Dirty-Oil Hoarding for Winter Begins in Asia as Gas Woes Deepen

(Bloomberg) -- Asia is stocking up on dirty fuel oil for winter power generation earlier than usual as a gas shortage sees environmental concerns take a back seat to making sure the lights remain on.

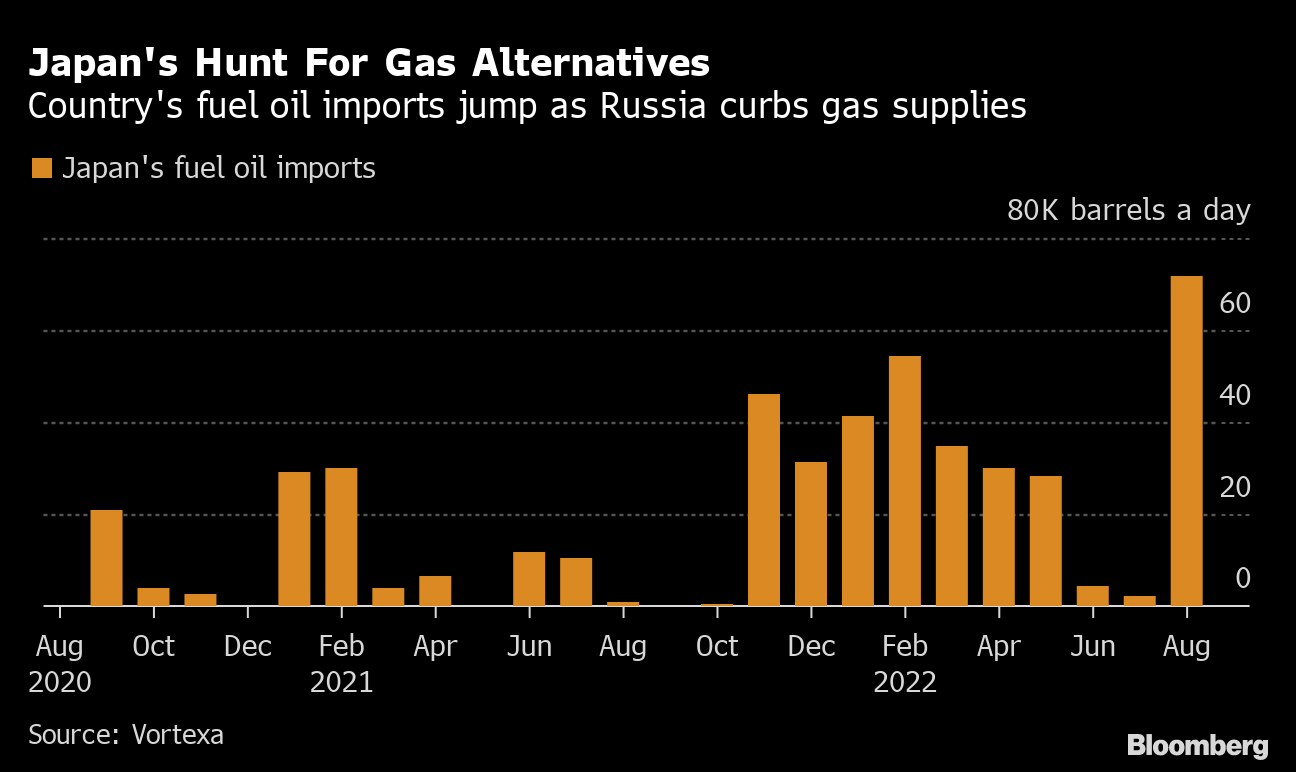

Japanese imports of the fuel, which can be used instead of natural gas to produce electricity, surged to a four-year high in August, and are set to stay high in the coming months, according to Vortexa Ltd. Taiwanese and Bangladeshi purchases last month were more than double a year earlier, the energy intelligence firm said.

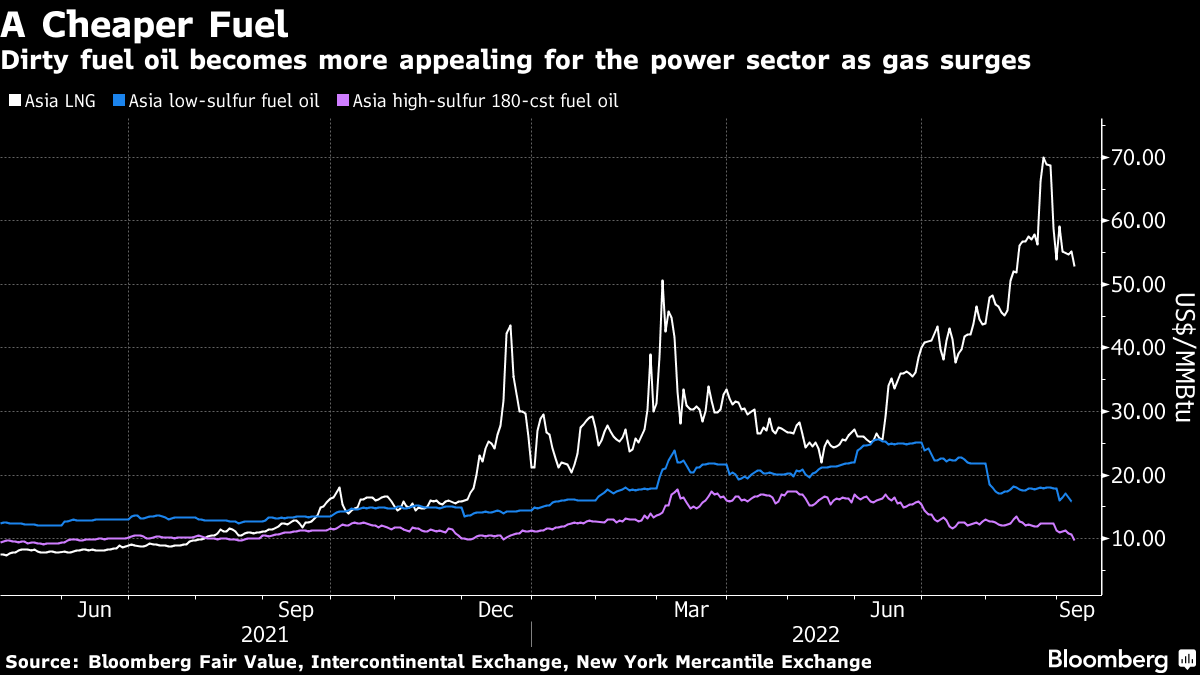

Fuel oil, most commonly used to power ships, is a perennial fallback option for utilities when gas supplies are scarce. Its use is sharply increasing this year as Russia’s weaponization of its gas exports sends prices skyrocketing. Despite implementing net zero targets, countries like Japan and South Korea are choosing to prioritize security of power supply over cutting emissions.

Japanese imports of fuel oil “are likely to remain robust in the coming months,” said Roslan Khasawneh, a senior fuel oil analyst at Vortexa. “Other Asian countries with oil-fired power generation capacity like Taiwan, South Korea and Pakistan” will at the least maintain their current level of overseas purchases, he said.

It’s not just fuel oil that utilities are turning to amid the shortage of liquefied natural gas. Aging coal-fired plants are being used for longer, while several governments around Asia are taking a more favorable view of nuclear power.

Any decision by Japan, the world’s second-largest gas importer, to curtail purchases from Russia could increase demand for fuel oil and other alternatives even more, according to Khasawneh.

Japanese trading houses said late last month they would stay in the Sakhalin-2 LNG gas project after Moscow moved to tighten control over the facility under a new Russian operator. While Tokyo has slapped sanctions on Russia and banned the import of coal from the country, it has so far drawn a line at natural gas.

Buyers in North Asia, where there are stricter pollution controls, typically boost purchases of cleaner low-sulfur fuel oil from November to February. South Asian countries usually buy high-sulfur fuel oil in the summer when air conditioning demand rises. Subdued prices of both varieties -- due in part to more Russian shipments -- are also making the purchases more attractive this year.

Asian countries, particularly in the north, had been phasing out power plants able to run on fuel oil, but energy shortages over the last year or so are now forcing a re-assessment of this. Power stations are typically set up to burn a primary type of fuel and only some have the flexibility to switch to alternatives.

“Although we have historically witnessed a rapid phase-out of liquids-run power plants, there is still some potential for a utilization increase,” said Sofia Guidi Di Sante, an analyst at Rystad Energy in Oslo.

World Embraces Dirtier Fuels as Gas Hits Exorbitant Heights

Wealthier North Asian countries are turning to fuel oil as a supplement to natural gas. Poorer countries in South Asia have been mainly priced out of the gas market and are already dealing with blackouts, so need the dirtier alternatives to prevent a further deterioration in power supply. Whatever the case, environmental concerns are being sidelined for the time being at least, highlighting how the war in Europe has set back action on climate change.

“Asian fuel oil demand for power generation should get some support through at least early 2023 from continuously high LNG prices in the region,” said JY Lim, Asia oil market analyst at S&P Global Commodity Insights. That’s particularly so for LSFO in Japan and HSFO in Pakistan and Bangladesh, he said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals