Summer Blackout Fears Fuel 300% Jump in Gauge of US Power-Plant Profit

(Bloomberg) -- US power plants are poised to reap their best summertime profits in nearly two decades thanks to soaring electricity prices that are outpacing the high costs of natural gas and coal.

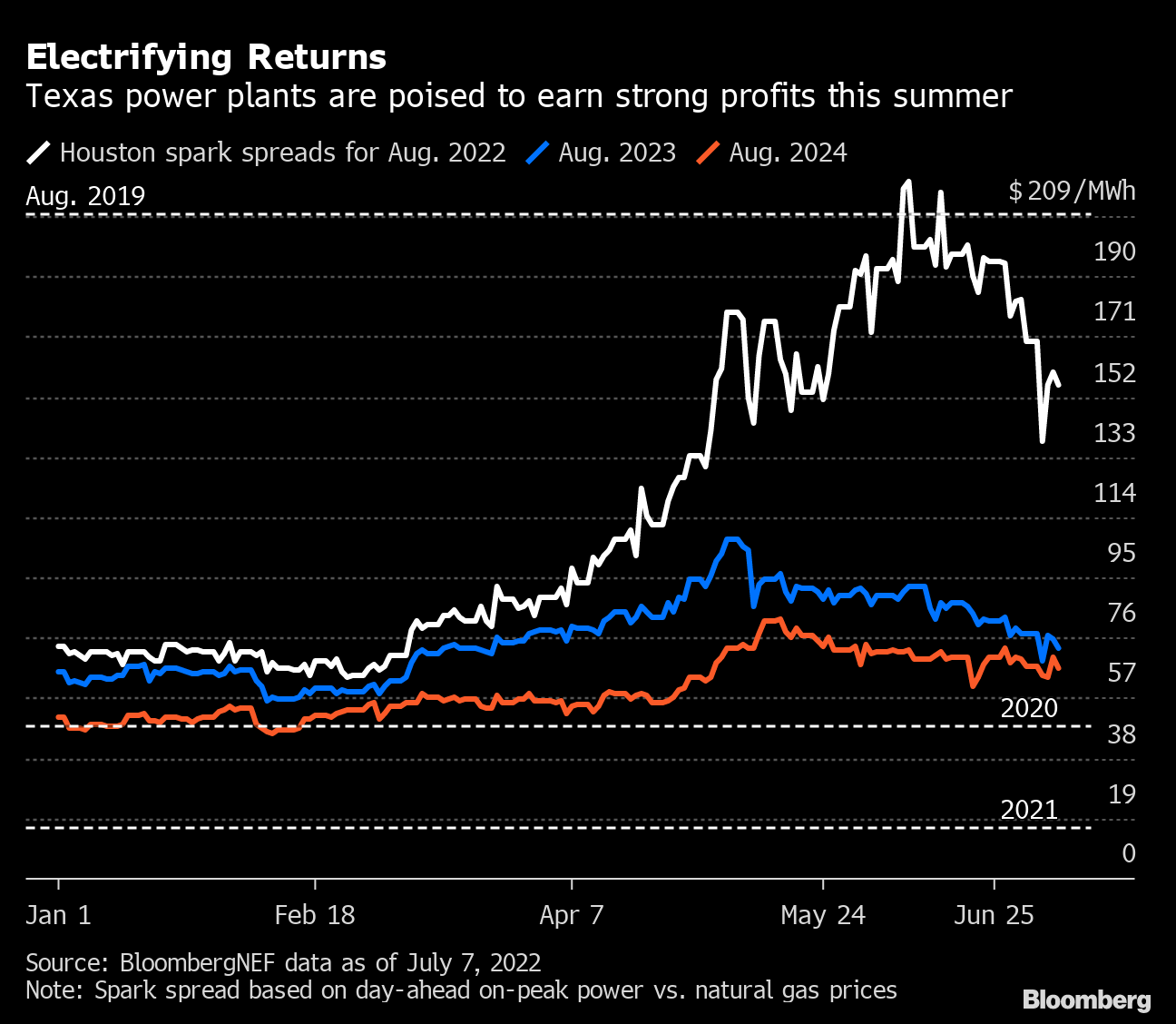

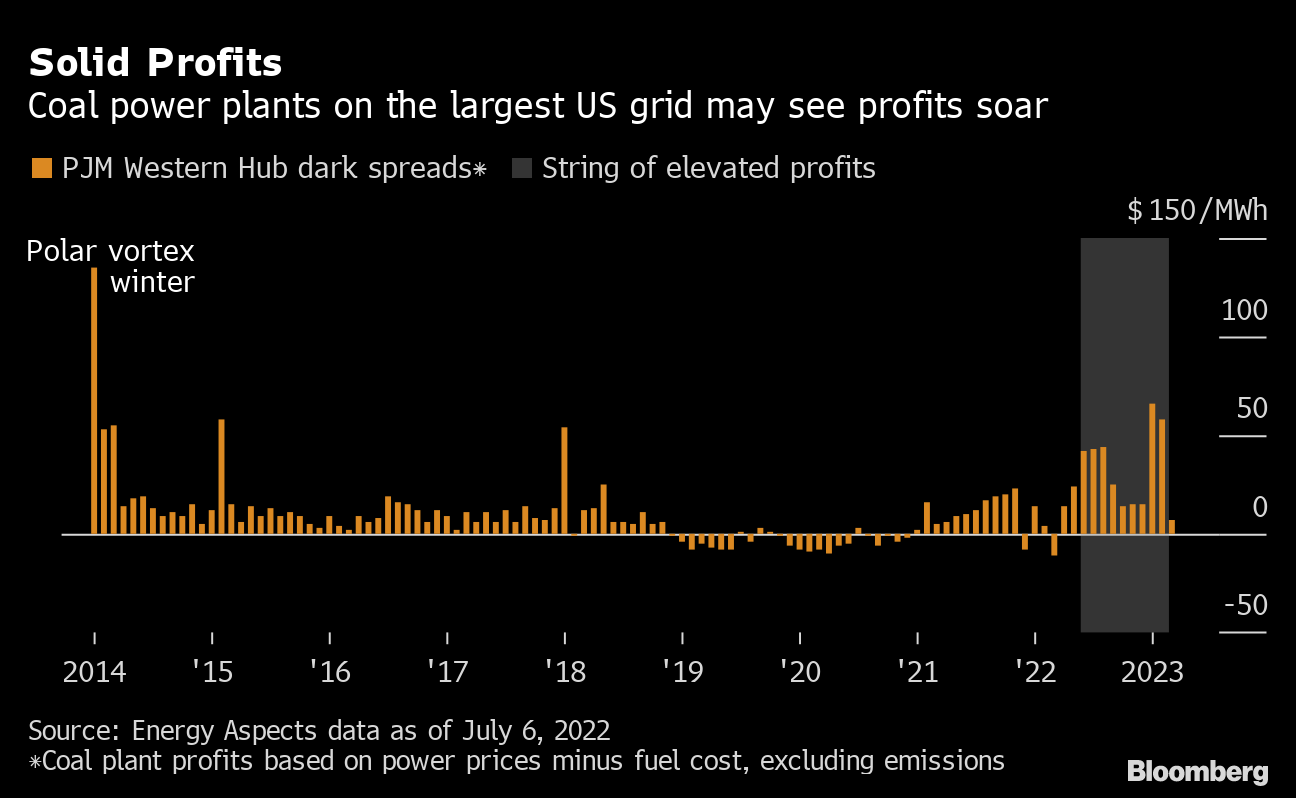

On America’s largest grid, stretching from New Jersey to Illinois, a key metric for gauging the profitability of coal plants has nearly quadrupled from a year ago to $43 per megawatt-hour, according to Energy Aspects Ltd., an electricity research and data provider. In Texas, it’s up almost 10-fold for gas plants, said BloombergNEF.

