Red-Hot Lithium Rally Cools as China’s BYD Flags Surplus

(Bloomberg) -- Red-hot lithium prices are getting a little less expensive, just as China’s electric-car giant BYD Co. flags that the market could swing back into surplus next year.

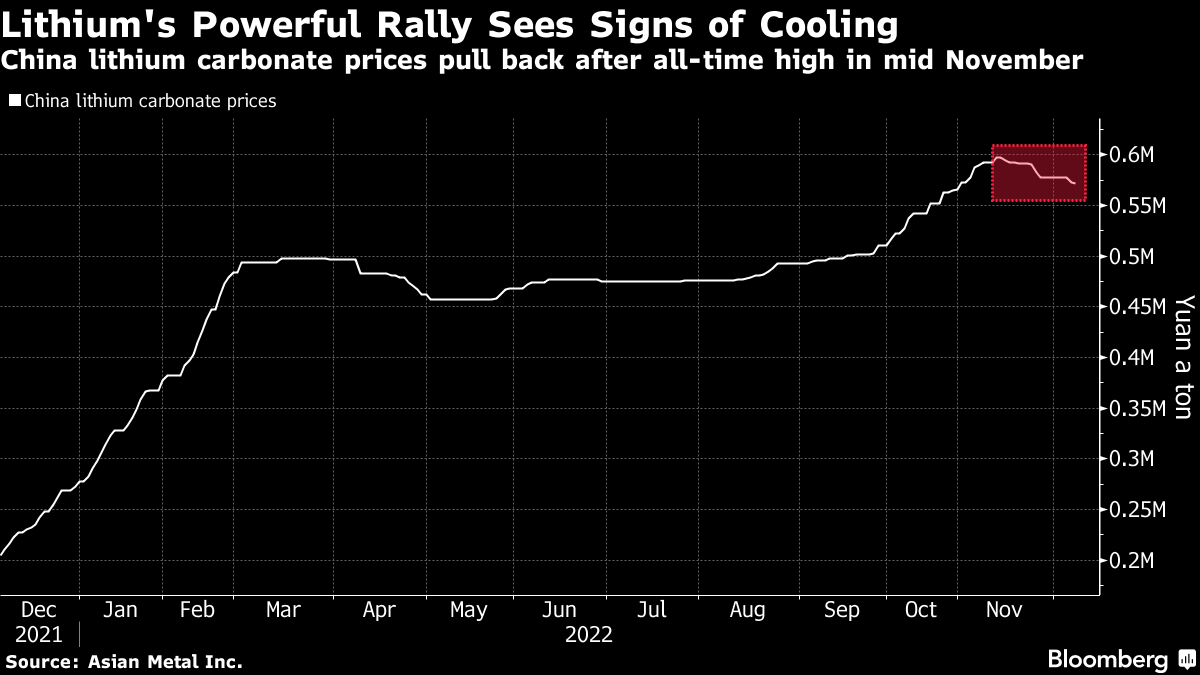

The battery material in China has continued to retreat from the all-time high hit last month as signs of demand weakness weigh on the market. Lithium carbonate fell 0.2% to 571,500 yuan ($82,000) a ton on Wednesday, although prices are still around double where they were at the start of the year.

BYD’s Executive Vice President Stella Li told Bloomberg in an interview on Tuesday that she sees new mines coming on stream next year, calling lithium prices “unreasonable.”

Lithium has enjoyed an extraordinary 1,200% gain over two years as supply has struggled to match rampant demand for electric vehicle batteries. That’s pinched manufacturers, which have been forced to raise prices. BloombergNEF’s annual lithium-ion battery survey showed a 7% jump in average pack prices in real terms this year — the first increase since the survey began.

Global passenger EV sales will grow less quickly in the fourth quarter than previously expected, especially as China faces a rising tide of Covid infections, according to BNEF. Meanwhile, Beijing’s subsidies for EVs that encouraged the rapid expansion of the past decade are due to be phased out at the end of the year.

The moderation in demand is overshadowing supply disruptions in China’s Jiangxi province, a key production hub.

Jiangxi Yongxing Special Steels New Energy Technology Co. has suspended lithium carbonate refining since the end of last month due to environmental scrutiny. Jiangxi Lingneng Lithium Industry Co. has also temporarily halted production because of disruptions to local infrastructure.

Yongxing said it would carry out maintenance in the meantime to ensure full production once operations resume, according to a filing from its parent company. Lingneng estimated that its stoppage would reduce output by about 20 tons a day, according to its parent.

The production cuts from the two firms aren’t enough to offset slower demand, said Susan Zou, an analyst at Rystad Energy. She expects the downturn in prices to continue in 2023, although losses won’t be large, at least in the first quarter, because the supply of lithium compounds remains tight.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

House Committee Says It Finds Evidence of ‘Climate Cartel’

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid