Going Green in Germany Looks Like Hardest Job for Fortum CEO

(Bloomberg) -- Turning Fortum Oyj’s German subsidiary into a clean power generator could be the toughest gig yet for Chief Executive Officer Markus Rauramo.

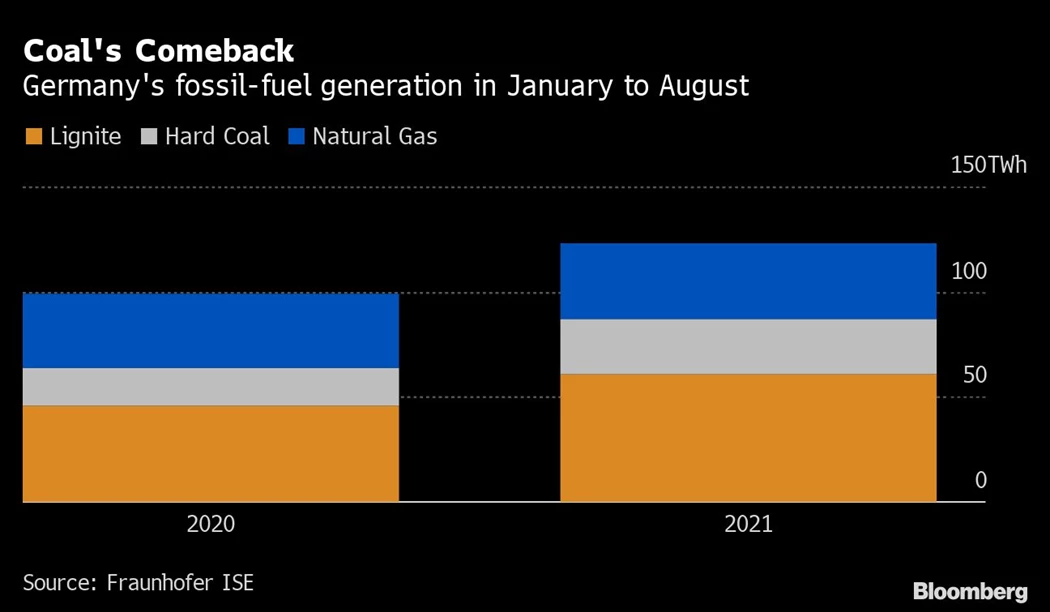

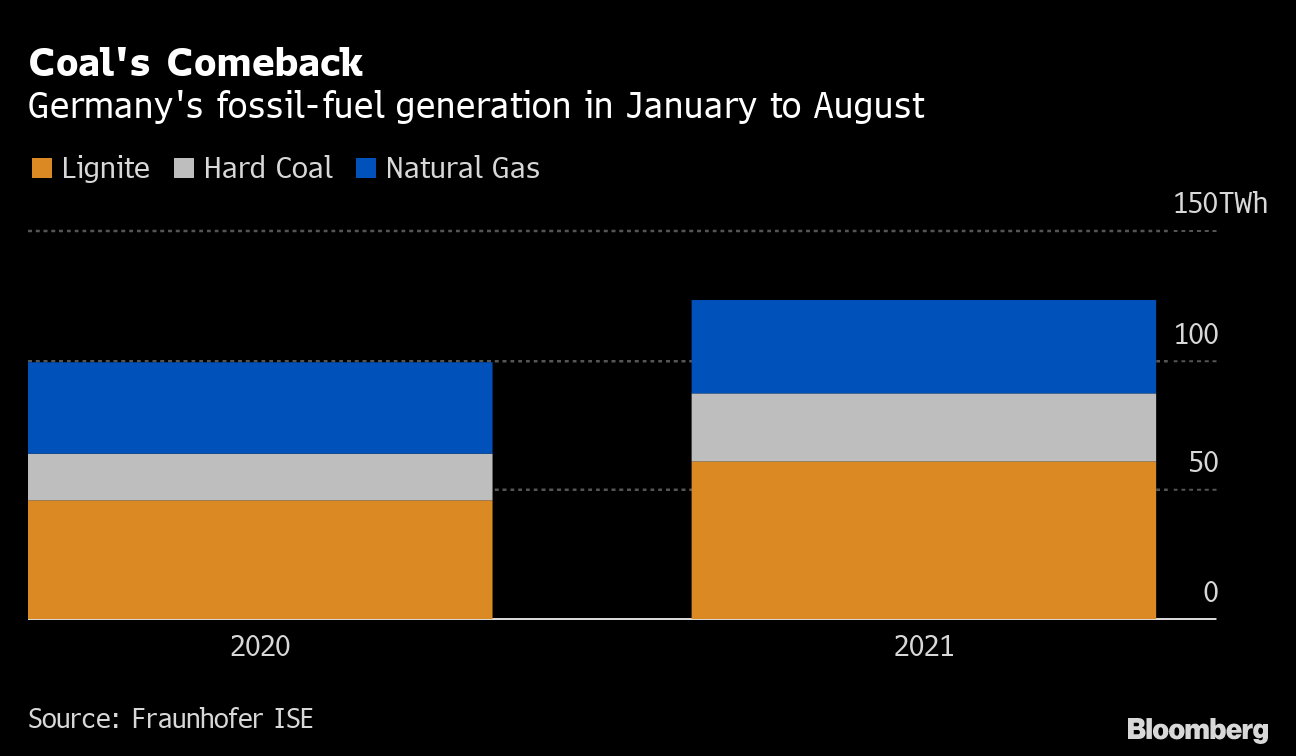

Carbon emissions are rising more than expected at Uniper SE after a rally in power prices and surging post-pandemic demand boosted output at legacy coal and gas plants. Curbing pollution from such facilities will be vital for programs like the European Union’s “Fit for 55” strategy to succeed since no other industry emits as much CO2.

The reliance on fossil fuels in Europe’s biggest power market was well known when Fortum began to build its stake in Uniper in 2017. But as Germany shuts its last nuclear plant next year, the solar and wind capacity meant as a replacement isn’t growing fast enough, forcing utilities to fall back on coal- and gas-fired generation to take up the slack.

“Rauramo has a tough challenge ahead,” said Patricio Alvarez, a utilities analyst at Bloomberg Intelligence. “A rise in expected emissions owing to rebounding power demand this year suggests it may take longer-than-expected to turn Uniper greener as it may still need to rely on fossil-fuel generation for some time.”

Fortum now owns more than 75% of Dusseldorf-based Uniper and analysts predict a full takeover as early as next year. While the integration has been a financial success, Rauramo is all too aware of the challenge in converting fossil assets into cleaner alternatives, he said in an interview from the company’s headquarters in Espoo, Finland.

Other energy bosses around the world are wrestling with the same questions. Emissions keep rising as coal is increasingly used to power the economic recovery. Whether they can be curbed will to a large extent decide the success of plans such as the EU’s target for net-zero emissions by the middle of the century.

“It’s also our duty to deal with the not-so-easy part of the transition,” Rauramo said.

That includes spending big in the coming decade. Fortum is investing about 3 billion euros ($3.6 billion) in solar and wind power, hydrogen and clean gas through 2025. The company has a target to make its European generation carbon free by 2035 at the latest and plans to have closed more than half of its coal-fired capacity by the end of 2025.

“It’s not only that we like the part of investing in completely ideal systems from a clean table, but we are also ready with our competencies to tackle the transitional angle of what is required to be done,” said Rauramo, who is keeping the options open on increasing Fortum’s stake in Uniper further.

There are investors that agree.

“If we cannot support these transitions, then what is our job?,” said Thomas Sorensen, who oversees almost $15 billion in client funds at the asset management arm of Nordea Bank Abp, the biggest Nordic bank. Nordea recently allowed Fortum back into its funds incorporating environmental, social and governance factors after “an extra deep analysis” of its plans following the Uniper acquisition, Head of Responsible Investments Eric Pedersen said.

Retiring Coal

Since December, the two companies have accelerated the retirement for about 40% of their coal assets, he said. Plants closing faster than originally scheduled include Heyden 4, Wilhelmshaven 1 and Scholven C in Germany, as well as the Ratcliffe plant in the U.K. Its Russia division will end coal-fired generation by the end of next year.

Even so, Uniper’s Datteln-4 coal plant, brought online just over a year ago, isn’t due to close until 2038. The German company has said it is “open to discuss” a faster exit should the biggest European economy start new comprehensive talks, Rauramo said.

But Rauramo is no stranger to big industry shifts. He held senior roles at Stora Enso Oyj, one of the world’s largest paper makers, when the forestry industry went through fundamental transitions as people started to read more electronically. He became Fortum’s CEO in July last year after leading its finance team since 2017.

Just how difficult Rauramo’s task will be became clear when Uniper last month said emissions at its European generation arm will probably go up by 21% this year. The estimate at the start of the year was a 9% increase.

“Restoring Fortum’s strong green image and meeting expectations of shareholders for the transformation, as well as integrating Uniper into Fortum will be the challenge for the company,” said Henri Parkkinen, an analyst at OP Group.

Last month, the world’s top climate scientists warned that the planet will warm by 1.5 degrees Celsius in the next two decades without drastic moves to eliminate greenhouse gases. The assessment from the United Nations Intergovernmental Panel on Climate Change was called “a code red for humanity” by U.N. Secretary General Antonio Guterres, who labeled it a death knell for coal and fossil fuels.

The energy transition entails “huge decommissioning of old emitting assets,” as well as clean energy, clean gas and flexible storage, Rauramo said. “Uniper geographically puts us into the place where this big energy transition is happening.”

(Updates with investor comment from 10th paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry