U.S. Solar Group Pushes Back Against China’s Offshore Plants

(Bloomberg) -- U.S. solar manufacturers have filed petitions requesting federal investigations into Chinese firms circumventing tariffs by manufacturing in Malaysia, Vietnam and Thailand.

The group -- which hasn’t identified its member companies -- filed the petitions with the U.S. Department of Commerce, according to Wiley Rein LLP, a Washington D.C. law firm advising the companies.

“The petitions seek to apply the existing tariffs on China to the specific companies in the three countries that are circumventing the tariffs,” Tim Brightbill, an attorney for the group, American Solar Manufacturers Against Chinese Circumvention, said in an email. The manufacturers have asked to remain confidential, he added.

The call from the American companies comes amid increased U.S. pressure against China’s solar industry as the Biden administration cracks down on alleged labor abuses in the Xinjiang region. Canadian Solar Inc. warned this week that all panel imports from China risk being detained by U.S. Customs.

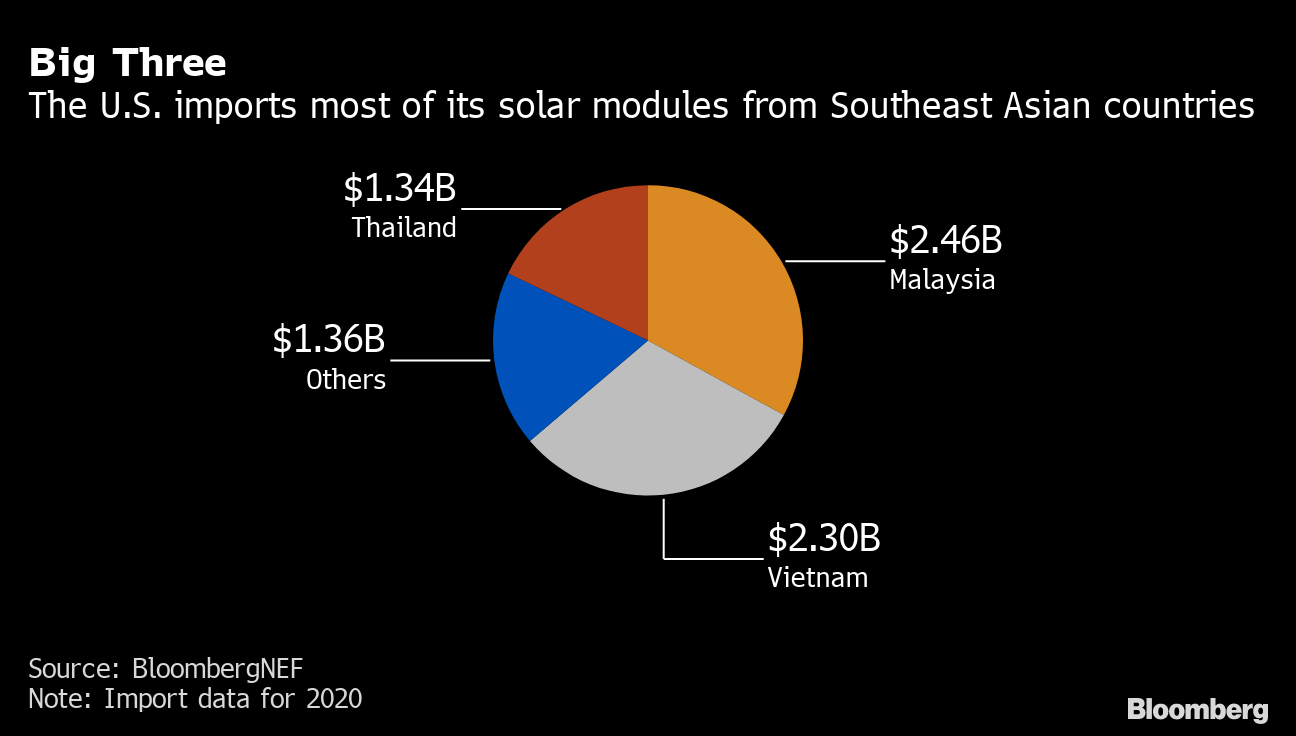

The flurry of activity threatens to disrupt the U.S. solar market, which relies on foreign manufacturers for the majority of its panels. Vietnam, Malaysia and Thailand were the three biggest suppliers of solar equipment to the U.S. last year, according to U.S. trade data.

“The investigations, which will likely be initiated in the coming weeks, could lead to tariffs on solar products from those countries,” Height Capital Markets analyst Benjamin Salisbury said in a note, referring to Malaysia, Thailand and Vietnam. More tariffs would also hinder U.S. access to solar imports not available domestically, potentially slowing the development of those clean energy projects, he added.

Chinese firms dominate the manufacture of photovoltaic panels, which is a multi-step process often done in separate factories that can be located in different provinces or even countries. Several companies have opened plants in other nations in recent years for the last stage, assembling the solar modules.

The petitions argue that this creates an obvious route to circumvent U.S. tariffs against Chinese solar products. The industry group is asking for the extension of those tariffs to cover products from factories built by Chinese companies in the Southeast Asian countries.

First Solar Inc., the largest U.S.-based solar manufacturer, declined to say whether it’s a member of the petitioning group. A spokesman said in an email that it’s focusing on its own technology and expansion while seeking a broad industrial policy to create a level playing field for U.S. manufacturing, but “in the absence of viable growth incentives, we will have no choice but to support trade measures.”

The petitions name several of China’s largest solar manufacturers, including Longi Green Energy Technology Co., Trina Solar Co., JinkoSolar Holding Co. and JA Solar Technology Co. Representatives from the companies and the China Photovoltaic Industry Association didn’t respond to requests for comment.

Wiley represented solar company SolarWorld Americas Inc. in its past efforts to impose tariffs on imported solar equipment. After SolarWorld and Suniva Inc. petitioned for import tariffs, then-President Donald Trump in 2018 approved duties of as much as 30% on solar equipment made outside the U.S.

Shares of some of the largest panel manufacturers fell in New York Tuesday. JinkoSolar declined as much as 8.3% on Tuesday and Canadian Solar fell as much as 6.6%.

Abigail Ross Hopper, president of the Solar Energy Industries Association, said in a message to members Tuesday that “the disruption to the U.S. solar market could be severe,” adding that they’re still assessing the potential impacts of the petitions.

(Updates with company and analyst comments from paragraph 6.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains

Chevron Is Cutting Low-Carbon Spending by 25% Amid Belt Tightening