While a potential windfall for power-plant owners, the wide margins suggest trouble for the country’s strained grids. They reflect concerns among wholesale power traders that extreme heat in the weeks ahead will drive electricity demand to record levels, making supplies perilously tight. State and federal officials have already warned that electric grids could be pushed to the brink of blackouts. Now the market is sending its own unambiguous distress signal.

“These prices reflect the increased risk of shortfalls,” said Peter Rosenthal, head of North American power for Energy Aspects, adding that he’s never seen margins this wide across so much of the country in more than 20 years analyzing power markets.

Also See: Texans Asked to Conserve Electricity as Grid Nears the Brink

The profits will come at the expense of households and businesses, which are already facing the worst inflation in decades. Steep electricity bills have begun to force some industrial companies to dial back operations.

Read: US industrial complex starts to buckle from high power costs

The likely beneficiaries, meanwhile, are some of America’s biggest private-equity firms that have bought up coal- and gas-fired plants in recent years, including ArcLight and Blackstone. Power giants including Vistra Corp., NRG Energy Inc. and Energy Harbor stand to gain, too.

It won't be a windfall for all power producers. Constellation Energy, for instance, expects to see limited gains because prices for almost all of its electricity output this year were locked in through contracts at the start of 2022, a spokesman said. Representatives of the other companies declined to comment or didn’t respond.

If there are blackouts or brownouts this summer, power markets would be torn into a sharp divide of haves and have nots. The plants that manage to remain online and continue producing power would stand to make huge profits. Those that can’t wouldn’t only miss out on making money—but they could also face fines and be forced to spend millions of dollars to buy power on the spot market to meet contractual obligations.

Spark and dark spreads

The most common metric for estimating the profitability of generators is calculated by subtracting the cost of fuel needed for a megawatt-hour from the price that power will fetch on the spot market.

For gas plants, that metric is called a spark spread. For coal plants, it’s known as a dark spread. (The actual net income of plants also depends on other factors, including how often they run as well as hedges and labor costs).

Nowhere are those spreads wider this summer than in Texas. In Houston, the price of power for delivery in August was about $155 a megawatt-hour more than the cost of natural gas to produce that power, according to BloombergNEF. That’s almost 10 times higher than in August 2021.

The reason for those huge spreads is simple enough: There’s widespread summertime concern over fuel availability and potential power outages, even after more gas was freed up following the shutdown of a major export terminal on the Gulf Coast. A vast swath of the US faces the risk of blackouts amid heat, drought, shuttered power plants as well as struggles to secure needed supplies, according to an assessment by North American Electric Reliability Corp.

High profits aren’t guaranteed for power plants this summer. Spark and dark spreads are notoriously volatile, subject to change based on weather forecasts and the price of gas and coal. A week ago, dark spreads on the grid stretching from New Jersey to Illinois soared above $100 per megawatt-hour. Within days, they shrank to nearly half of that—and they may continue to contract depending on Mother Nature and fuel prices.

Read also: Global energy shortage sets the stage for a hot and deadly summer

One reason power can be such a precious commodity is that unlike oil, gas, corn and wheat, electricity can’t easily be stored. (Yes, there are batteries. But the amount of capacity available in the US is a miniscule fraction of overall power demand). Electricity is also finicky because power flowing onto grids must match the amount that households and businesses are using. Otherwise, the whole system becomes unstable.

Texas suffered the ultimate mismatch last year. A historic winter freeze caused demand to surge and plants to go offline, which then forced a vast shutdown of the state’s grid to prevent further failures. The Texas catastrophe exceeded grid operators’ worst-case scenarios—and the memory of it is still fresh with forecasters as they grapple today with the summertime constraints.

Accessing fuel

A big constraint is how much fuel is available. Coal prices in the US are at a record high, driven by surging global demand for electricity, rising summer temperatures and limited supplies. US gas prices, meanwhile, are trading at the highest levels for this time of year since 2008 as Europe relies more on the US for supplies as it pushes to wean itself off Russian fuel.

“I don’t think most of America understands how bad this problem with natural gas is,” said Gary Cunningham, director of market research at risk management firm Tradition Energy. “They are about to see.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals