Thailand Mulls Tax Cuts, Subsidies to Spur Electric Car Adoption

(Bloomberg) -- Thailand is weighing an array of incentives including lower taxes and cash subsidies to develop the market for electric vehicles, betting the perks may spur automakers to invest more and make the Southeast Asian nation a manufacturing hub for cleaner cars.

Prime Minister Prayuth Chan-Ocha’s cabinet may soon consider subsidies between 70,000 baht ($2,145) and 150,000 baht depending on the type and model of vehicle, and lower excise tax and import duties on completely built and partially built EVs, according to a draft proposal viewed by Bloomberg from the National Electric Vehicle Policy Committee headed by Deputy Prime Minister Supattanapong Punmeechaow.

The wider incentives for imports will last until 2025 when local production is expected to gather momentum. The tax breaks for EV carmakers are on the condition that companies produce the same number of vehicles or more by 2025 that they import in the preceding years, according to the proposal.

Supant Monkolsuthree, chairman of the Federation of Thai Industries and a member of the EV policy committee, confirmed the contents of the draft plan. Sompop Pattanariyankool, a spokesman for the Energy Ministry, declined to comment on the plan before the cabinet approval.

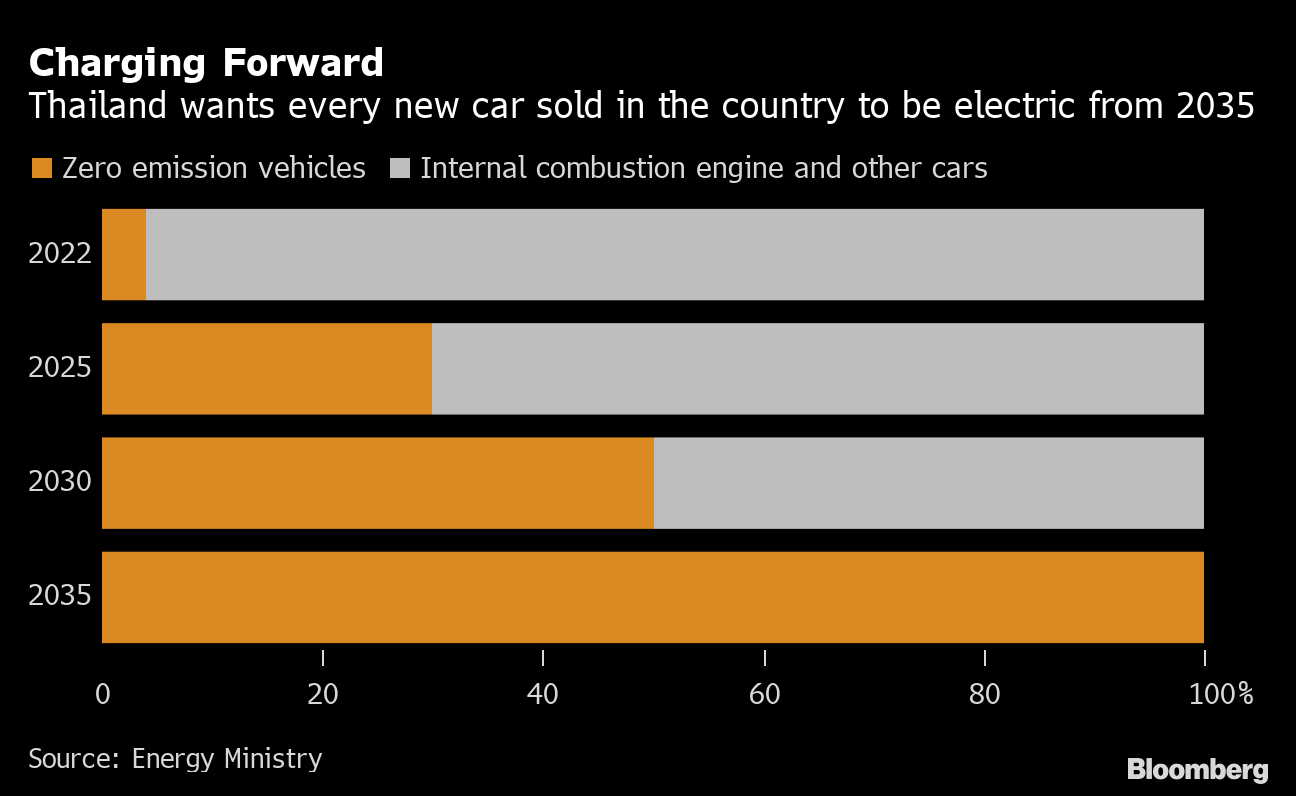

The EV policy committee is a panel of government and industry officials responsible for drawing up a policy roadmap to help Thailand achieve 100% zero emission vehicle production by 2035.

Thailand is bidding to retain its status as an automobile manufacturing hub in Southeast Asia as carmakers globally pivot to electric vehicles. The nation expects to draw as much as 400 billion baht in investment EV manufacturing over the coming years.

Toyota Motor Corp., Foxconn Technology Group, China’s Great Wall Motor Co. and PTT Pcl are among companies planning to build factories in Thailand.

The subsidy for imported EVs will be paid to local firms, which will in turn pass on the benefits to buyers. If the companies are found in breach of the rules later, they will lose all incentives, forfeit their bank guarantees and must pay back the subsidy with accrued interest, according to the proposal.

“The package should be helpful in creating local demand for EVs and also encourage producers to start producing EVs or they will lose the opportunity to benefit from this market,” Supant said.

More details of the EV package:

- Subsidies to range between 70,000 baht and 150,000 baht for cars and trucks

- EV motorcycles to get 18,000 baht subsidy

- Proposal would cut excise tax to 2% from 8% for cars

- Waive excise tax for trucks

- Reduce import duty by as much as 40% for completely built cars during 2022-2023

- Waive import duty for key parts of completely knocked down vehicles including battery and traction motors

- Cars priced below 2 million baht set to get the most benefits

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Malibu Firefighters Make Gains on Blaze as Wind Warnings Persist

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters