US Crackdown on Solar-Tariff Dodgers Endangers Biden’s Green Ambitions

(Bloomberg) -- The US government’s finding that some Chinese solar manufacturers are evading decade-old tariffs threatens to undermine efforts to fight climate change in the world’s biggest economy.

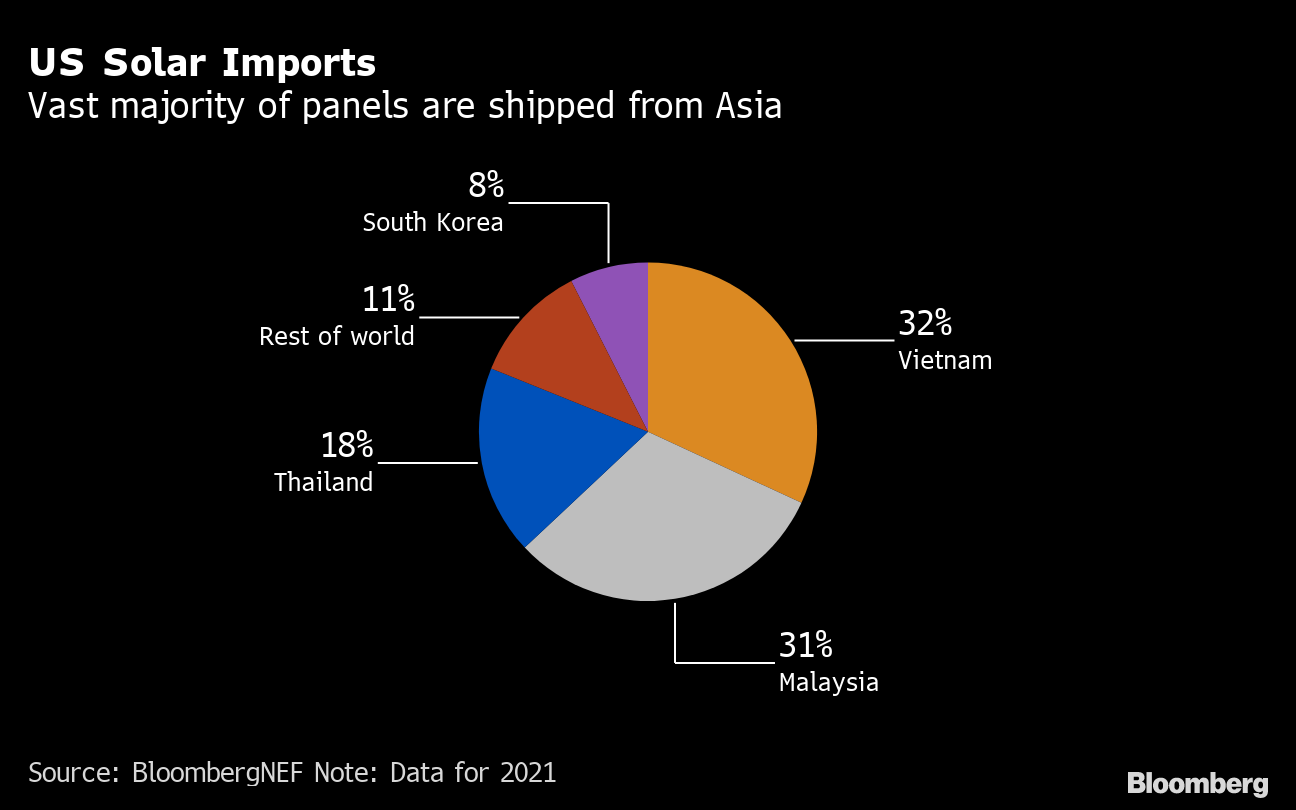

While President Joe Biden’s landmark climate law is already spurring a revival in domestic clean-energy manufacturing, the US remains heavily dependent on imported solar panels. And the preliminary trade probe finding released Friday by the Commerce Department could chill planned solar projects nationwide, by exposing imported panels from Southeast Asia to tariffs as high as 254% as soon as June 2024.

The upheaval could jeopardize Biden’s green ambitions, including his push to decarbonize the country’s electrical sector by 2035. The move could mean higher prices for panels and risks stifling solar installations in one of the world’s biggest renewables markets. That would set back the global push to shift from fossil fuels to cleaner-energy alternatives.

“There is no doubt that this will slow installations in the United States,” Joe Osha, an analyst at Guggenheim Securities, said in an interview. “Project developers will have to take a more holistic view at their supply chain and consider things like geopolitics and human rights — not what’s cheapest.”

The Commerce Department said in its initial finding that some Chinese solar manufacturers had evaded decade-old anti-dumping and countervailing duties by completing panels in Cambodia, Thailand, Malaysia and Vietnam. The agency is continuing its probe, which is meant to be quasi-judicial and free from political interference, with a final decision expected in May.

“A fair and level playing field is critical as companies embark on significant expansion plans,” said Mike Carr, executive director of the Solar Energy Manufacturers for America Coalition.

Although criticized by solar developers and some advocacy groups, the ruling was narrower in scope than some had expected. Companies that were not specifically identified by Commerce — but have operations in the four countries — can avoid new tariffs by formally attesting their products are “not manufactured using wafers produced in China.”

Still, the US agency’s move introduces yet another obstacle for a supply chain still reeling from Covid-related hindrances. Solar developers anticipate higher administrative costs as a result, hurting their competitiveness against other power sources including natural gas.

The finding also creates new challenges for the Biden administration, which is trying to balance two oft-competing objectives: boosting clean-power installations that are dependent on imports while trying to revive domestic manufacturing.

Commerce singled out four manufacturers as having been initially found dodging anti-dumping and countervailing duties on China by completing manufacturing in the region: BYD (H.K.) Co. Ltd. in Cambodia, Canadian Solar Inc. in Thailand, Trina Solar Science & Technology in Vietnam and Vina Solar Technology Co. in Vietnam, a unit of Longi Green Energy Technology Co.Longi, the world’s largest solar company, said in an emailed statement to Bloomberg that the finding will not affect its operations nor will it change its plans for the American market. Representatives for the other companies didn’t respond to requests for comment. Another 22 firms were also deemed to be evading tariffs because they did not cooperate with the probe. Read More: Longi Says US Finding on Tariff Evasion Won’t Impact Firm’s Plan

If the initial finding is finalized, the US would begin collecting cash deposits as high as 254% for affected imports beginning June 6, 2024, though most companies would be subjected to rates below 35%.

Impacts will be felt long before the tariff moratorium lapses because “solar companies are making critical 2024 procurement decisions now,” said JC Sandberg, interim head of the American Clean Power Association.

Biden previously sought to soften the blow by freezing new tariffs for affected solar imports through June 2024, but it’s not clear that moratorium will survive potential legal scrutiny. And analysts emphasized the US market is likely to remain heavily reliant on solar imports even after that point.

“Domestic manufacturing is not likely to offset overseas supply,” Timothy Fox, a ClearView Energy Partners analyst, said in an interview. “You can’t build a module without inputs, and those come from overseas.”

--With assistance from and .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry