Solar Power May Be the Next Victim of China’s Coal Shortage

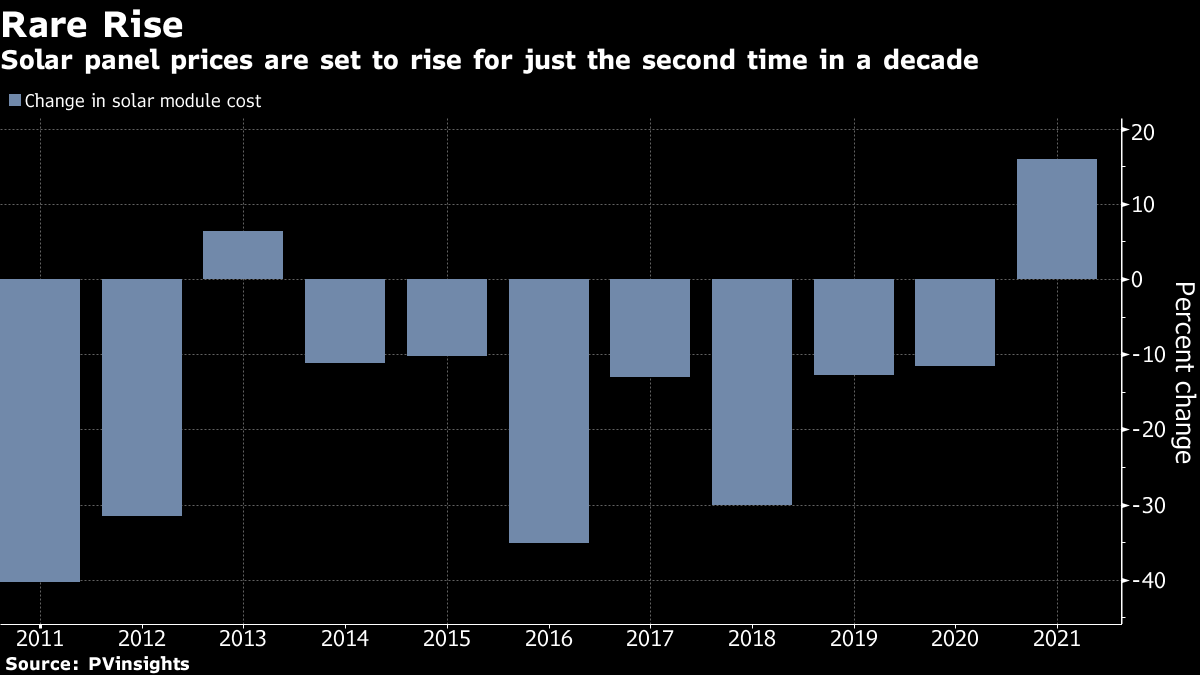

(Bloomberg) -- Solar power’s rare year of rising costs may get worse thanks to China’s power crisis.

Prices of silicon metal, used to make the material that comprises solar panels, have surged about 300% since the start of August after a top-producing province ordered production be slashed amid a power crunch. China dominates global solar production, with its coal generators powering many of the factories that make clean energy equipment.

The move could further fracture the global supply chain that has already been upended by geopolitics, with the U.S. detaining some Chinese imports earlier this year for alleged labor abuses in the nation’s Xinjiang region. It all points to higher prices for solar panels.

“It is yet another excuse for polysilicon makers to increase the price, and the pricing environment for solar modules is very nervous at the moment,” said Jenny Chase, BloombergNEF’s head of global solar research.

Until this summer, silicon metal had a rather innocuous history. Made by heating common sand and coke in a furnace, prices ranged between $1 and $2.50 a kilogram from 2003 until August. That’s when Yunnan province, one of the top production hubs, announced that as part of its efforts to meet energy-intensity targets, production of the metal from September to December would be cut by 90% from August levels.

Silicon metal is purchased by companies that use caustic chemicals and intense heat to purify it into polysilicon, an ultra-conductive material that helps convert sunlight into electricity in photovoltaic panels.

The price of solar-grade polysilicon jumped 13% to $32.62 a kilogram on Wednesday, the highest since 2011. The material is up more than 400% since the start of June 2020 as soaring solar demand pushed processing plants to capacity.

To be sure, the impact to solar panels will be smaller. Dennis Ip, an analyst with Daiwa Capital Markets, sees them rising from from 1.8 yuan (28 U.S. cents) per watt to as much as 2 yuan, bringing them back to mid-2019 prices. Still, that could be enough to delay some solar projects as developers wait for prices to fall.

“Solar installations in the second half will be suppressed, and 2021 installations will be lower than street expectations,” he said in a research note Wednesday.

(Updates with details throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry