Biden Climate Goals to Take Backseat in Biggest U.S. Power Grid

(Bloomberg) -- The power grid serving nearly 20% of the U.S. population is about to throw a roadblock in President Joe Biden’s plan to decarbonize the electricity sector.

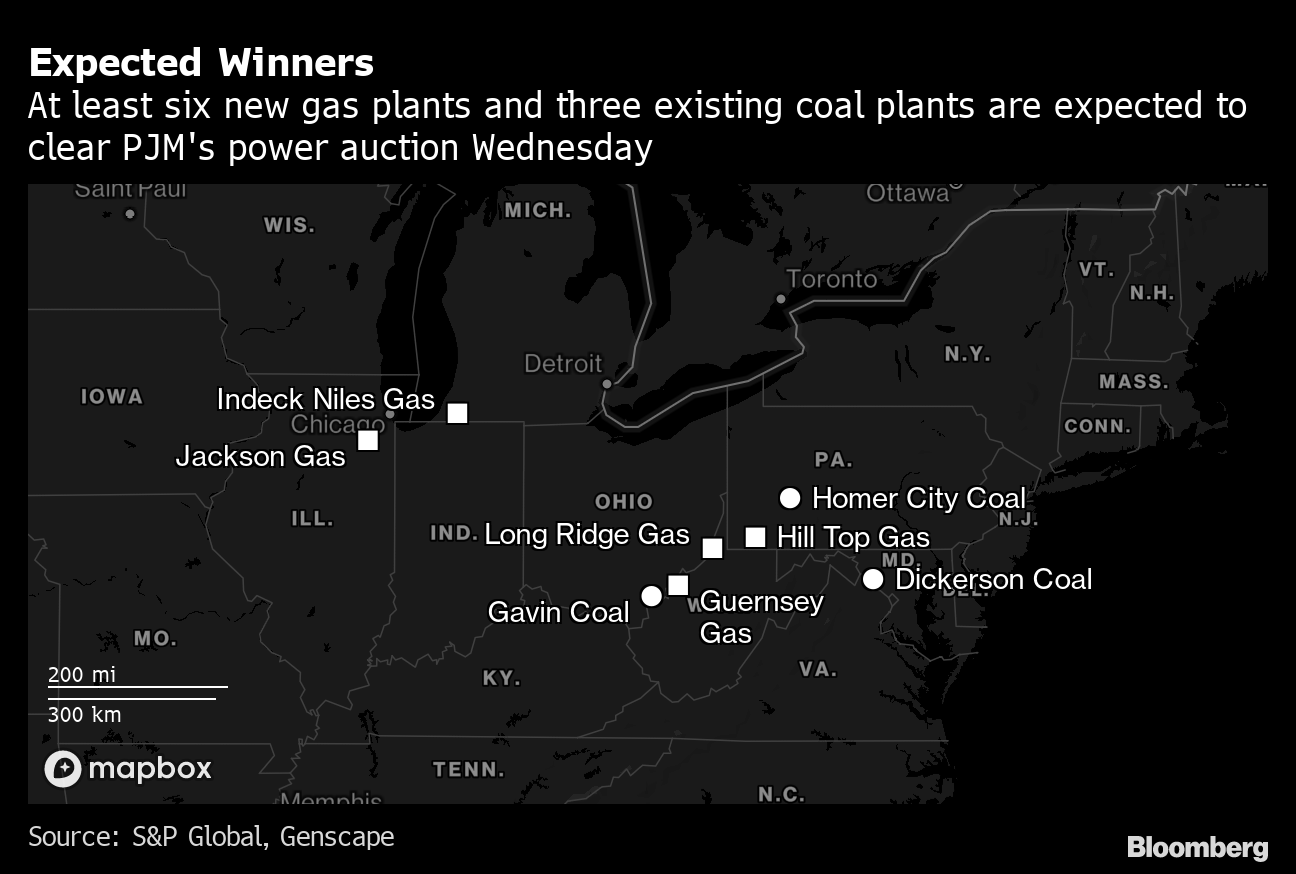

PJM Interconnection LLC, which keeps the lights on for 65 million people from Chicago to Washington, D.C., is expected to clear a fleet of new natural gas plants-- and even extend the lives of some coal plants -- when it releases the results of its massive electricity auction Wednesday. That’s because Trump-era changes to the way the auction is structured give a leg fossil fuels, at the expense of zero-carbon sources such as nuclear, wind and solar.

“The market has been trending toward renewables, but this is pulling it back,” said Ari Peskoe, director of Harvard Law School’s Electricity Law Initiative. “It’s fighting the future.”

As much as 4 to 6 gigawatts of new gas capacity and several clunker coal plants could clear the auction, according to some estimates, while nuclear and renewables are expected to be the big losers. Such an outcome would further entrench fossil fuels in the biggest U.S. power market, and runs counter to the president’s goal of eliminating greenhouse gases from the power industry by 2035.

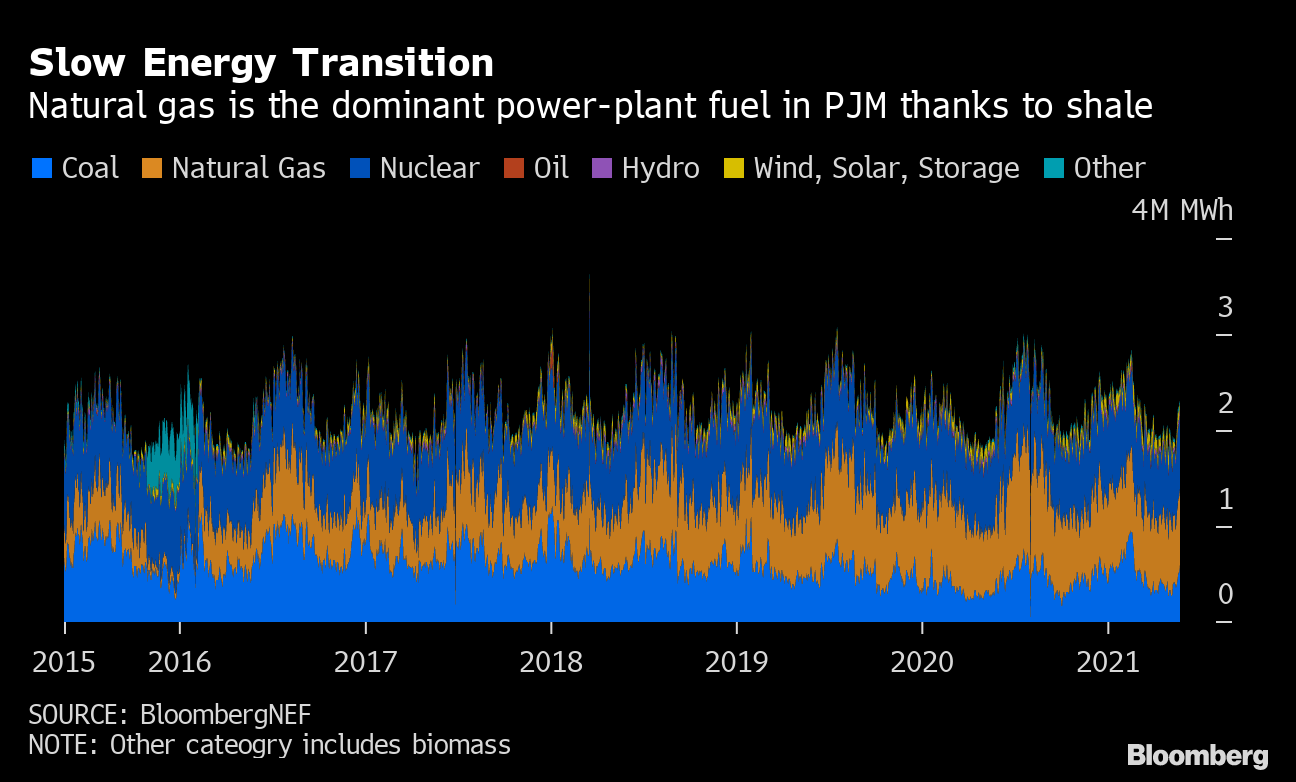

PJM is already one of the most carbon-intensive grids, with 60% of its electricity coming from coal and gas. The auction, intended to secure a year’s worth of power supplies at the lowest cost for consumers, can help to determine the region’s power mix for decades to come. Because participating generators rely on it for the bulk of their revenues, plants that clear the auction have an incentive to continue operating for as long as they can. The last auction, in 2018, generated more than $9 billion in revenue for generators.

The latest auction is the first to run under the new rules imposed by the Trump administration after two years of delays and contentious wrangling between power providers, PJM and federal regulators. The new structure creates a price floor for some bidders, effectively disadvantaging nuclear and renewables that receive state subsidies while making it easier for costlier fossil fuels to compete.

“Coal comes out as the big winner,” said Brianna Lazerwitz, an analyst for BloombergNEF. “Nuclear would be hit the hardest.”

Still, the boost for the dirtiest fossil fuel may be short-lived. Not only is the Biden administration moving to overhaul market rules by the next auction in December, falling demand on the PJM grid points to lower clearing prices and lower revenues for energy suppliers.

Grid-wide prices could fall to about $85 per megawatt-day from $140 in the previous auction in 2018, according to analyst estimates collected by Bloomberg. Coal plants may not be able to clear the lower end of that price, according to Katie Bays, an analyst at FiscalNote Markets. Even if some coal plants make it this time around, long-term patterns show that the fuel’s future is limited.

“Coal has no economic justification for existing in this market,” Bays said.

The story is more complicated for nuclear plants, which are struggling because reactors have high operating costs while other fuels are increasingly cheaper. States including New Jersey and Illinois offer clean-energy credits for nuclear power, so the auction rules make it difficult for reactors there to compete. That’s triggered a backlash from utilities that say the format makes it difficult to meet their clean-energy goals.

Two Exelon Corp. plants west of Chicago are already scheduled to close this year and are unlikely to clear the auction, according to Moody’s Investors Service Inc. analyst Toby Shea. The company has said two other nuclear plants in Illinois are also uneconomic, and state lawmakers are currently debating additional subsidies that would help keep them in operation. Failing to clear the PJM auction would further burden the facilities’ balance sheets.

Exelon declined to comment.

Still, this year could see the addition of 4 gigawatts of nuclear generation that didn’t clear the last auction. The plants, divested by previous owner FirstEnergy Corp. during bankruptcy to Energy Harbor, were likely able to ratchet down costs, potentially allowing them to compete, said Shea.

In response to the new rules, Dominion Energy Inc., one of the biggest U.S. utility owners, has pulled out of the PJM auction altogether. The Virginia-based company is the biggest power provider in the state, has said it would eliminate carbon emissions from its fleet by 2050, and the new PJM format will “make renewables more expensive” than delivering clean energy through alternative markets.

Illinois, New Jersey and Maryland have also threatened to leave the capacity auction unless the new price floor is eliminated. PJM has already launched a stakeholder process to do so.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture