Europe Banks on Its €72 Billion to Counter Biden’s Green Payouts

(Bloomberg) -- Europe’s initial anger at President Joe Biden’s massive green subsidy plan has waned in light of assessments that rank EU incentives to boost clean technology as equal to or surpassing some of the benefits offered in the US law.

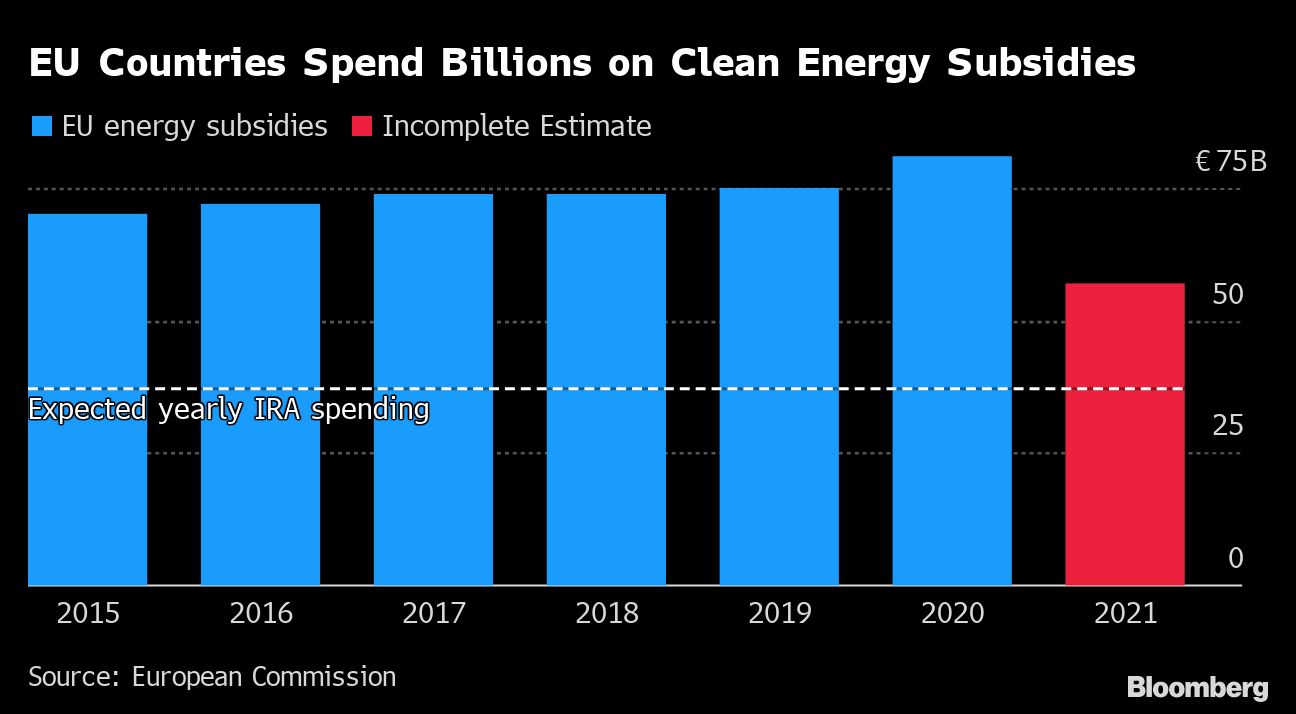

The US’s Inflation Reduction Act — which offers as much as $369 billion in handouts and tax credits over the next decade for clean energy programs — is playing catch-up to the EU, which currently spends more than €70 billion ($74 billion) in renewable energy subsidies each year, according to people familiar with the thinking in the European Commission and some capitals.

Frans TimmermansPhotographer: Thierry Monasse/Bloomberg

Frans TimmermansPhotographer: Thierry Monasse/Bloomberg

Now that some EU officials no longer regard the IRA as a threat in the race to support climate-friendly domestic manufacturing, many in Europe are instead shifting their focus to China, which they believe presents a much greater risk, said the people, who spoke on the condition of anonymity.

“The IRA is an opportunity to green the US economy, but we have some advantages vis-a-vis the US that we need to emphasize,” Frans Timmermans, the EU’s green deal chief, told reporters earlier this month in Strasbourg, France. The EU provides an amount that “is at least comparable to the amount of money that the Americans are putting on the table,” he said.

Moreover, the EU also has a green trade tool of its own: the Carbon Border Adjustment Mechanism, which will slap a levy on emissions-intensive imports like steel, cement and hydrogen from countries with less-strict climate rules. The US, which does not put a federal-level price on carbon, would in theory be subject to the measure, which will be phased in later this year.

When the US law was passed last year, many European leaders lashed out at it as an attempt to steal investment dollars. French President Emmanuel Macron accused Washington of creating a “double standard” with Europe, and questioned the “sincerity of transatlantic trade.” Belgian Prime Minister Alexander De Croo in January accused the US of trying to lure green industries, saying: “They are calling Belgian firms, German firms in a very aggressive way to say: ‘Don’t invest in Europe, we have something better.’”

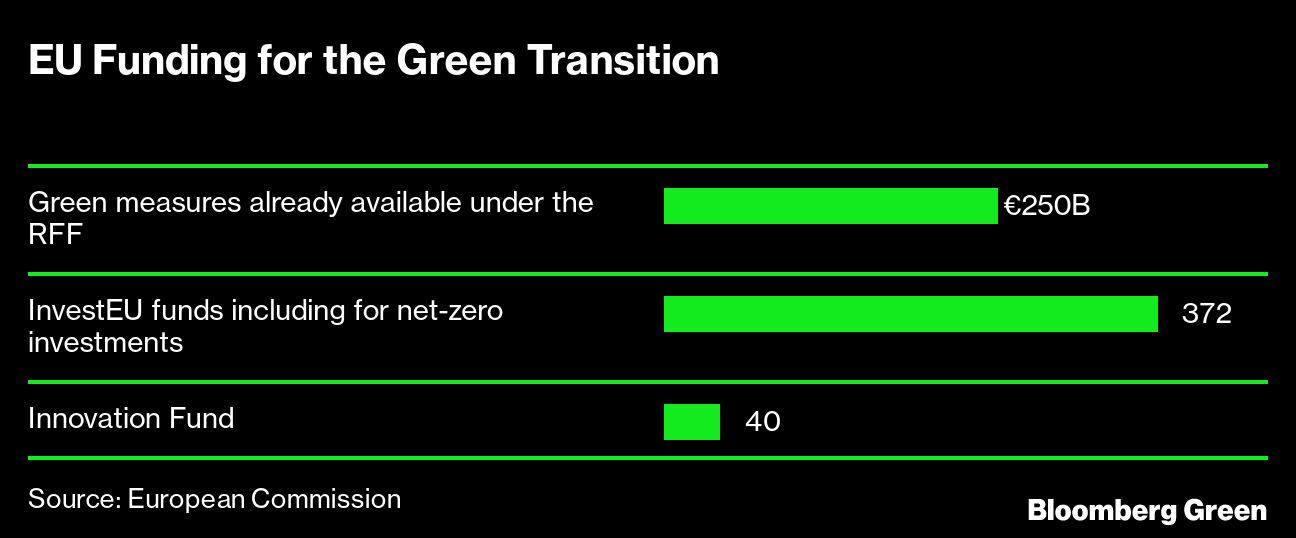

But officials have since changed course, praising the US for the law’s green features and using it as an opportunity to highlight the EU’s own massive spending, namely though its €724 billion pandemic-era Recovery and Resilience Facility, and its REPowerEU plan, aimed at ending Europe’s dependence on Russian fossil fuels.

While the IRA will be a boon for investment in the US, the extent to which that comes at the expense of Europe will be “absolutely marginal,” Jacob Kirkegaard, a senior fellow at the German Marshall Fund, said in an interview.

“A lot of European businesses are going to invest in the US, but that’s market development, that’s going where the growth is,” Kirkegaard said. “That doesn’t mean they’re going to relocate from Europe — because the reality is they’re going to be investing massively in Europe as well.”

One of the EU’s challenges isn’t the amount of capital available — there’s plenty of that — but how easily it can be allocated and accessed. There’s also a push to make the bloc’s regulations more nimble across the the value chain, from sourcing materials and financing investments to incentives for manufacturers and end consumers.

Electric Vehicles

The IRA offers consumers a tax credit of up to $7,500 for electric vehicles assembled in North America as long as at least 40% of the value of the raw materials in their batteries is derived from materials extracted or processed in the US, or in countries that have a free-trade agreement with Washington. This incentive alone is worth about $7.5 billion, according to a Congressional Budget Office cost estimate.

Nearly every EU member state provides some form of support to boost electric vehicle sales, including bonuses worth as much as €10,000. The bloc’s recovery fund also provides more than €11 billion toward low-emission mobility initiatives, such as electric vehicles and powering stations.

One lingering worry, however, is that IRA tax credits could have a longer-term impact on automotive supply chains, and that investments might be diverted to the US so long as the incentives continue to align with assembly requirements there, the people said.

The CBO figures for federal spending are estimates, and some expect that the actual value of the subsidies will be much greater. Since about two-thirds of the spending in the law is uncapped, the total value could reach $800 billion over a decade — about double the CBO projection — according to analysts at Credit Suisse Group AG.

Renewable Energy

The IRA has allocated about $95.6 billion to boost renewable energy sources, including hydrogen, solar and wind. On average, the EU has spent about €72 billion on renewable energy subsidies each year since 2015, according to a commission report.

Given high demand in Europe, the EU’s wind manufacturing capacity is not expected to relocate unless financing dries up, the people said. The EU’s solar industry, however, is more exposed as it imports most products, especially from China.

Europe needs to team up with the US to find its own “optimal area of green transformation,” said Alicia Garcia-Herrero, a senior fellow at the Brussels-based Bruegel think tank.

“If not, what’s going to happen? Europe is going to continue to import everything from China from batteries to solar panels, and the US will create its own ecosystem,” she said. “That’s what Europe cannot afford.”

Hydrogen

The tax credits in the IRA to boost hydrogen production are worth about $13 billion, according to the CBO analysis. This is roughly in line with the €10.6 billion in public spending projects that EU countries have allocated to boost the hydrogen value chain.

Ultimately, the IRA is unlikely to have a significant impact on the EU as the level of subsidies suggests that most of the focus will be on the domestic US market, according to European officials. The EU is currently aiming to produce 10 million tons of renewable hydrogen and import the same amount. Should the US become a source of hydrogen, it could benefit the EU. The recovery fund provides significant support across the whole hydrogen value chain, from production to end-use.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

House Committee Says It Finds Evidence of ‘Climate Cartel’

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid