Greening Energy to Fight Climate Threat May Cost $92 Trillion

(Bloomberg) -- Governments and companies will need to invest at least $92 trillion by 2050 in order to cut emissions fast enough to prevent the worst effects of climate change.

That’s the latest forecast from analysts at BloombergNEF, who see that scale of spending as necessary to drive a rapid electrification of the global economy and slash reliance on fossil fuels.

Thirty years is a short timeframe to achieve the scale of transformation that is needed to limit further dangerous increases in global temperatures. Investment in infrastructure to accommodate energy transition will need to rise to between $3.1 trillion and $5.8 trillion annually on average until 2050, up from about $1.7 trillion in 2020, BNEF found. That means the final bill could be as much as $173 trillion, about eight times U.S. gross domestic product in 2019.

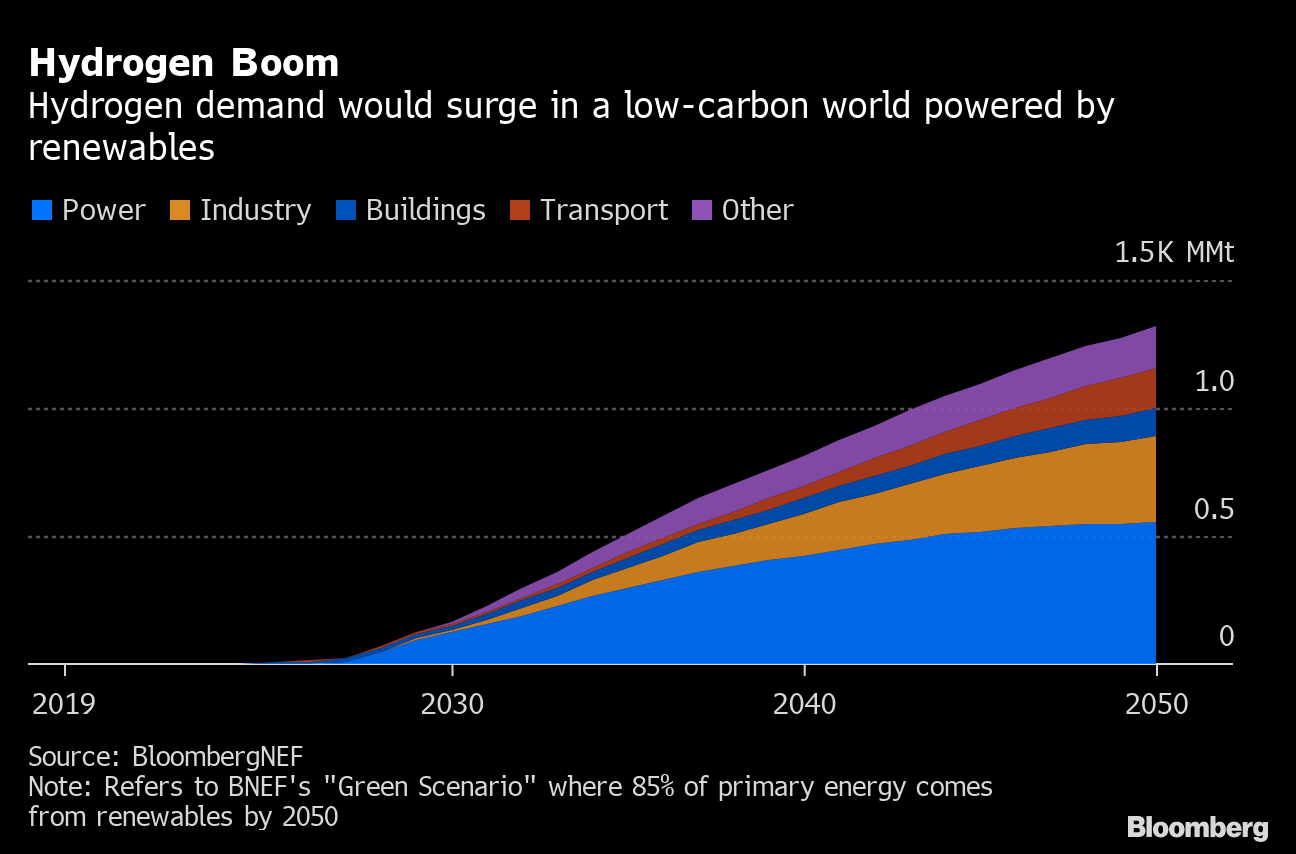

That level of spending would help limit the increase of average global temperatures to 1.75° Celsius from pre-industrial levels, compared with about 1.2°C of warming already present. Without further action, events such as the heatwaves, floods and wildfires experienced around the world in the last few weeks will likely get more frequent, dangerous and costly.Scaling up the role of electric power underpins all hopes for a drastic cut to greenhouse gas emissions. More than three quarters of the potential decline in emissions this decade will likely need to come from electricity supply and the increasing use of wind and solar power, according to BNEF. Another 14% of the drop in emissions in that period can be achieved from vehicles, homes and industries switching to electric power from burning fossil fuels. Hydrogen will also have a significant role to play, with demand set to soar.

Overall, electricity generation will need to at least double by 2050 to almost 62,200 terawatt-hours, making up almost 50% of final energy consumption, compared with about 19% now. A scenario where renewables are the dominant energy source would require even more electricity production. All of that power production will take time to plan, finance and build.

“There is no time to waste,” said Seb Henbest, BNEF’s chief economist. “If the world is to achieve or get close to meeting net zero by mid-century, then we need to accelerate deployment of the low-carbon solutions we have this decade — that means even more wind, solar, batteries, and electric vehicles, as well as heat pumps for buildings, recycling and greater electricity use in industry, and redirecting biofuels to shipping and aviation.”

So far, global leaders haven’t got the message. Less than 15% of the $2.4 trillion that governments spent to support the post-pandemic economic recovery went to investments in clean energy, an inadequate amount to get the world on a path to reach net zero emissions by 2050, according to a report this week from the International Energy Agency. Executives from some of the world’s biggest renewable energy companies called on leaders of the Group of 20 nations to set more ambitious renewable energy targets to have a chance to meet global climate goals.

There are many low-carbon technologies that will form a part of the energy transition. BNEF describes three different scenarios, one where renewables supply the bulk of energy, one where nuclear power grows significantly and one where fossil fuel plants equipped with technology to capture emissions play a dominant role.

These modeling exercises are a staple of the energy industry. That’s because many of the assets built to extract, transport and use energy require huge investments for infrastructure that lasts decades. Looking at how different sources of clean energy can help meet the same climate goal provides policymakers and energy companies with tools needed to make those investments.

In all of BNEF’s scenarios, hydrogen will need to be a bigger source of energy for applications like heavy industry and chemicals production. That could lead to demand of as much as 1,318 million metric tons of hydrogen in 2050, making up about 22% of total final energy consumption, compared with less than 0.002% today.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

With Trump Looming, Biden’s Green Bank Moves to Close Billions in Deals

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture