European Energy Prices Soar as Russian Curbs Risk Economic Pain

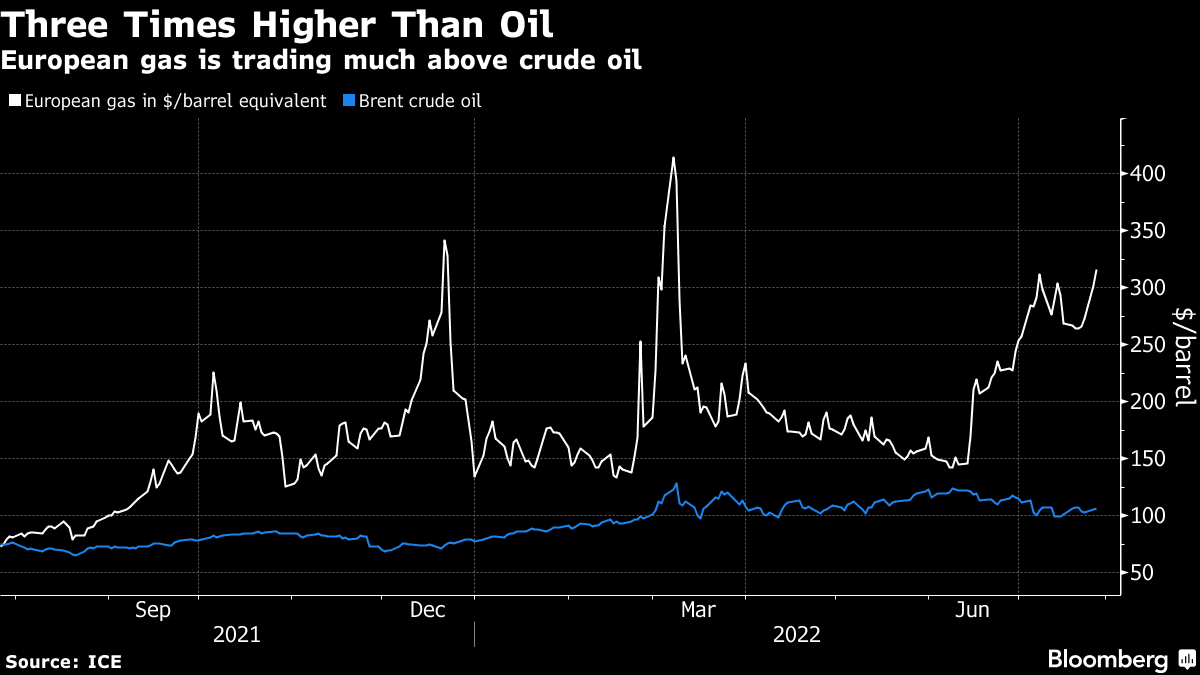

(Bloomberg) -- European energy prices surged as Russia tightened its grip on gas supplies, deepening a crunch that’s threatening to plunge the continent’s largest economies into recession.

Electricity prices in Germany and France, Europe’s biggest power markets, surged to a record on Tuesday, as natural gas jumped as much as 21.5% and coal futures for next year hit an all-time high. That’s leaving Europe without vital fuel to keep the lights on at a time when countries race to secure energy ahead of winter.

Higher energy prices in Europe could translate into more pain for households, businesses and industry already battered by soaring living costs caused by the highest inflation levels in decades. Germany, Europe’s biggest economy, has already triggered two stages of its gas emergency plan and could enact the last step if there’s a clear deterioration in the situation.

Prices have soared since Russia’s Gazprom PJSC said it will halt another turbine that pumps gas into the Nord Stream pipeline, slashing flows through the link to just 20% of capacity from Wednesday. Moscow has steadily reduced shipments through the link over the past month, citing technical reasons, exacerbating a crisis that’s squeezed everything in Europe from the economy to the currency.

The Kremlin is using the pipeline to pile political pressure on European leaders to reconsider their crippling sanctions on Russia and their support for Kyiv, according to people familiar with the leadership’s thinking. Flows are likely to remain at minimal levels as long as the standoff over Ukraine continues, they said.

“Yesterday’s announcement by Gazprom has underlined once again that we have to be ready for possible supply cuts from Russia at any moment,” said European Energy Commissioner Kadri Simson. “And to be ready for that we have to act now, we have to take care of our preparedness, we have to tackle this crisis right now and together.”

European Union energy ministers reached a political agreement to cut their gas use by 15% through next winter as the prospect of a full cut-off from Russian supplies grows increasingly likely.

Read: EU Deal to Cut Gas Use Is Full of Carve-Outs to Keep Unity

Very high energy prices usually trigger some demand destruction, when energy-intensive industries shut operations because it’s not profitable.

“If demand is reduced that would impact prices downwards,” said Fabian Ronningen, an analyst at Rystad Energy. “But cutting power demand also means reduced services to consumers and industry which can have a wide-ranging impact outside of the energy sector.”

German year-ahead power climbed as much as 11% to a record 380 euros per megawatt-hour on the European Energy Exchange. The equivalent French price jumped as much as 6.7% to an all-time high.

Dutch front-month futures, the European gas benchmark, closed 13.2% higher at 199.92 euros per megawatt-hour, the highest settlement since early March. Crimped shipments from Russia have pushed the contract to more than 10 times the seasonal average of the past five years.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters

A $50 Billion London Investor Takes a Contrarian View on Trump