Drought-Fueled Power Crisis in China Poses Risk to Clean Energy

(Bloomberg) -- Power outages across China’s Sichuan province pose a new threat to clean energy supply chains already pressured by high costs of raw materials.

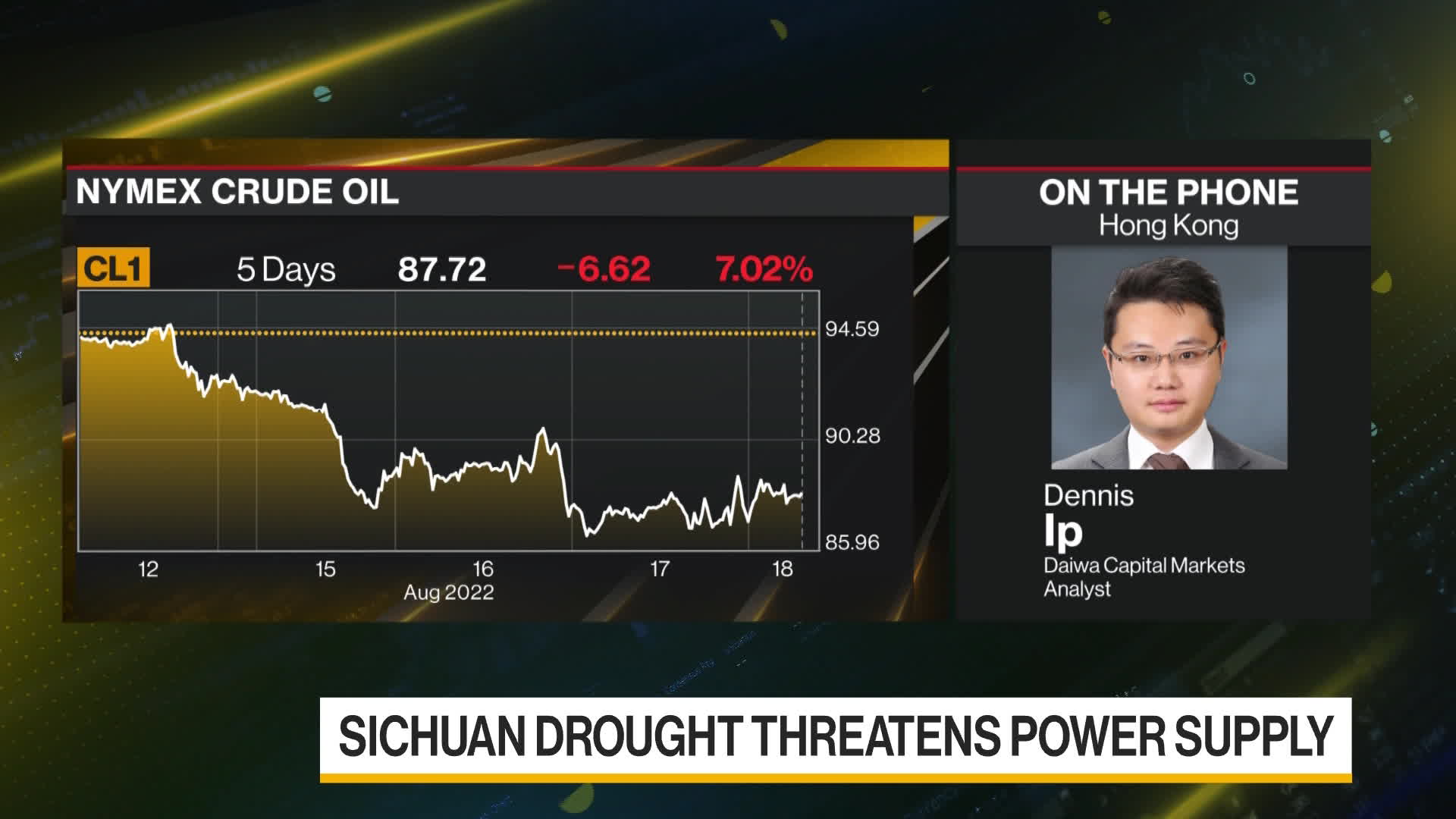

Disruptions at manufacturing plants in the region are likely to impact output of lithium compounds for electric car batteries and polysilicon used in the production of solar panels, according to Dennis Ip, an analyst with Daiwa Capital Markets.

“Extreme weather has already caused a lot of interruptions in the economy and in industrial production,” Ip said Thursday in a Bloomberg Television interview. Together with the impact of the war in Ukraine, that’s “going to affect energy costs and the costs of renewable energy installations,” he said.

Robert Bosch GmbH, one of the world’s biggest auto-parts makers, is experiencing disruptions at two manufacturing sites for power tools and automotive components in Chengdu, a spokeswoman for its China business said. The producer joins companies including Toyota Motor Corp. and Contemporary Amperex Technology Co., the world’s top battery maker, in confirming impacts from the squeeze on power supply.

Production has been adjusted until Aug. 21 following local protocol, and currently the impact is manageable, the Bosch spokeswoman said Thursday in an emailed statement. Authorities in Sichuan instructed factories to suspend activities through Aug. 20, according to Toyota.

A grueling heat wave and drought that’s drying up reservoirs and stretches of rivers, including the Yangtze and Jialing, have curbed hydropower output crucial to Sichuan’s energy mix, and lifted power demand across a swathe of Chinese provinces. The situation is straining electricity generators that have been racing to add fuel stockpiles to avoid a repeat of catastrophic supply curbs last year.

Goldman Sachs Group Inc. lowered its projection for China’s 2022 gross domestic product growth to 3% from 3.3%, citing the impact of energy constraints along with weaker-than-expected July economic data.

Outages at component manufacturers in China have the potential to deliver a more serious impact on supply chains than recent Covid-19-related measures, according to Everstream Analytics, a risk analysis firm. High temperatures are not expected to relent until late August, and there’s a risk that factory shutdowns could be extended or spread to other provinces, the company said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

Malibu Firefighters Make Gains on Blaze as Wind Warnings Persist

Longi Delays Solar Module Plant in China as Sector Struggles

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry

California Popularized Solar, But It's Behind Other States on Panels for Renters