China Wants the Market to Help Speed Battery Storage Build-Out

(Bloomberg) -- China is crafting rules to attract more energy storage investment in order to accelerate a build-out needed to eliminate carbon emissions from its power sector.

The nation’s top economic planner and energy agency will let new energy storage facilities, which mostly rely on batteries, make money from buying and selling electricity, they said in a joint statement posted online this week. They also want regional authorities to create price mechanisms that entice power companies to participate in the market.

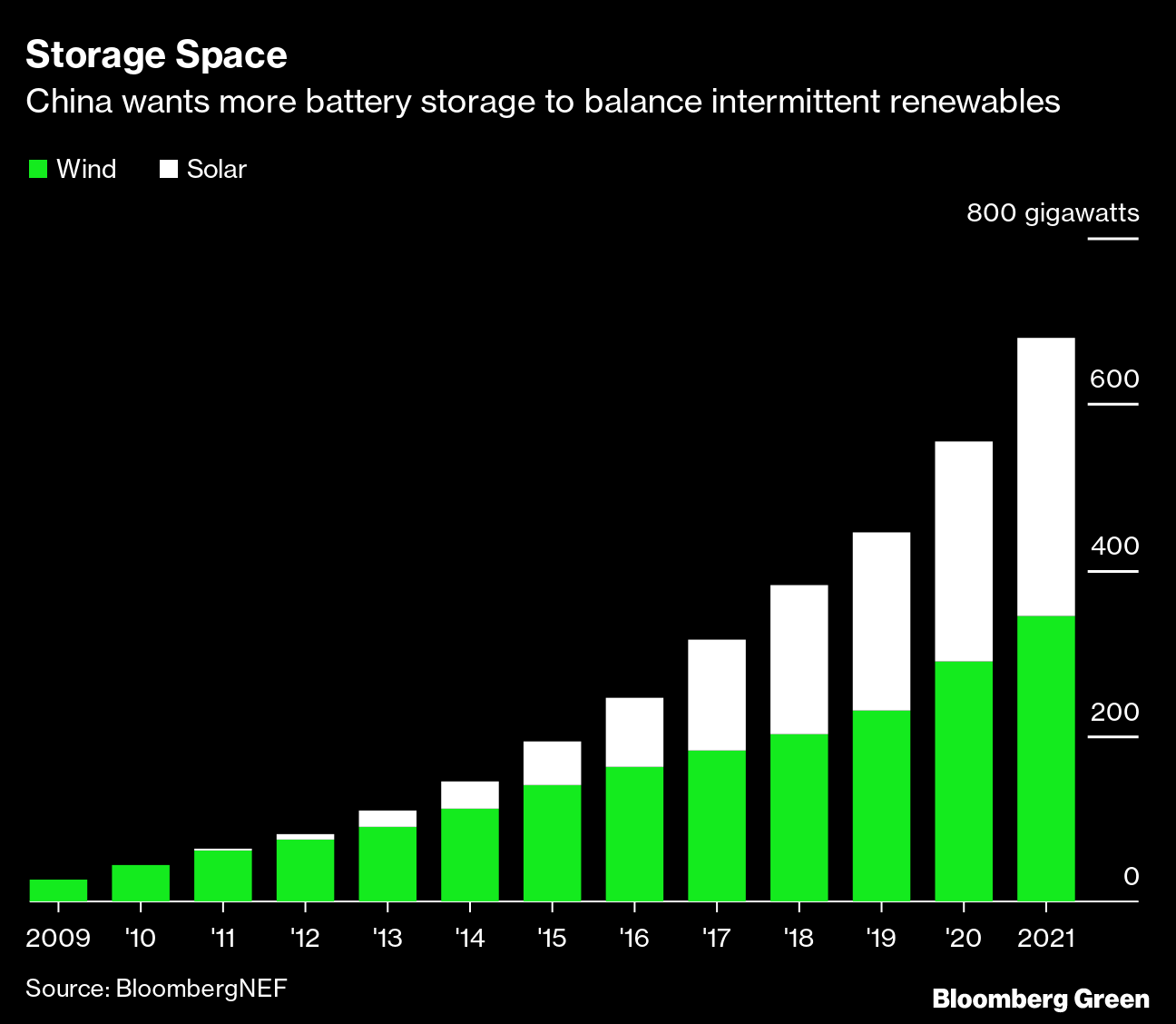

The goal is to accelerate the build-out of independently owned battery storage facilities to help balance out the rapidly growing but intermittent generation capacity from wind turbines and solar panels. The country’s biggest grid operator wants 100 gigawatts of storage capacity by 2030, up from 3.3 gigawatts nationally at the end of 2020.

“The new policy finally gives energy storage a path to market-driven growth,” Trivium China analysts said in a note on Friday. “China’s grids need hundreds of gigawatts of energy storage to achieve carbon neutrality before 2060. That was never going to happen without pricing mechanisms capable of making energy storage profitable.”

The market policies released by the National Development and Reform Commission and the National Energy Administration target so-called “new energy storage,” which includes batteries, compressed air and other technologies but not pumped hydro, the dominant form of energy storage in the country today. That technology is also being expanded, from about 32 gigawatts now to 120 by 2030.

China’s coastal province of Zhejiang, just south of Shanghai, plans to install 3 gigawatts of new-energy storage capacity between 2021 and 2025, according to a five year plan released by the municipal government this week. The southern region of Guangxi also announced plans to build 2 gigawatts of centralized storage capacity by 2025, in addition to a batch of pumped hydro energy storage projects.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture