Utility Giant SSE Eyes Network Stake Sale, Renewable Push as Activist Circles

(Bloomberg) -- SSE Plc is selling a stake in its electricity network assets to fund a net zero spending drive as it grapples with pressure from activist investor Elliott Investment Management.

The British utility expects to sell 25% share of both its transmission and distribution grid assets, confirming an earlier Bloomberg report. The sale will fund a 65% increase in capital expenditure for net zero infrastructure to 12.5 billion pounds ($16.8 billion) during the next five years, according to a strategic update on Wednesday. Spending will be allocated 40% to networks, 40% to renewables and 20% to other flexible generation.

The sale comes amid pressure from activist investor Elliott Investment Management which has called for SSE to spin off its renewables business from the grid assets to improve shareholder value. The U.S.-based hedge fund sees such a split as key to speeding up SSE’s expansion plans in the U.K. and internationally.

SSE said that separation “would not be the best route for growth, execution and value creation, and was not therefore in the long-term interests of its stakeholders,” according to the statement.

SSE’s new strategy will help it take advantage of strong interest in infrastructure assets and regulated utility businesses from investment funds seeking stable, long-term returns. It can then plow that money into developing its clean energy projects, which include the world’s biggest offshore wind farm.

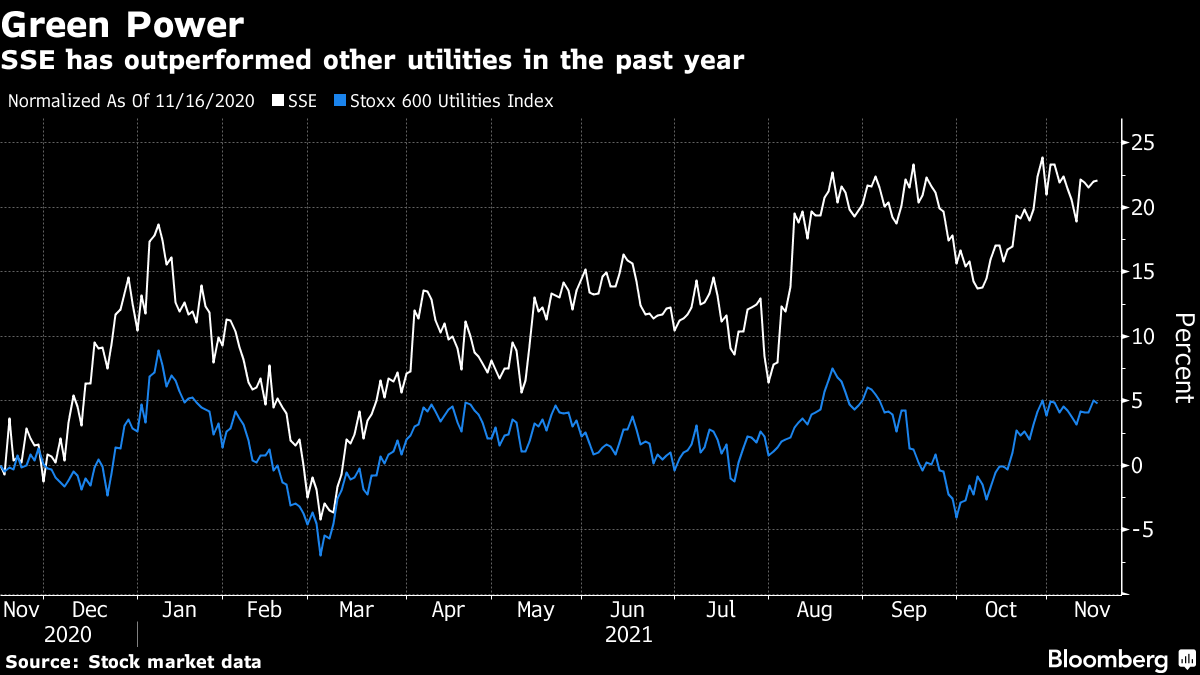

SSE, which is a member of the blue-chip FTSE 100 Index, has risen 11% in London trading this year to give the company a market value of 17.7 billion pounds.

The company’s portfolio includes about 4 gigawatts of wind and hydroelectric power assets and the investment plan announced Wednesday will double that capacity by 2026.

While SSE’s new plan shows an increased ambition for its renewables division, it’s far behind Europe’s other major green power developers. Earlier this week, RWE AG announced 50 billion-euro spending plan to 2030. Denmark’s Orsted is to invest 350 billion Danish krone ($53 billion) to 2027 and Spain’s Iberdrola plans to spend 150 billion euros by 2030.

SSE’s pretax profit jumped 30% to 174 million pounds in the first half of the year. The group expects adjusted earnings of 83 pence per share for the full year, in line with analyst forecasts.

SSE said the number of retail energy suppliers failing since early September along with market volatility has increased its collateral requirements. So far, this has been met through new new letters of credit, guarantees and performance bonds with “no significant cash amounts required to date,” according to the statement.

“SSE will maximise its long-term potential and capture growth opportunities during a critical time for the energy sector,” Alistair Phillips-Davies chief executive officer of SSE said. “We are constructing more offshore wind than anyone else in the world right now and expanding overseas.”

About 80% of the renewable power spending is on projects already under construction or in development. That means the announcement is more a reflection of the company’s current portfolio than a view into what will change in the future. About 15% is for future pipeline development, which would be about 750 million pounds, with the remaining 5% on operational maintenance and lifespan extensions.

(Updates with background on SSE from third paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening

Free Green Power in Sweden Is Crippling Its Wind Industry