LNG Japan Agrees $880 Million Deal to Join Giant Gas Project

(Bloomberg) -- LNG Japan Corp. agreed a deal worth as much as $880 million for a stake in a giant natural gas project off Australia, a new step to secure supply of a fossil fuel the nation expects to retain a key role in its energy mix.

The joint venture, owned by Sumitomo Corp. and Sojitz Corp., will acquire a 10% interest in the Scarborough operation from Woodside Energy Group. It also struck a pact for the supply from the project of 12 cargoes — or about 900,000 tons — of liquefied natural gas a year for a decade from 2026, the Perth-based producer said Tuesday.

Scarborough, which will drill gas offshore and process it at an expanded plant on the Burrup Peninsula in Western Australia, is forecast to produce as much as 8 million tons of LNG a year and has become a lightning rod for climate activists opposed to the development of new fossil fuels projects.

“The support of LNG Japan is testament to the quality of the Scarborough project,” Woodside’s Chief Executive Officer Meg O’Neill said in a statement. “It also underscores the ongoing demand from Japanese buyers for new supplies of gas and the role of gas in supporting Japan’s energy security.”

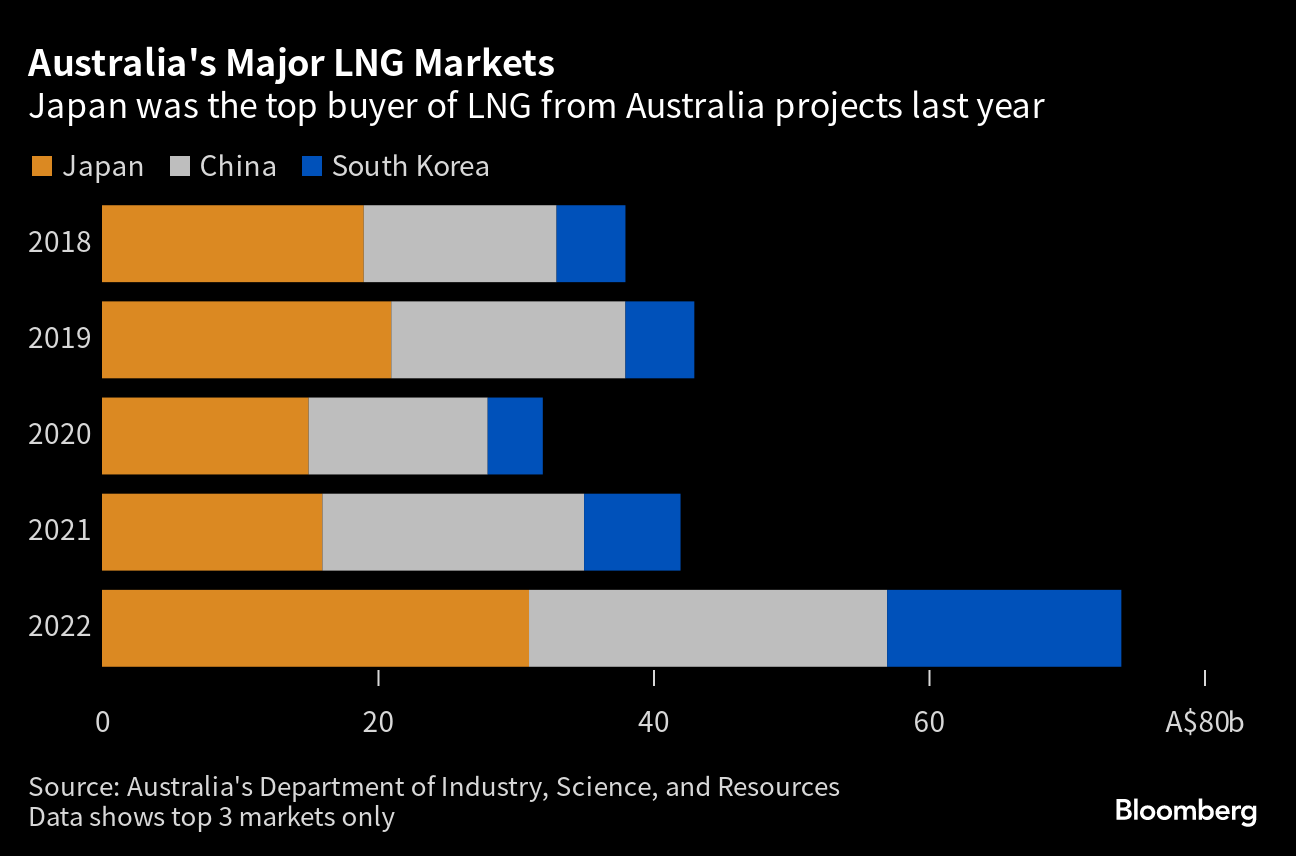

Japan, the largest buyer of Australian LNG, has been striking new pacts with major shippers after last year’s energy crisis prompted the government to press companies to lock in supply and invest in projects. Japan and Germany used a Group of Seven summit earlier this year to call for support for new investment in gas projects.

Scarborough’s direct carbon dioxide emissions are estimated to be about 4.4 million tons a year, and that figure swells to 56 million tons if the burning of the gas by consumers, or scope 3 emissions, are included, the Australia Institute think tank said in a June report.

Woodside is seeking to reduce its ownership of the Scarborough project, while remaining the development’s operator. The producer, which rose 0.6% in Australia trading Tuesday to the highest since November, would be open to investment from Chinese consumers, O’Neill said in May.

Under the deal, LNG Japan will pay a $500 million purchase price and other amounts including reimbursements for project spending that are expected to bring the total to about $880 million, according to Woodside’s statement.

Separately, Sumitomo, Sojitz and Woodside will work on potential collaborations in areas that could include ammonia, hydrogen, carbon capture and storage, and carbon management technology under the deal.

(Updates to add shares and details from seventh paragraph)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals