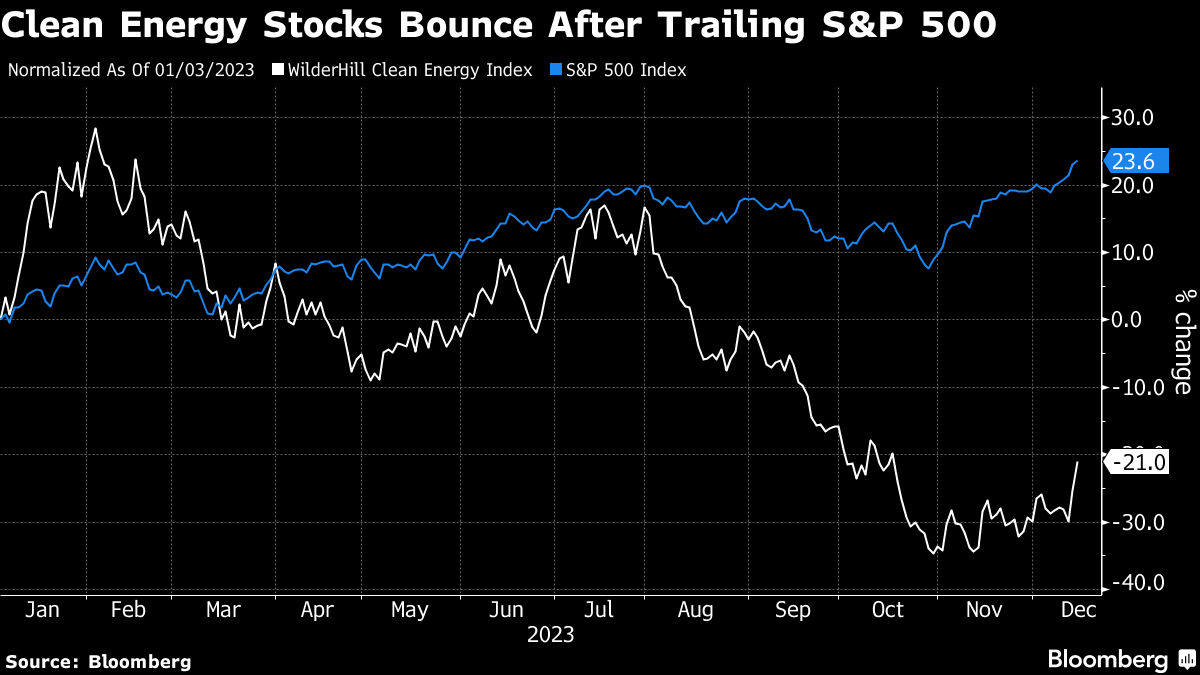

Clean Energy Index Rises Most in a Year With Fed Rate Cuts in Sight

(Bloomberg) -- The Wilderhill Clean Energy Index rose as much as 14% over two days on Thursday as investors cheer the possibility of a soft landing in the world’s largest economy.

The surge was the biggest since November 2022 and came after Federal Reserve chair Jerome Powell signaled that interest rates are at or near the peak. The rise comes after a tough year for the solar, wind and electric-vehicle charging industries, which suffered a $30 billion rout after being plagued by higher financing costs.

“It’s a pretty simple story,” said Rob Barnett, Bloomberg Intelligence senior analyst. “These are capital-intensive businesses, so when interest rates are lower that lowers the cost of doing business, whether it’s wind or solar.”

All but three stocks in the 77-member index climbed Thursday morning, led by TPI Composites Inc.’s 60% jump. The gauge includes leaders in clean-energy industries such as solar, wind and electric vehicles and includes Tesla Inc., Maxeon Solar Technologies Ltd. and ChargePoint Holdings Inc.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Malibu Firefighters Make Gains on Blaze as Wind Warnings Persist

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters