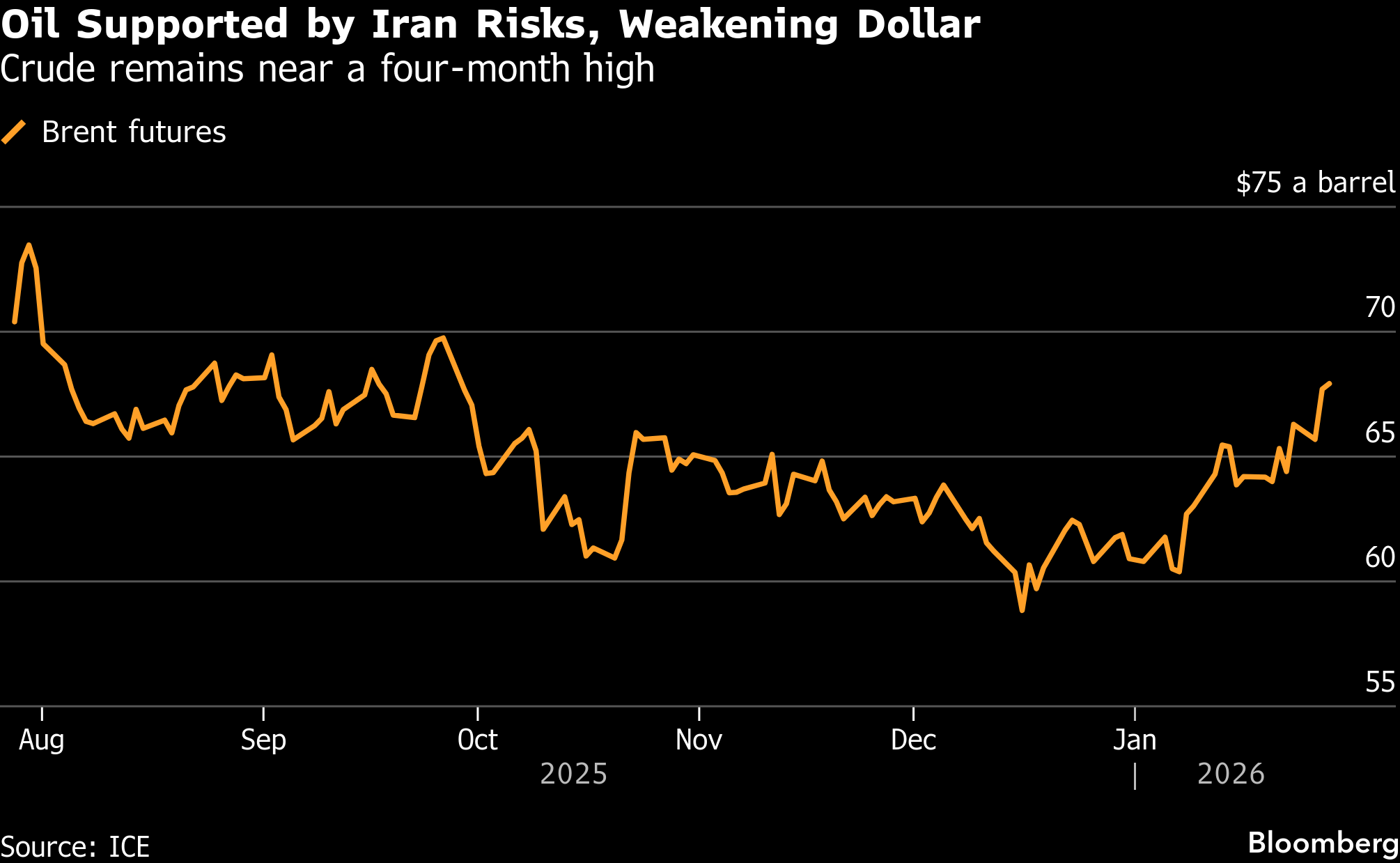

Oil Steady Near Four-Month High on Iran Risks and Weak Dollar

(Bloomberg) -- Oil held near a four-month high as traders monitored President Donald Trump’s renewed threats against Iran, while a weaker dollar boosted the appeal of commodities priced in the US currency.

Brent was near $68 a barrel after jumping 3% in the previous session to the highest since late September. West Texas Intermediate was above $62. Trump reiterated on Tuesday that a “big armada” was headed to the Middle East, adding that hopefully the US won’t have to use it.

Trump’s focus on Iran followed the Islamic regime’s crackdown on protests against the government of Ayatollah Ali Khamenei, and has injected some risk premium into oil prices. Futures have started the year on a strong footing, despite forecasts for a glut as OPEC+ and other producers pump more.

A gauge of the dollar tumbled to the lowest in almost four years on Tuesday after Trump said he wasn’t concerned about the currency weakening. The drop has been fanned by his unpredictable policymaking, including threats to take over Greenland and pressure on the Federal Reserve.

“The sell-off in the US dollar is providing a boost to oil, along with lingering concerns over Iran,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “We are also seeing a lot of strength in timespreads, which calls into question the largely held surplus view.”

The prompt spread for both oil benchmarks — the difference between their two nearest contracts — has widened in a bullish backwardation structure over the course of this month, indicating tighter supply.

©2026 Bloomberg L.P.