Goldman to RBC See a Slow-But-Sure European Green Stocks Revival

(Bloomberg) -- European renewable-energy stocks, battered for much of this year, present a buying opportunity because their growth story remains intact. That pitch from Goldman Sachs is luring some investors -- those not in a hurry, that is.

The way Goldman tells it, with governments promising to phase out fossil fuels and the environmental, social and governance mantra still resonating, the sector is bound to eventually provide rich rewards for the long-term investor. RBC Wealth Management concurs.

“For us, the recent correction represents a good opportunity to build strategic positions in these stocks which should benefit from strong secular growth,” said Frederique Carrier, head of investment strategy at the firm. But “patience may be required,” she said.

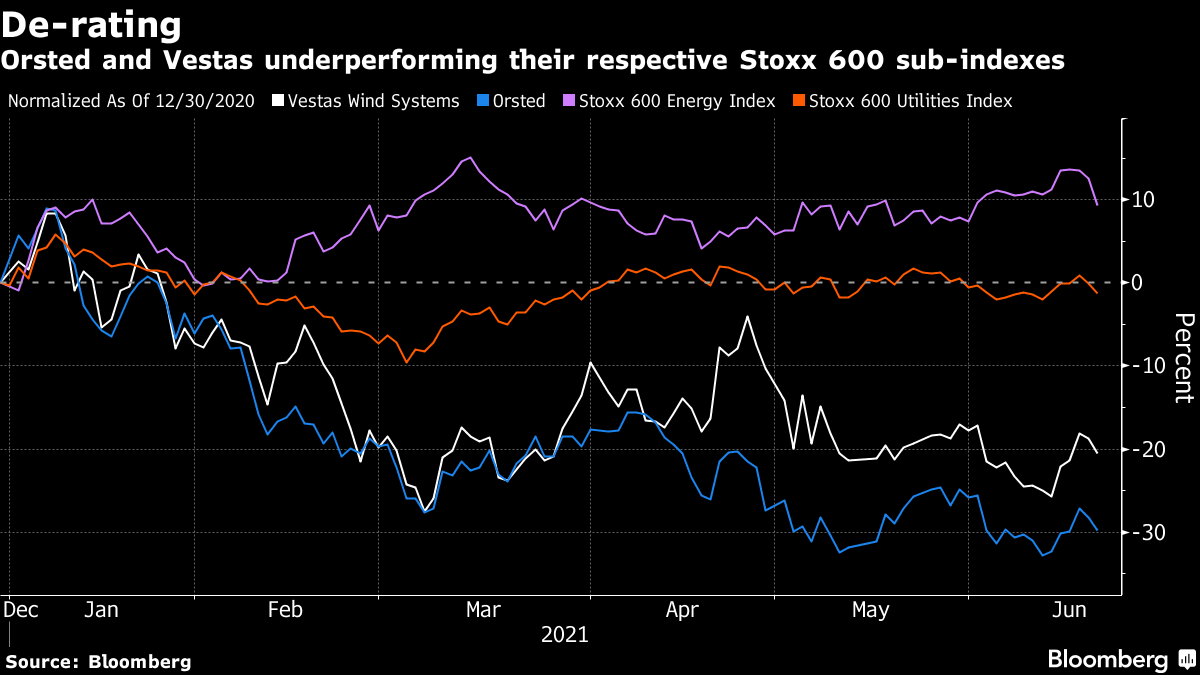

After a stellar rise last year, renewables have fallen out of favor. The European Renewable Energy index is down 27% from its January peak, and three of the 10 worst-performing Stoxx 600 constituents in 2021 are renewable-energy plays -- tumbling an average of 35%. Last year, they were among the best performers in the index, with Norwegian electrolyzer company Nel ASA more than tripling and solar power firm Scatec ASA more than doubling.Many factors have coalesced to pull the sector down, leaving renewable-energy equities trading at a discount to other growth stocks. As the economy rebounds after the pandemic, cheaper value stocks are outperforming pricier growth shares. Also, prominent clean-energy exchange-traded funds are rebalancing holdings, putting technical pressure on some high-flying renewable names. Added to that are rising bond yields, inflation jitters and increasing competition in a sector where, as Carrier says, valuations got “a bit stretched.”

“Renewable companies have just been stuck in with all the other growth stocks,” said Randeep Somel, portfolio manager on the M&G Climate Solutions fund, suggesting that’s a mistake. Unlike tech stocks that benefited from a pandemic-driven demand boost, “it is the one area where you are guaranteed a positive growth trajectory,” he said.

That may be, but some still see renewables as pricey. For instance, even after declines this year, wind-turbine maker Vestas Wind Systems A/S trades at around 34-times forward earnings, while Siemens Gamesa Renewable Energy SA is at nearly 43-times, according to Bloomberg data. That compares with around 17 times for the Stoxx 600 Europe benchmark.

“What we’re not doing is just buying the very expensive pure-plays,” said James Sym, head of European equities at investment firm River & Mercantile. “They’re still expensive. I have no idea, and nor does anyone else, whether inflation proves to be transitory.” If it doesn’t, pricey clean-energy stocks could be “very vulnerable,” he said.

To investors like Martin Todd, those concerns look “misplaced” given the underlying growth story for renewables and as inflation fears and commodity prices ease.

“If anything, the investment case has strengthened,” said the portfolio manager at Federated Hermes.

Hints of a recovery are starting to emerge. A global basket of “green transformation” stocks created by Saxo Bank has risen more than 10% in the past five weeks. Analysts are also turning positive. UBS AG upgraded its rating on Orsted and Berenberg said Vestas is among its top clean-energy picks, with both brokers saying the stocks are attractive after falling this year.

“Now is a good entry point for investors looking for a long-term play given the momentum is growing and we are likely to see multiple decades of growth,” said Harrison Williams, an analyst at Quilter Cheviot. His preferred stocks are Vestas and Portuguese renewable utility EDP Renovaveis SA.

The European Union reached an agreement on its Green Deal in April and U.S. President Joe Biden has set out a $2.25 trillion plan to invest in clean power and electric vehicles. Bloomberg New Energy Finance forecasts two years of record onshore wind builds in Europe in 2021 and 2022, plus a record year for solar builds in 2021 too. Then there’s the November United Nations Climate Change Conference, which could help to boost sentiment, M&G’s Somel said.

That said, anyone looking for a quick rebound may be in for a disappointment. For starters, the market backdrop of economic recovery will be more conducive to value stocks. Also, while renewables have strong winds in their sails, much of them are on the horizon.

“We won’t necessarily see a bounce back within six months, but this ultimately does not matter as it is a theme that is going to dominate for years to come,” said Williams.

Renewable stocks could rebound in the fourth quarter, said Adeline Diab, head of ESG and thematic investing in EMEA for Bloomberg Intelligence.

Investors may “rush into” clean-energy names before the end of the year as they align with the EU Taxonomy, the bloc’s sustainable investment framework, she said. The “most direct and quick way” to do this is to invest in pure-play names like Vestas or wind-farm operator Orsted A/S, Diab said.

“Despite elevated equity valuations, investors cannot overlook one of the biggest transformations of our society since industrialization,” said Peter Garnry, Saxo Bank’s head of equity strategy.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

WEC Energy Offered $2.5 Billion US Loan for Renewable Projects

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals