource, with perhaps as much as 50 more years of mine life given the potential in surrounding rock outside the explored area.

Others see similar potential, and the rush is getting more crowded. There’s Cornish Lithium, Cornish Tin, Cornwall Resources, British Lithium (based in St Austell, Cornwall), and Tungsten West, which is due to restart its tungsten mine across the county border in Devon this year. French specialty minerals producer Imerys SA says it detected lithium at its Cornish kaolin, or China clay, facility and is assessing its viability.

Metals prices are high enough “to make it worthwhile exploring in Cornwall,” said Frances Wall, professor of applied mineralogy at the Camborne School of Mines, the UK’s last specialist mining college. Even so, “these are long and difficult journeys for all of these projects. Nothing is done until the mine is open.”

Cornish Lithium is a case in point. Arguably the poster child of southwest England’s mining potential, the company reckons it’s sitting on the largest deposit in Europe. Yet it’s been left scrambling for the funding needed to successfully develop its projects “and continue to move forward with securing a domestic supply of lithium,” it said on June 27.

Cornwall’s key geological feature is its granite backbone. Intrusions of molten granite several hundred millions of years ago caused minerals to form in ore-bearing “lodes.” It’s these mineral-rich deposits, predominantly copper and tin, that have been mined since antiquity, peaking in the 1800s when Cornwall boasted the richest mines in the world.

Echoes of that activity can be seen in the old mine workings that still dot the countryside in the area around Redruth, Camborne and the north Cornish coast, evidence of a proud industrial heritage that seemed to have had its day.

When Ryan Law first started trying to convince investors of Cornwall’s potential for geothermal energy, no one took him seriously. Fast forward two decades and he’s responsible for a hole that extends more than 5 kilometers (3.1 miles) into the earth’s crust, the UK’s deepest onshore well.

This is the country’s first geothermal energy pilot project, situated on the unassuming United Downs industrial estate near Redruth. Construction of GEL’s power plant will start later this year, with geothermal electricity due to go live in 2024, another UK first.

Private equity firm Kerogen Capital and Thrive Renewables Plc invested £15 million in GEL in March of this year, then in May the government allocated £22 million to the UK’s first deep geothermal district heating network near Truro, also in Cornwall, to be supplied by the United Downs plant. Law has planning permission for two more sites in the county with a further two under consideration.GEL’s fortunes are helped by the fact the water injected and heated at depth comes up rich in lithium, a key element in EV battery production. Innovative techniques allow that to be extracted. GEL aims to produce 12-14,000 tons a year out of a theoretical UK demand of some 50,000 tons by 2030. “We’re now in a good place,” said Law.

The UK’s geology has indelibly shaped its economic, cultural and political history. The fact that Britain is an island — a key driver of anti-European sentiment that culminated in Brexit — is due to a catastrophic flooding event that severed a chalk bridge connecting it to continental Europe about 125,000 years ago.

The coal fields of central Scotland, northern England and southern Wales fueled the Industrial Revolution that yielded the technology and funds for Britain’s imperial ambitions. The closure of the UK’s deep coal mines under Prime Minister Margaret Thatcher in the 1980s can be traced in the deprivation of those areas today.

As the local Member of Parliament who grew up in what was Cornwall’s industrial heartland, George Eustice recalls the “body blows” it suffered with the closure of tin mining and the dying out of associated engineering firms. Unemployment remains above the UK average, while economic output is lower. Cornwall also lost EU funding after Britain quit the bloc.

It’s important to be realistic about the projects just starting up, said Eustice, the Conservative MP for Camborne and Redruth. But they hold out the promise of building a successful manufacturing supply chain around them, and can be strategically valuable, he said.

“There’s been a change in political calculations around the world,” said Eustice. “National resilience has basically risen up the agenda as hopes in globalization have receded.”

Eustice is pressing for more government help, as other countries race ahead. Germany said June 26 it plans a state fund of as much as €1 billion ($1.1 billion) to support mining of critical minerals, while the EU launched a Critical Raw Materials Act in March.

In the UK, translating words into action is taking too long, according to Sally Norcross-Webb, who founded mining company Cornish Tin in 2017 and was joined in late 2021 by Clive Newall, a co-founder of copper giant First Quantum.

A corporate finance lawyer in the City of London with experience in mining and exploration, Norcross-Webb’s company has found tin mineralization beyond the extensive historic mining that underlays the entire region like a Swiss cheese. On a unusually warm June day, she also announced the company was on the brink of accessing a potential new lithium field.

Now there’s proof of viable resources of both tin and lithium, Norcross-Webb wants politicians to act with more urgency to secure the domestic supply chain. “Are we serious about it or not?” she said. “We don’t see a great deal of evidence from the UK government that we are serious about it.”

The gamechanger could be a Jaguar Land Rover battery plant its owner, Tata Group, is considering building in southwest England, reportedly after asking for as much as £500 million in government aid. That could potentially create a huge demand for locally sourced critical minerals.

Lithium was first identified in the hot springs of Cornish mines in 1864, but there was little use for the element so it was mostly left underground. The UK now dangerously lags its European competitors, and is even further behind the US, in extracting it, according to Mike Round, the head of geothermal lithium at Cornish Lithium.

The company is drilling a fourth exploration borehole at about 2 kilometers depth – the “sweet spot” for cost versus lithium content. A demonstration plant producing “a saleable should be up and running within the next couple of years, with full commercial production from around 2028, said Round.

It’s received some £8 million in UK government aid and could use more. Money aside, other issues include the time needed for planning permission and the difficulty of getting visas for drillers, many of whom come from Eastern Europe.

It’s a complaint echoed by Pat Forward at the company’s more conventional “hard rock” lithium project in a former quarry to the north near St Austell. This is “clay country,” where huge open-cast workings mine the kaolin used in making paper and ceramics. Forward sees the prospect of the JLR battery plant a few hours away in Somerset as “massive for us, and massive for them if they can get lithium down the road in Cornwall.”

The development of a responsible supply chain of critical minerals is a unique chance for Cornwall, but also a make-or-break moment for the nation. “If we can’t produce it in the UK or Europe,” said Forward, “we have a big problem.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry